Alibaba Group (NYSE: BABA) has faced turbulent waters in recent years, witnessing its stock plummet by nearly 60% over the past five years. Despite this downturn, the company’s billionaire co-founder Jack Ma has lauded Alibaba’s restructuring initiatives, hailing the divisional split that has rendered the company more nimble and customer-centric.

Now, let’s dissect Alibaba’s future prospects and assess whether the stock presents itself as a buy, sell, or hold opportunity.

The Cash Flow Engine

Through the storm, one aspect where Alibaba has excelled is its capacity to generate copious amounts of cash flow. In the fiscal third quarter, culminating in December, the company boasted $9.1 billion in operating cash flow and $8 billion in free cash flow. Across the initial nine months of the fiscal year, Alibaba raked in a staggering $22.4 billion in operating cash flow.

A robust cash flow position offers companies unparalleled flexibility. They can channel it towards rejuvenating growth within the organization, making acquisitions, or pursuing stock buybacks. In the case of Alibaba, the company swiftly launched a $25 billion share buyback program following its fiscal Q3 results in February. Subsequently, Alibaba embarked on a spree of share repurchases, reclaiming $4.8 billion in shares within the first quarter of 2024 alone. Over the preceding couple of years, Alibaba has reacquired shares worth $23.3 billion.

Furthermore, Alibaba is directing investments towards bolstering its core businesses: e-commerce and cloud computing, with a view to reigniting growth. In e-commerce, Alibaba is focusing on enhancing price competitiveness, service quality, and user experience. Strategies encompass elevating product supply, introducing more branded and manufacturer-direct products to the platform, and furnishing suppliers with flexible models to optimize pricing.

The company is also delving into enhancing the entire customer journey, from presale procedures to logistics. Moreover, early-stage experimentation with its proprietary large language model (LLM) for artificial intelligence (AI) aims to enhance search functionalities and advertising capabilities.

Within its cloud computing vertical, Alibaba is steering clients away from low-margin project-based contracts towards its public cloud solution. Concurrently, the company is upping its ante in AI-related hardware and software investments, expanding infrastructure to cater to the burgeoning demand for AI-driven computational power.

Image source: Getty Images.

The Road Ahead: Navigating Risks

Amid the challenges, Chinese companies, including Alibaba, face constraints in leveraging AI owing to U.S. embargoes on cutting-edge GPU technology from players like Nvidia. Consequently, Alibaba may not witness immediate benefits akin to U.S. cloud computing giants such as Microsoft and Alphabet. Concurrently, Alibaba opted to slash cloud computing prices to entice AI developers to its data center offerings. Thus, while AI holds promise in the long run, short-term hurdles persist.

In the realm of e-commerce, Alibaba grapples with price competition, prompted by the ascendancy of PDD Holdings and its highly popular Pinduoduo platform, significantly snatching market share. Although Alibaba’s T-Mall and Taobao platforms maintain a robust foothold as premier e-commerce channels in China, increased competition has intensified within the Chinese e-commerce domain.

Moreover, a lackluster post-pandemic recovery in the Chinese economy has cast a shadow over Alibaba’s performance. Despite a resurgence in the Chinese economy during the initial quarter and government prophecies of economic sustenance initiatives, uncertainties linger.

The Temptation of a Bargain

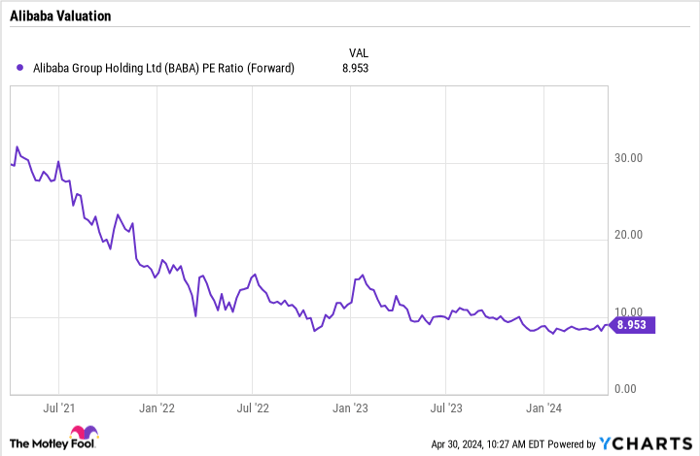

Notably, Alibaba’s allure lies in its valuation. Trading at a mere 9x forward P/E ratio, the stock presents a compelling bargain for a company that has expanded its revenue by 9% over the preceding nine months and is flush with cash flow.

BABA PE Ratio (Forward) data by YCharts

While a low valuation alone doesn’t warrant a stock purchase, Alibaba’s discounted price tag as a leading Chinese entity, dishing out abundant cash for share repurchases and business fueling, suggests a compelling investment case. Despite looming risks, the stock’s potential seems promising over the ensuing years. Therefore, Alibaba presently emerges as a buy.

Would You Bet on Alibaba Group?

Prior to diving into Alibaba Group’s stock, ponder over these insights:

The Motley Fool Stock Advisor team recently pinpointed the top 10 stocks they believe are primed to yield remarkable returns, with Alibaba Group not clinching a spot. The recommended stocks harbor the potential for monumental growth in the foreseeable future.

Reflect on the instance when Nvidia breached this list on April 15, 2005—with a $1,000 investment at the time of endorsement translating into a remarkable $544,015 return!

Stock Advisor furnishes investors with a lucid blueprint for triumph, featuring portfolio-building guidance, consistent analyst updates, and two fresh stock recommendations monthly. Since 2002, the Stock Advisor service has outperformed the S&P 500 by over fourfold.

*Stock Advisor returns as of May 3, 2024