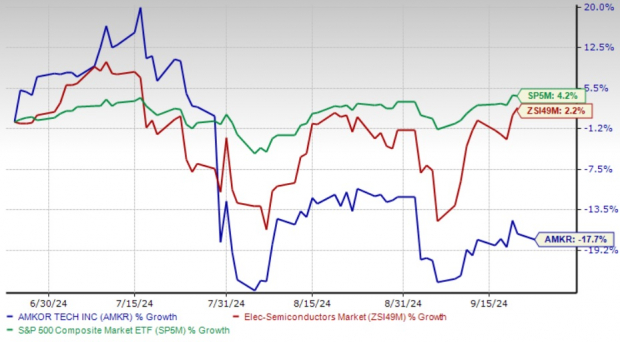

Amkor Technology has hit a patch of turbulence as its shares plummeted by 17.7% in the last three months. This downward spiral starkly contrasts with the Zacks Electronics – Semiconductors industry’s 2.2% growth and the S&P 500 index’s 4.2% return. The company’s downward trajectory can be attributed to a flurry of challenges that have deterred investors.

Over the past year, Amkor grappled with disruptions in its supply chain due to geopolitical tensions, alongside macroeconomic hurdles spurred by surging inflation and interest rates. Moreover, the leader in outsourced semiconductor packaging and test services (OSAT) faced the brunt of the semiconductor shortage, which curtailed its revenue and profit margins.

The most recent quarter saw AMKR continue to struggle with the sluggish recovery in the automotive and industrial sectors, coupled with weakened demand from traditional data center clients. Reports have surfaced indicating that several of Amkor’s factories are not running at full capacity, impeding its revenue growth.

Compounding the company’s woes is the diminishing demand for its 2.5D integrated circuit caused by inventory adjustments in the automotive and industrial segments. Additionally, the cost of operations soared as Amkor invested in constructing a new factory in Vietnam, resulting in a hit to its bottom line.

Amkor Technology Three Month Performance

Image Source: Zacks Investment Research

Amkor Technology Sails in Choppy OSAT Waters

As a major player in the OSAT domain, Amkor Technology offers innovative packaging and test technologies with a strong reputation for high-volume manufacturing. With a global presence spanning multiple countries in Asia and Europe, Amkor has solidified its position as a key player in the OSAT sector. The company has forged partnerships with tech giants such as Apple, Qualcomm, Intel, Broadcom, AMD, and more.

In a significant development, Apple teamed up with Amkor in late 2023, designating the latter as its primary supplier at the Peoria manufacturing and packaging facility. This collaboration saw Amkor providing chip packaging solutions to Apple, marking a decade-long alliance that has continued to evolve.

Despite its global footprint and prestigious partnerships, Amkor faces stiff competition in the OSAT market from Taiwan Semiconductor Manufacturing Company (TSM) and ASE Technology Holding (ASX). While both TSM and ASX operate internationally in the OSAT sector, they possess their fabrication facilities. TSM, though primarily focused on chip manufacturing, boasts a robust advanced packaging division. On the other hand, ASX specializes in IC packaging, testing, and assembly services, offering products like System-in-Package and 3D IC technologies.

In the face of these challenges, AMKR anticipates third-quarter fiscal 2024 revenues to hover between $1.785 billion and $1.885 billion (mid-point at $1.835 billion), slightly below the Zacks Consensus Estimate of $1.84 billion. For fiscal 2024 revenues, the Zacks Consensus Estimate stands at $6.51 billion, signaling a marginal uptick of 0.15% year over year.

The Verdict

Amkor Technology finds itself grappling with macroeconomic impediments, rising operational costs, fierce competition, and a lackluster growth trajectory amid a sluggish recovery in its core markets. Presently, AMKR holds a Zacks Rank #5 (Strong Sell). For investors, the prevailing recommendation would be to part ways with the stock for now.