Opportunity knocks in the materials sector as oversold stocks unveil a chance to tap into undervalued companies.

For careful investors pondering market movements, the Relative Strength Index (RSI) stands as a formidable tool for assessing stock momentum. By juxtaposing a stock’s strength on up-price days with down-price days, the RSI can offer traders keen insights into short-term performance indicators. A stock is commonly seen as oversold when its RSI dips below 30, according to market experts.

As we delve into the current landscape, here’s a glance at three major players in the materials sector exhibiting significantly low RSIs that investors might eye with intrigue:

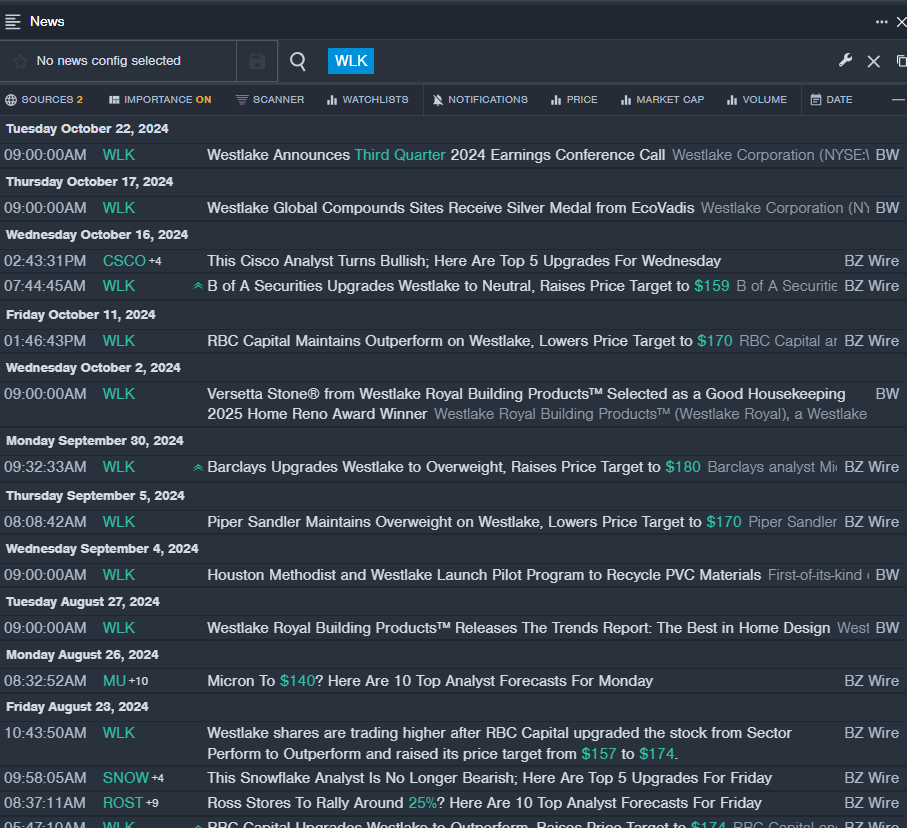

Westlake Corp WLK

- Westlake is set to unveil its third-quarter 2024 earnings prior to the opening bell on Tuesday, Nov. 5, amid a 7% stock downturn over the past month and a 52-week lowest point at $112.77.

- RSI Value: 27.60

- WLK Price Action: The company’s shares dwindled by 0.9%, concluding at $134.79 on Thursday.

- A real-time newsfeed from Benzinga Pro keeps market updates flowing for avid investors.

Newmont Corporation NEM

- Newmont’s recent financial report on Oct. 23 revealed quarterly GAAP earnings of 76 cents per share and quarterly revenue soaring to $4.605 billion, exceeding the consensus estimate of $4.568 billion. With a 13% dip in stock value over five days and a 52-week low of $29.42, Newmont’s stock presents an enticing proposition.

- RSI Value: 20.36

- NEM Price Action: Newmont shares plunged by 14.7% to $49.25 during the Wednesday close.

- Benzinga Pro’s insightful charting tools decode the intricacies of market trends around NEM shares.

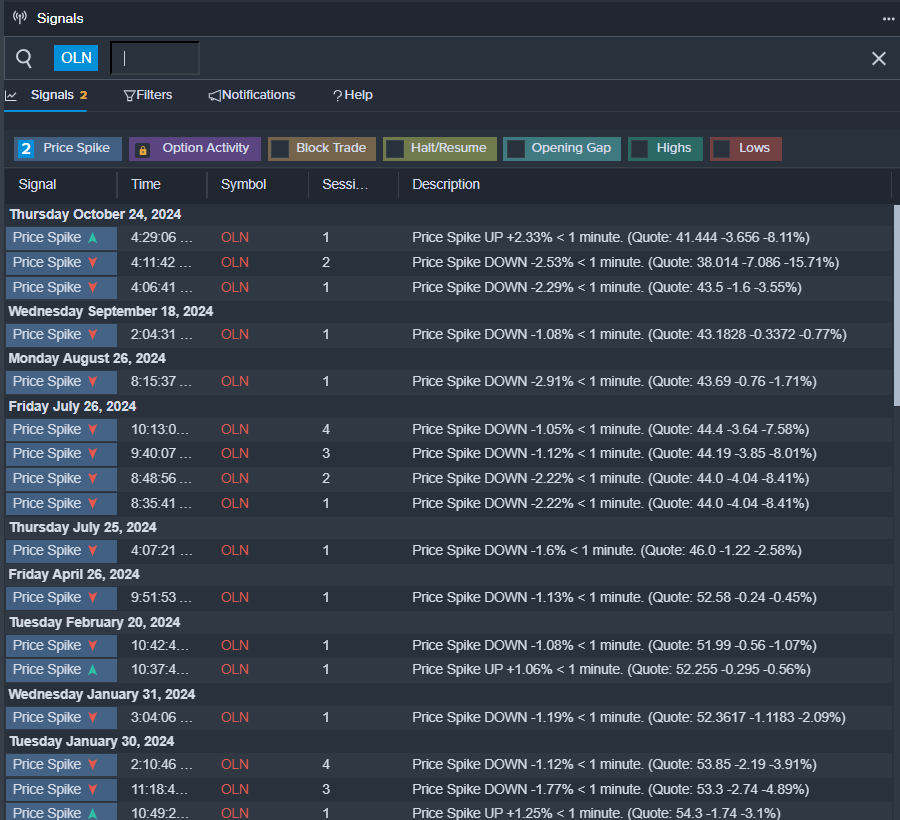

Olin Corp OLN

- Amid a recent mixed third-quarter financial report on Oct. 24, Olin expressed concerns over Hurricane Beryl’s impact on its chemical operations. CEO Ken Lane acknowledged the persistent operational challenges post-hurricane, accentuating the company’s resilience amidst adversity. The company’s stocks saw a modest 5% downturn over five days, marking a 52-week low at $39.47.

- RSI Value: 27.97

- OLN Price Action: Olin shares slipped marginally by 0.1% to attain a closing value of $45.04 on Thursday.

- With timely signals from Benzinga Pro’s feature on stock movements, investors stay afloat on potential OLN share upswings.