Nuclear energy stocks and ETFs have come to the fore as ARK Invest’s founder Cathie Wood reshared the firm’s study on how regulatory hurdles and anti-nuclear sentiment have caused cost overruns and rendered nuclear energy less cost-competitive than natural gas today.

This comes as Tesla Inc. and SpaceX CEO Elon Musk is all set to co-lead the Department of Government Efficiency (DOGE) along with Republican politician Vivek Ramaswamy. As the task force promises to dismantle bureaucracy, reduce regulations, and cut wasteful expenditures, ARKinvest tried to redirect DOGE’s official page on X (formerly Twitter) to focus on the regulatory hurdles that nuclear energy as a sector has faced in the last 20 years.

What Happened: “The International Energy Agency has identified nuclear energy as vital to achieving net zero emissions by 2050, yet nuclear power in the United States has stagnated at ~20% of the energy mix since the Chernobyl disaster in 1986,” said an ARKInvest note based on data from IEA as of October 2023.

In addition to its cost-effectiveness, nuclear power provides a reliable, continuous, and carbon-free supply of energy. These are important now since an explosion in demand for artificial intelligence is taxing the electricity consumption of data centers.

Also read: Trump’s DOGE With Musk At The Helm ‘Riddled With Conflicts Of Interest’ Says, Clinton-Era Official Robert Reich

Daniel Maguire, research associate at ARKInvest stated in his report dated April 2024 that stringent regulatory changes and anti-nuclear sentiment have stunted the build-out of nuclear capacity and caused cost overruns in developing US nuclear plants.

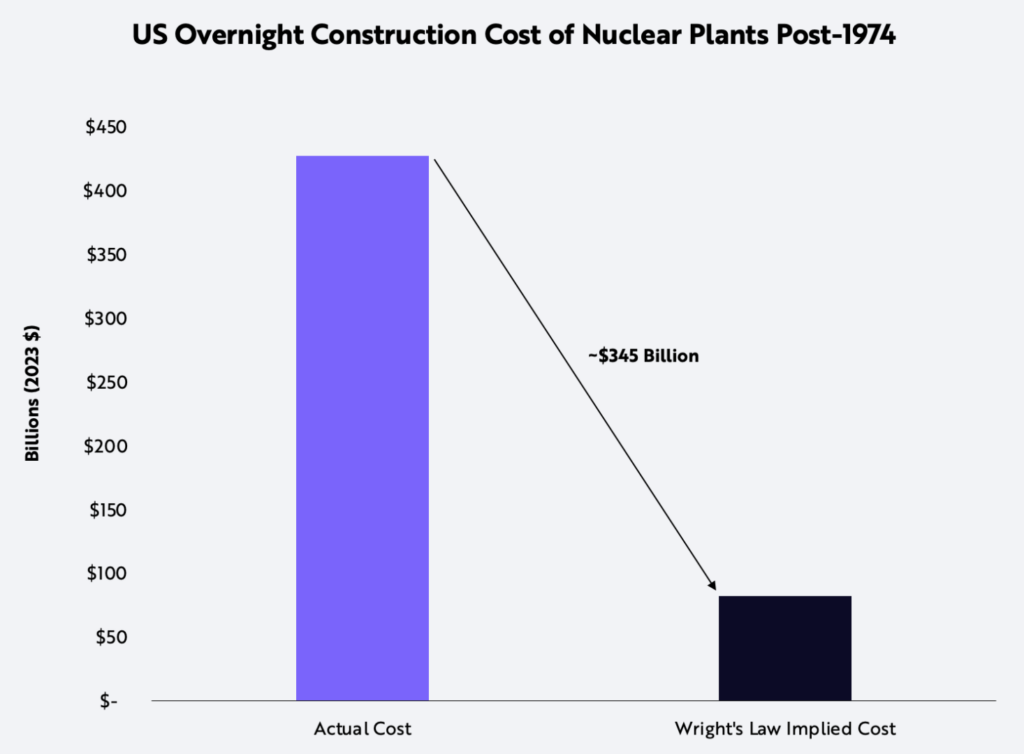

Regulatory changes in the mid-to-late seventies, including the establishment of the Nuclear Regulatory Commission and the Energy Research and Development Administration, introduced stricter licensing measures, increasing costs significantly. Without such stringent regulations, ARKInvest’s research suggests that lower cost trajectories could have saved the US about $345 billion, or ~72% of the total.

Why It Matters: With the introduction of the U.S. Advanced Reactor Demonstration Project and other emerging government support programs, nuclear cost overruns should reverse course as countries look for robust clean energy solutions to meet their net carbon emissions reduction commitments.

Maguire’s tweet shared by Wood, tagged the Department of Government Efficiency, to bring this to light. The department is scheduled to complete its work by July 4, 2026, coinciding with America’s 250th independence anniversary. Focus on this area could help spur activity in the nuclear energy sector by developing clean, carbon-free energy production avenues at lower costs.

Also read: Tesla CEO And DOGE Co-Lead Elon Musk Says ‘Excess Government Spending’ Causes Inflation: Here’s What Experts Say

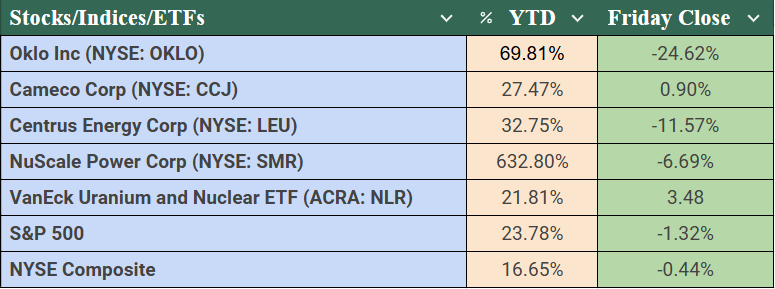

Price Action: Despite long-running regulatory hurdles and higher costs, nuclear energy stocks have performed well on a year-to-date basis. Oklo Inc OKLO, Cameco Corp CCJ, Centrus Energy Corp LEU, NuScale Power Corp (SMR) and VanEck Uranium and Nuclear ETF NLR have all outperformed NYSE composite on a year-to-date basis, which only rose by 16.65%.

The five-year charts as per Benzinga Pro, show that Centrus Energy Corp shares have been volatile, whereas NuScale Power Corp has achieved consistent returns.

Read next: Activist Hedge Fund ValueAct Boosts Meta Stake With $121M Bet, But CEO Morfit Supports Mark Zuckerberg’s AI Vision: Here’s What Investors Should Know

Image Via Shutterstock

Market News and Data brought to you by Benzinga APIs