The stock market has surged to new highs this year. A combination of falling interest rates, optimism about the economy, and clarity following the election have put a charge in most stocks.

Many stocks still appear to have plenty of room to run even higher. Cameco (NYSE: CCJ), Brookfield Renewable (NYSE: BEPC)(NYSE: BEP), and Brookfield Infrastructure (NYSE: BIPC)(NYSE: BIP) stand out to a few Fool.com contributors for their upside potential even after their recent supercharged returns. Here’s a look at what makes them look like compelling investment opportunities right now.

Cameco has the fuel for growth

Reuben Gregg Brewer (Cameco): A recent regulatory ruling has left some investors worried about the potential offered from restarting shuttered reactors. But aside from that, most of the news coming out of the nuclear power industry in the United States has been pretty positive of late. Notable industry backers include technology giants Microsoft, Alphabet, and Amazon.

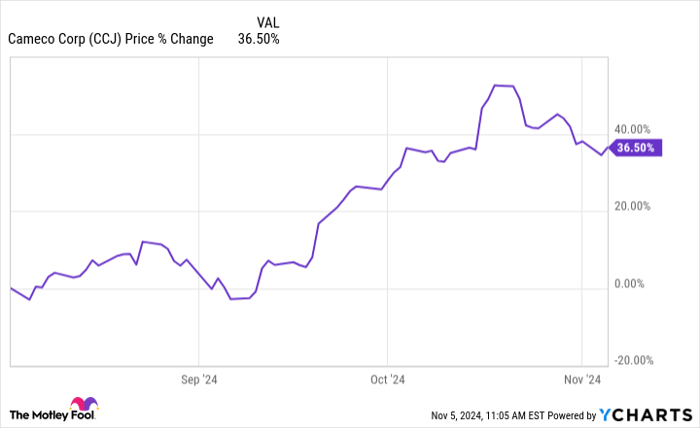

Basically, nuclear provides power that doesn’t emit carbon dioxide and it is always available, unlike intermittent power sources like solar and wind. For energy hungry data centers, that’s a big win. Adding to the allure is a set of companies, including NuScale Power, that are working to build small-scale modular nuclear reactors. These reactors are expected to be safer to operate, easier to build, and flexible enough to be transported to where they’re needed. This is where Cameco comes in, given that it is one of the world’s largest miners of uranium. The stock is up more than 30% in just three months based on the current enthusiasm around nuclear power. If that enthusiasm continues, and particularly if it means more nuclear power generation is approved and even built, Cameco could continue to rocket higher.

But there’s a big caveat: Uranium is a commodity that trades based on supply and demand. If the nuclear power story falls short, Cameco’s stock price advance could stall out. In other words, if you buy Cameco, you first need to believe that nuclear power is in the early days of an industry renaissance.

Powerful growth ahead

Matt DiLallo (Brookfield Renewable): Brookfield Renewable has delivered supercharged growth over the past several years. The leading renewable-energy producer has grown its funds from operations (FFO) per share at a 12% compound annual rate since 2016. It’s on track to deliver 10%-plus FFO per share growth again this year. That has helped power more than a 20% increase in its share price over the past 12 months.

The renewable-energy company has plenty of power to continue growing briskly in the future. It expects to deliver more than 10% annual FFO-per-share growth over the next decade. That growth is highly visible and secured through 2029, with increasing visibility and security beyond that year.

A big growth driver is Brookfield’s massive development pipeline. The company has over 230 gigawatts (GW) of projects in various stages of development, including 65 GW in advanced stages. It expects to commission 10 GW of capacity annually over the next several years, including delivering more than 10.5 GW for Microsoft in the 2026-2030 timeframe. Rising power prices add to its growth visibility. It expects inflation escalators in existing contracts and higher market rates as legacy agreements expire to increase the earnings of its current portfolio.

On top of that, Brookfield expects to benefit from its ability to complete accretive acquisitions. The company is currently evaluating over $100 million in M&A opportunities. Brookfield and its partners most recently agreed to acquire a 53% interest in Neoen, which is developing renewable power in the fast-growing French, Australian, and Nordic markets. Brookfield intends to buy out the rest of Neoen in the future.

Brookfield Renewable expects to grow its earnings at more than a 10% annual rate for the next decade. That should enable it to increase its dividend, which yields 4.5%, by 5% to 9% annually. Add it up, and Brookfield could produce a supercharged total return over the next 10 years.

Bouncing back with more room to grow

Neha Chamaria (Brookfield Infrastructure): Shares of Brookfield Infrastructure, the infrastructure-focused sibling of Brookfield Renewable, gained significant momentum since plunging in the last quarter of 2023 amid fears of high interest rates, among other things, and recently hit their 52-week highs. Shares of the corporate entity (BEPC), in particular, swiftly caught up with units of the partnership (BEP) and are up a solid 42% in one year, as of this writing. The best part is that Brookfield Infrastructure is growing rapidly, as its numbers reflect, which is why this supercharged stock could soar even higher.

Brookfield Infrastructure’s just-released third-quarter earnings report offers a great insight into the company’s operational performance and growth plans. During the nine months ended Sept. 30, the company grew its funds from operations (FFO) by nearly 10% to $1.8 billion. Brookfield Infrastructure generates steady, contracted cash flows for the services it offers on its utility, transportation, midstream energy, and data infrastructure assets. At the same time, it regularly recycles capital and invests in growth, all of which combined contribute to FFO growth.

To give you some examples of what the company’s been up to this year, Brookfield Infrastructure has already achieved its capital recycling target of $2 billion for 2024 through the sale of mature assets. It has also invested consistently through the year, and some of its major investments include the acquisition of several data centers in North America, 76,000 telecom tower sites in India, and a stake in a Brazilian rail and ports logistics company.

With Brookfield Infrastructure targeting 10% FFO-per-unit growth and 5% to 9% annual dividend per share growth, the stock should continue to generate solid returns for shareholders in the coming years

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $23,446!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $42,982!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $428,758!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of November 4, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Matt DiLallo has positions in Alphabet, Amazon, Brookfield Infrastructure Corporation, Brookfield Infrastructure Partners, Brookfield Renewable, and Brookfield Renewable Partners. Neha Chamaria has no position in any of the stocks mentioned. Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, and Microsoft. The Motley Fool recommends Brookfield Infrastructure Partners, Brookfield Renewable, Brookfield Renewable Partners, Cameco, and NuScale Power and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.