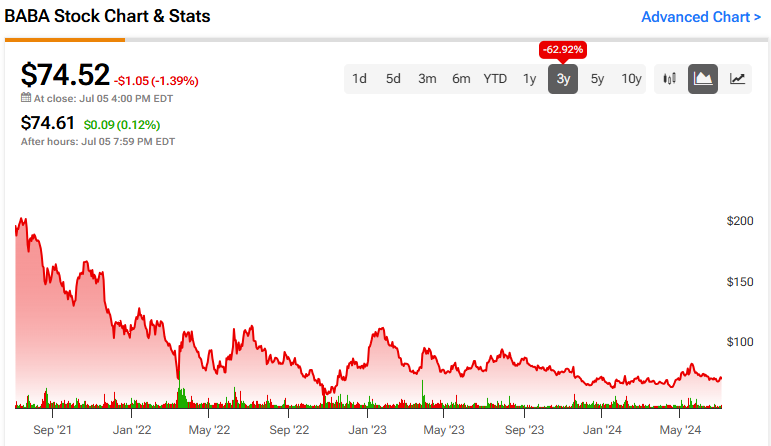

Alibaba stock on the NYSE remains in a delicate state, showing little signs of resuscitation from its current slump. While major indices have soared to unprecedented heights over the past year, investors seem disenchanted with the prospect of this Chinese e-commerce juggernaut. Nevertheless, as Alibaba’s growth trajectory gains momentum and its management intensifies efforts to shower shareholders with capital, notably through buybacks, the stock might soon catch the eye of bullish investors again. As a result, I find myself gravitating towards a bullish stance on BABA stock.

Positive Growth Trajectory Paves the Way for a Strong FY2025

Alibaba’s most recent performance painted a picture of rejuvenated growth, setting the stage for a robust FY2025. In the closing quarter of 2024, ending March 31st, Alibaba raked in revenues of $30.7 billion, marking a 7% increase year-over-year. This propelled the company’s annual revenue to $130.4 billion, up by 8% from FY2023. Significantly, this rebound in revenue contrasts starkly with the previous year’s meager 2% growth, nearly plateauing.

Alibaba’s growth spurt was spurred by vigorous progress across the board. The cornerstone e-commerce platforms, Taobao and Tmall, witnessed a single-digit revenue surge of 4% year-over-year. This success was fueled by a surge in the number of buyers and purchase frequency. Demonstratively, gross merchandise value (GMV) on both platforms soared by double digits, energized by brisk order growth, enhancements in user experience, and competitive pricing.

On the global front, Alibaba International Digital Commerce (AIDC) boasted an even more impressive revenue surge of 45%. Management attributed this to robust combined order growth, revenue contributions from AliExpress’ Choice, and enhanced monetization that bolstered Alibaba’s international standing.

Although Cloud Intelligence revenues inched up a modest 3% from the previous year, the company made substantial strides that could boost growth in this segment in the near to medium term. Notably, Alibaba witnessed double-digit revenue growth in its primary public cloud services and triple-digit growth in AI-related revenues.

Though Alibaba did not disclose the specifics of its AI-related revenues, the indications are that the company is on the cusp of becoming a dominant force in China’s AI landscape. Amidst limited engagement between Western and Chinese AI technologies, Alibaba’s colossal scale in cloud computing positions it as a formidable competitor. Few companies domestically have the capacity to rival Alibaba, underscoring the potential for the stock.

Profitability, Valuation, and Capital Appreciation

Alibaba’s resurgence in revenue for FY2024 translated into impressive profitability gains, largely attributable to the company’s astounding economies of scale. The company achieved a 12% spike in adjusted EBITA, totaling $22.9 billion, with the adjusted EBITA margin swelling from 17% to 18%. Furthermore, Alibaba’s adjusted net income surged by 11% to $21.8 billion, while on a per-American Depositary Share (ADS) basis, this figure climbed a more substantial 14% to $8.62, facilitated by a reduced ADS count attributed to Alibaba’s buybacks.

Market analysts anticipate a slight moderation in Alibaba’s ADS for the current year, with consensus estimates hovering at $8.20 for FY2025, reflecting a marginal decline of 4.7%. Despite this, Alibaba’s stock continues to trade at an exceptionally modest forward P/E ratio of 9x. Indeed, Alibaba carries well-documented risks that warrant acknowledgment. Yet, at this valuation, the stock’s investment proposition becomes increasingly difficult to ignore, given its entrenched position in the market.

This is notably underscored by Alibaba’s burgeoning capital returns. Management has made a resolute commitment to rectify the stock’s undervaluation, demonstrating a clear focus on rewarding existing shareholders and enticing new ones through bolstered confidence in the stock. Since early 2022, the company has repurchased and retired close to 11% of its shares, while the current year’s regular and special dividends ($1.66 per ADS in total) entail an additional yield of 2.2% at prevailing stock price levels.

With ample room for further escalation in Alibaba’s capital returns, the composite yield from buybacks and dividends is primed to become increasingly enticing if the stock price maintains its current levels. Considering the stock’s already considerable total yield in the high single digits, this facet emerges as the paramount bullish stimulant. Tangible capital returns wield a potent sway that is hard to downplay.

Analyst Sentiment: Is BABA Stock a Buy?

The prevailing sentiment among Wall Street analysts skews towards bullish for Alibaba, and this sentiment aligns seamlessly with its subdued valuation. With 14 Buy ratings against three Holds, the stock maintains a Strong Buy consensus. The average price target for BABA stock, perched at $103.70, recently outpaced the current stock price, suggesting a substantial upside measure of 39.2%.

Key Takeaway

Alibaba’s stock has languished behind the competition over the years, even during the broader market’s recent ascent. Nevertheless, recent developments hint at a potential reversal of fortunes. With a resurgence in growth for FY2024 and promising prospects for FY2025, Alibaba’s investment prospects appear increasingly favorable. Coupled with a renewed emphasis on capital returns, including hefty share buybacks and an expanding dividend, Alibaba seems poised to reclaim the attention of bullish investors.

Irrespective, at its current valuation, the anticipated rewards seem to outweigh the risks, notwithstanding the inherent uncertainties linked to a company like Alibaba.

Disclosure