Bank of America analysts recently made a bold suggestion to Detroit automakers General Motors (GM), Ford (F), and Stellantis (STLA) – exit the Chinese market swiftly and refocus on the U.S. market. Top-rated BofA auto analyst John Murphy argues that this strategic pivot will allow the companies to hone in on their profitability stronghold in North American trucks.

General Motors, once a key player in China with its Buick brand, experienced a drastic sales drop to 2.1 million vehicles in 2023, reporting a loss of $106 million in the last quarter.

Murphy emphasized that Ford and Stellantis have faced challenges in gaining a sustainable market share in China despite collectively selling 30 million vehicles last year. He predicts that persistent financial losses in China will deplete the automakers’ resources and advises redirecting attention towards developing competitive electric vehicle (EV) line-ups to rival Tesla (TSLA). Murphy asserted during a presentation at the Automotive Press Association event that China is no longer a core strategy for GM, Ford, or Stellantis.

Notably, Murphy boasts a 58% overall success rate on his recommendations, with an average return of 11.3% per rating.

Identifying the Prime Auto Stock

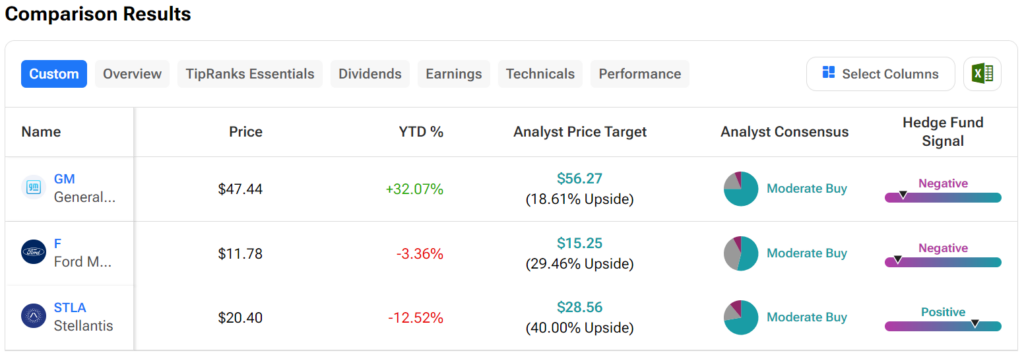

Among the trio, industry analysts on Wall Street designate STLA stock as the top auto stock to invest in. Forecasts project its price to surge by 40% from current levels to $28.56 per share. Interestingly, professional fund managers also seem to concur, as STLA stock is the sole option with a Positive Hedge Fund Signal.