The most oversold stocks in the consumer staples sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here’s the latest list of major oversold players in this sector, having an RSI near or below 30.

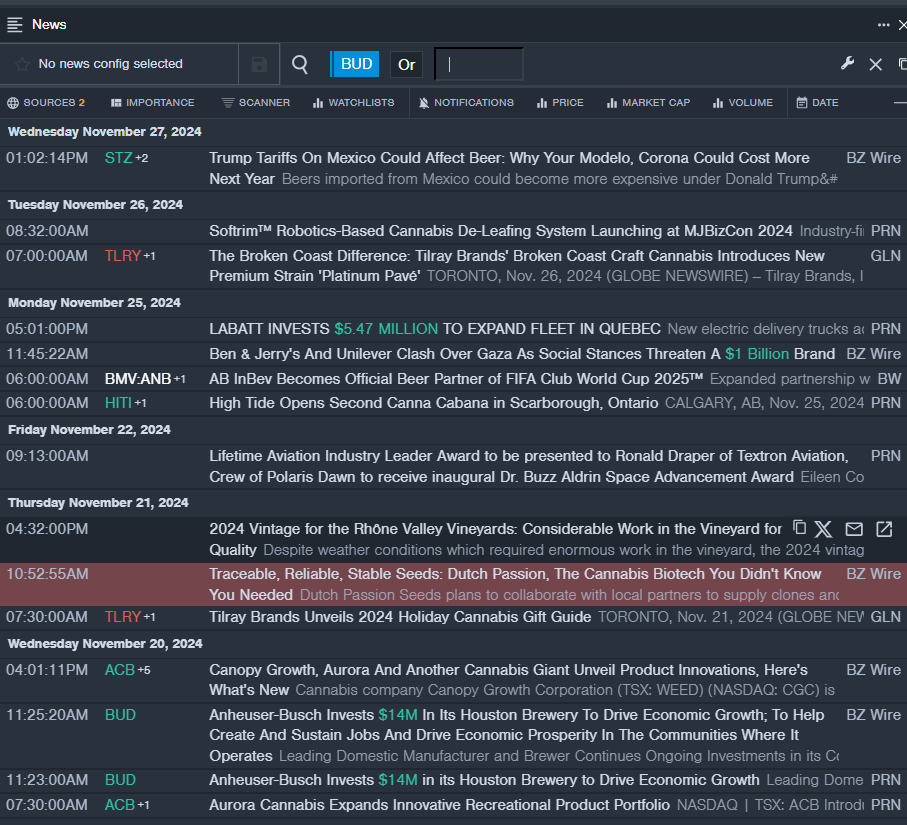

Anheuser-Busch Inbev SA BUD

- On Oct. 31, the company reported third-quarter adjusted earnings per share of 98 cents, beating the street view of 89 cents. Quarterly sales of $15.046 billion missed the analyst consensus estimate of $15.644 billion. “Consumer demand for our megabrands and the execution of our mega platforms delivered another quarter of top- and bottom-line growth with margin expansion,” said Michel Doukeris, CEO. “Our teams and partners continue to execute our strategy and we are confident in our ability to deliver on our raised FY24 EBITDA growth outlook of 6-8%.” The company’s stock fell around 16% over the past month and has a 52-week low of $53.67.

- RSI Value: 23.33

- BUD Price Action: Shares of Anheuser-Busch Inbev gained 0.3% to close at $54.08 on Wednesday.

- Benzinga Pro’s real-time newsfeed alerted to latest BUD news.

United-Guardian, Inc. UG

- On Nov. 8, the company posted third-quarter earnings of 19 cents per share, up from 14 cents per share in the year-ago period. Donna Vigilante, President of United-Guardian, stated, “We are pleased to announce that sales and earnings increased in the third quarter and for the first nine months of 2024 compared with the same periods in 2023. We continue to have strong sales of our cosmetic ingredients, which increased by 8% in the third quarter and 68% in the first nine months of 2024.” The company’s stock fell around 30% over the past month and has a 52-week low of $6.80.

- RSI Value: 28.86

- UG Price Action: Shares of United-Guardian fell 0.5% to close at $9.55 on Wednesday.

- Benzinga Pro’s charting tool helped identify the trend in UG stock.

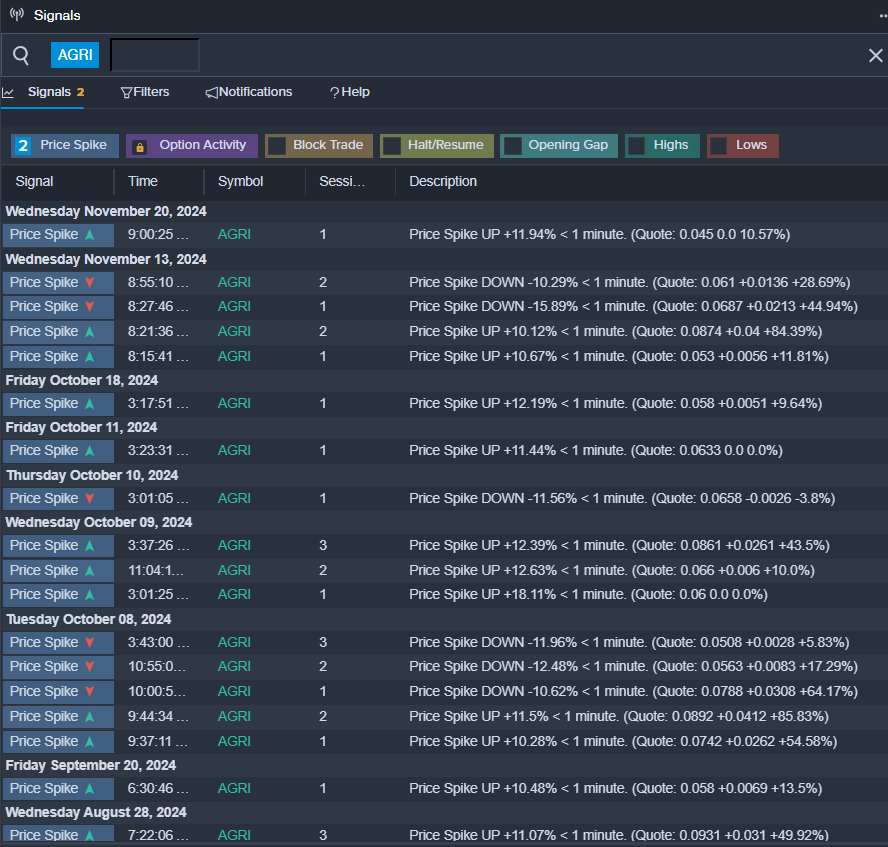

AgriFORCE Growing Systems Ltd AGRI

- On Nov. 20, AgriFORCE announced evolution of business model to follow bitcoin mining facility acquisition. The company’s stock fell around 41% over the past month and has a 52-week low of $0.035.

- RSI Value: 29.48

- AGRI Price Action: Shares of AGRI fell 3.5% to close at $0.036 on Wednesday.

- Benzinga Pro’s signals feature notified of a potential breakout in AGRI shares.

Read This Next:

Market News and Data brought to you by Benzinga APIs