In the realm of Chinese e-commerce stocks, the clash between two key players, Alibaba and PDD Holdings, has ignited a fervent debate among investors. Through a meticulous evaluation using TipRanks’ Comparison Tool, the battlefield revealed both contenders flaunting bullish outlooks. Nevertheless, a victor emerges from this scrutiny with a flair that demands acknowledgment.

While Alibaba casts its net wide, encompassing the spheres of China and the global market, with platforms like Tmall and Taobao under its hood, PDD stands distinguished for its hallmark Pinduoduo discount e-commerce platform along with its international arm, Temu. Alibaba’s repertoire extends to cloud computing and the ownership of various technology entities.

The tale of the tape reflects Alibaba’s year-to-date uplift of 5%, albeit a disheartening 18% descent over the past year. Conversely, PDD shares waver on a different path, plunging 12% year-to-date yet soaring by a lofty 43% over the preceding 12 months.

The peculiar dichotomy in these share price performances belies their comparable valuations. Adorned in the cloak of market metrics, we inspect their price-to-earnings (P/E) ratios to discern the nuances of their valuations in relation to each other and their industry.

Of note, the Chinese online retail and e-commerce domain harbors a breed of unprofitable entities, placing Alibaba and PDD in an exclusive league susceptible to scrutiny on a price-to-sales (P/S) scale. The current trade in the Chinese e-commerce sector, at a P/S ratio of 1.2x, stands juxtaposed against a three-year average of 1.4x.

An In-depth Look at Alibaba (NYSE:BABA)

With a tantalizing P/E of 18.4x and a P/S of 1.3x, Alibaba appears alluringly priced, especially when juxtaposed against the expansive projected earnings growth mirrored in the significantly lower forward P/E of 8.8x. Such a robust projection warrants a bullish outlook.

The realm of forward multiples, shrouded in the mists of unpredictable future horizons, bears weighty relevance, particularly in the realm of Alibaba, widely heralded as the China-based doppelganger of Amazon. While perched on the cusp of redefining perceptions about growth stocks, Alibaba mirrors Amazon with its burgeoning cloud empire. Forecasts paint a picture of a burgeoning Cloud revenue poised for double-digit expansion, fueled by the company’s strategic redesigns.

The fiscal saga that culminated in March 2024 saw Alibaba’s overall revenue sprout by 8% year-on-year (in renminbi), effectively shedding its erstwhile growth-stock veneer. Yet, the quiescent waters may stir if the cloud platform unleashes the torrential revenue growth prognosticated, inciting a rebirth of the mammoth revenue escalations that nudge a company into the revered annals of growth stocks.

Anchored in the present, Alibaba’s stock dangles at temptingly low levels, straddling the historical spectrum of a five-year P/E range teetering between 10x and 30x since August 2019. A penance seemingly exacted for the harrowing 96% year-on-year net income slump in the March quarter appears as a dark shadow. The narrative, however, unravels the tale that most of the plummet stemmed from declines in publicly traded investments.

Forewarned be those who tread the Alibaba path, for the route is shrouded in shadows of expectation rather than tangible financial manifestos. In contrast, Amazon fancies itself at a regal P/E of 52.5x and a P/S of 3.3x, beckoning attention to China’s hospitable sales growth terrain, a frontier where the sheer magnitude of the Chinese populace reigns supreme.

Deciphering the Mystique of BABA Stock Target Price

An expansive empire unfurls before Alibaba, adorned in the regalia of a Strong Buy consensus rating garnished with 13 Buy, three Hold, and zero Sell ratings in the preceding three-month saga. The average Alibaba stock price target perches at $104.06, whispering sweet melodies of a 33.5% upside potential.

Peer into the Veil Shrouding BABA’s Analyst Ratings

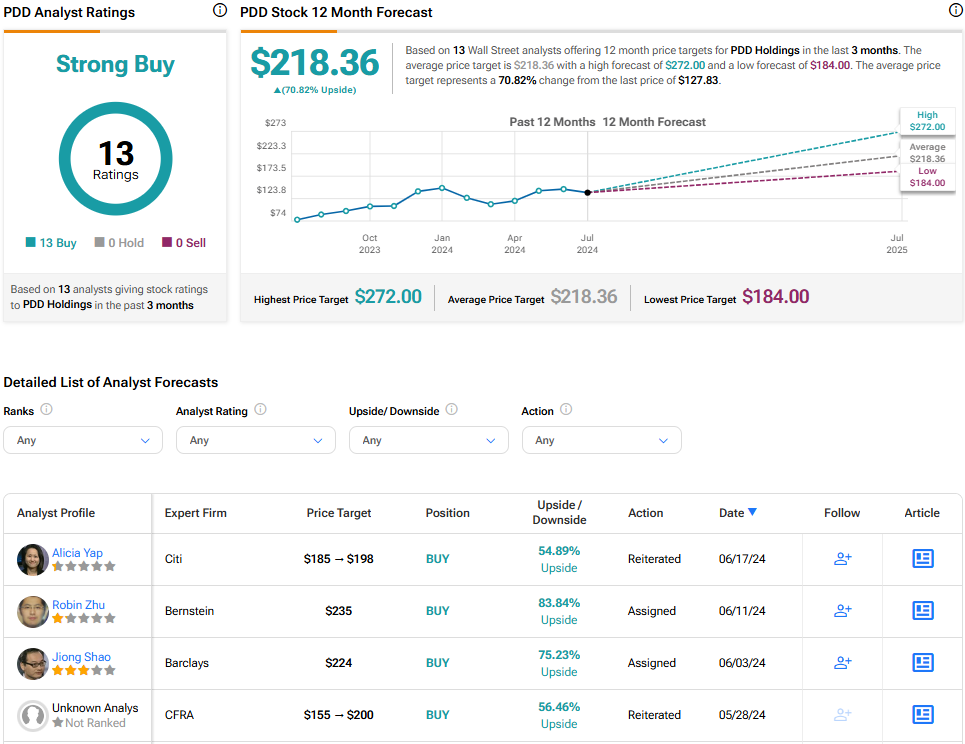

The Enigma of PDD Holdings (NASDAQ:PDD)

Nestled within a P/E of 17x, PDD mirrors Alibaba’s valuation prowess, although the ominous P/S of 4.4x raises crimson flags hinting at potential overvaluation. Yet, adorning the facade of a growth stock on a sales pedestal lingers the tale of 2023, a year marked by a phenomenal 90% revenue growth (in renminbi), albeit on a miniature scale compared to the Alibaba colossus. An aura of bullish optimism seems fitting.

Traversing the bumpy terrain of its P/E spectrum, PDD’s odyssey oscillates from 17x to 51x since March 2022, the watershed moment of profitability dawned. The loftier echelons of the forward P/E at 10.5x beckon with allure but also carry a tinge of unease, shadowed by the specter of regulatory perils entangling PDD along the avenues of its Temu marketplace focused on North America and its TikTok citadel, boasting an ardent following of 1.8 million acolytes.

A whiff of perturbation lingers within the winds of U.S. scrutiny looming over TikTok, casting shadows on Chinese tech entities, PDD included. Skepticism shrouds PDD’s veils as reports dance around queries regarding Temu’s adherence to legislations prohibiting products derived from coercive labor practices. Unfortunately, veiled behind elusive financial partitions, PDD fails to present segregated Temu earnings, a scenario that often sets investor hearts aflutter with apprehension.