Apple, a member of the illustrious Magnificent 7 group, has been hogging the limelight in the markets owing to its stellar performance in the past year girded by strong earnings. The juggernauts of the mega-cap realm have only swelled further, turning the scrutinizing spotlight even brighter.

The tech giant, Apple AAPL, took center stage in its much-awaited Apple Event where it unveiled a gamut of new products and features tailored for consumers. The month ahead is set to be eventful for the company, especially with the impending release of the latest iPhone iteration.

The Buzz around iPhone 16 Pro

The star of the show, unsurprisingly, was the iPhone 16 Pro, which garnered significant attention during the event. Apple pulled back the curtains on a host of new features for the model. Notable mentions include improved battery life, forthcoming AI capabilities, and the most expansive display screen yet.

Crucially, the iPhone 16 Pro is architected for Apple Intelligence, a personal intelligence system that assists users in writing, self-expression, and seamless task completion. Moreover, reports suggest that the iPhone 16’s glass is twice as tough as that of any other smartphone, promising durability.

The performance of Apple’s iPhones has seen a mix of hits and misses in recent times, delivering a rollercoaster of results over the past year.

Image Source: Zacks Investment Research

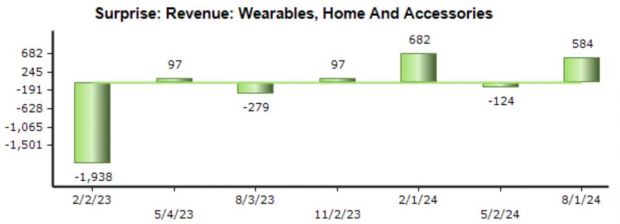

The new Apple Watch 10 also made its debut, boasting its largest and most advanced display yet. Featuring Apple’s first wide-angle OLED Display, the watch ensures easier screen readability at a glance. Like the iPhone, Apple’s Wearable results have exhibited a mix of triumphs and letdowns over the past year.

Image Source: Zacks Investment Research

Should Investors Consider Apple Shares?

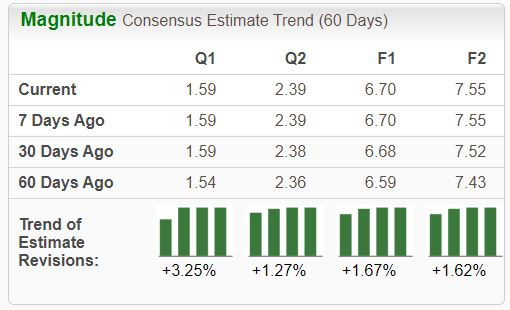

Apple’s earnings outlook has taken a bullish turn across the board in recent months, with a particularly striking trend projection for its current and upcoming fiscal years. The mega-cap titan is anticipated to achieve a 9% EPS growth accompanied by a 2% uptick in sales in FY24.

Image Source: Zacks Investment Research

Trading at elevated valuation multiples, in line with its historical high-growth persona, Apple’s current PEG ratio stands at 2.3X, significantly above the five-year median. This indicates that investors are shelling out a premium for expected earnings growth.

While it’s no secret that Apple’s growth has been tapering, the recent buzz surrounding its fresh product lineup could potentially reverse this trend. Apple is just scratching the surface of its AI offerings, a pivotal factor to consider when evaluating its long-term prospects.

Despite the growth deceleration, Apple remains a cash-generating powerhouse, clocking $34.1 billion in free cash flow in its latest quarter.

The Final Verdict

The tech behemoth, Apple AAPL, has unwrapped a slew of new products and models in today’s event, launching a dynamic September for the company. The standout highlight for investors is likely the revelations surrounding the AI features nested within the iPhone 16 Pro, albeit these features won’t be initially preloaded.

A sleeker Apple Watch and revamped AirPods will serve to bolster its Wearables arm, which has exhibited robust growth in recent years.

In a nutshell, Apple seems to be a dark horse in the AI race, staying relatively low-key compared to many other firms flaunting their offerings. While the valuation multiples may seem steep in light of forecasted growth, the stock continues to be a prime long-term pick for investors’ portfolios given its prodigious earnings prowess and flush cash position.

The Quest for Top Stocks in the Near Term

Just released: Seasoned professionals distill 7 stellar stocks from a selection of 220 Zacks Rank #1 Strong Buys. These tickers are labeled “Most Likely for Early Price Pops.”

Since 1988, this exclusive list has outpaced the market by more than 2X with an average annual gain of +23.7%. Make sure to focus on these carefully chosen 7 options.

Would you like to see them now?

For more on Apple Inc. (AAPL), check out the Free Stock Analysis Report.