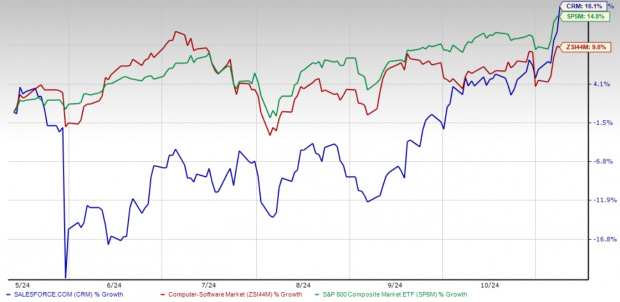

Salesforce, Inc. CRM has shown robust momentum in a highly volatile market environment, with shares climbing 16.1% over the past six months. This solid performance has outpaced the Zacks Computer – Software industry’s 9.6% gain and the S&P 500’s 14.8% rise. The stock’s upward trend has reignited investor interest, making it an appealing option for those looking to capitalize on its growth trajectory. Here’s why buying Salesforce now could be a smart move.

6-Month Price Return Performance

Image Source: Zacks Investment Research

Salesforce’s Unmatched Market Leadership

Salesforce’s dominance in the customer relationship management (CRM) space is a testament to its comprehensive product suite and strong partner ecosystem. Competing with giants like Microsoft, Oracle and SAP, Salesforce maintains a competitive edge, consistently recognized by Gartner as a market leader. This leadership is rooted in its ability to deliver cutting-edge CRM solutions that resonate with enterprises seeking to streamline customer interactions and drive productivity.

One of the cornerstones of Salesforce’s growth strategy is its strategic acquisitions, which enhance its technological capabilities and market reach. The $27.7 billion acquisition of Slack in 2021 has seamlessly integrated communication and collaboration tools into its CRM platform, unlocking new cross-selling opportunities. In 2023, Salesforce bolstered its market presence with the acquisitions of Spiff and Arikit.ai, adding innovative tools that appeal to a tech-savvy business audience.

The most recent acquisition in September 2024, a $1.9 billion deal to acquire Own Company, exemplifies Salesforce’s commitment to expanding its data protection and management capabilities. This move is crucial as companies increasingly rely on artificial intelligence (AI) and digital transformation for growth and efficiency.

GenAI Initiatives: A Game-Changer for Salesforce’s Growth

Salesforce’s aggressive push into generative AI has enhanced its product portfolio. The March 2023 launch of Einstein GPT marked the company’s official entry into generative AI, providing clients with powerful tools to streamline processes and increase productivity. The subsequent launch of the AI Cloud service in June 2023 strengthened Salesforce’s position, offering comprehensive AI solutions tailored to enterprise needs.

These strategic moves aim to keep Salesforce at the forefront of the AI revolution, ensuring its products stay relevant and highly effective as businesses increasingly adopt AI-driven solutions.

Strong Partnerships Cement Salesforce’s Position

Salesforce’s growth is not just fueled by internal innovation but also by strategic alliances with other tech leaders. Its partnerships with International Business Machines IBM, Amazon’s AMZN Amazon Web Services (“AWS”) and Alphabet’s GOOGL Google Cloud have added substantial value to its offerings.

For instance, the integration of IBM’s watsonx AI and Data Platform with Salesforce’s Einstein 1 Platform enables more personalized, AI-driven customer experiences. Collaborating with Amazon’s AWS has enhanced Salesforce’s cloud capabilities, providing scalable, reliable solutions to enterprise clients. The partnership with Alphabet’s Google Cloud has merged advanced data analytics and AI tools with Salesforce’s CRM suite, creating a powerful ecosystem that drives operational efficiency and business insights.

These collaborations allow Salesforce to innovate rapidly, expand its capabilities and maintain a leading market position.

Salesforce’s Attractive Valuation and Technical Indicators

Despite its recent stock surge, Salesforce remains attractively priced. Its forward 12-month price-to-earnings (P/E) ratio of 29.55 is below the industry average of 32.84, indicating that the stock is trading at a relative discount.

Image Source: Zacks Investment Research

From a technical standpoint, Salesforce shares are trading above their 50-day and 200-day moving averages — an encouraging sign for continued upward momentum. These technical indicators reinforce the stock’s potential for further gains in the short term.

Moving Average Signal Bullish Trend

Image Source: Zacks Investment Research

Conclusion: Buy Salesforce Stock Now

Salesforce’s strategic acquisitions, expanding AI capabilities and valuable partnerships position it well for continued growth. The company’s strong financials, coupled with its attractive valuation and positive technical indicators, make a compelling case for buying this Zacks Rank #2 (Buy) stock. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

While competition in the tech space remains fierce, Salesforce’s proven ability to innovate and maintain market leadership makes it a stock worth owning. For investors looking for a solid play in the CRM and AI space, Salesforce is a buy for now.

Free Report: 5 Clean Energy Stocks with Massive Upside

Energy is the backbone of our economy. It’s a multi-trillion dollar industry that has created some of the world’s largest and most profitable companies.

Now state-of-the-art technology is paving the way for clean energy sources to overtake “old-fashioned” fossil fuels. Trillions of dollars are already pouring into clean energy initiatives, from solar power to hydrogen fuel cells.

Emerging leaders from this space could be some of the most exciting stocks in your portfolio.

Download Nuclear to Solar: 5 Stocks Powering the Future to see Zacks’ top picks free today.

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Salesforce Inc. (CRM) : Free Stock Analysis Report

International Business Machines Corporation (IBM) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report