Artificial intelligence (AI) has become a significant driving force for many stocks over the past year, propelling the shares of Super Micro Computer (NASDAQ: SMCI) and Advanced Micro Devices (NASDAQ: AMD) by 607% and 101%, respectively, over the last 12 months.

However, a deeper dive into the financial performance of these companies reveals substantial disparities in the impact of AI on their businesses. One company is experiencing a substantial surge in revenue and earnings due to AI, while the other is still striving to establish a strong foothold in this burgeoning market.

Let’s closely examine the potential of these AI stocks to determine which one is currently the most promising investment option.

The Case for Super Micro Computer

Super Micro Computer, commonly referred to as Supermicro, specializes in selling AI server solutions such as rackmounts utilized for deploying AI chips. The company’s bespoke and modular server solutions support AI chips from prominent players like Nvidia, Intel, and AMD. Consequently, with the escalating demand for AI server chips, Supermicro’s product sales have witnessed an exponential surge.

The company reported a staggering 103% year-over-year revenue growth to $3.66 billion in its fiscal 2024 second quarter (ended on Dec. 31). Additionally, its adjusted earnings soared from $3.26 per share in the same quarter of the previous year to $5.59 per share. Management attributed this remarkable growth to both new customer acquisitions and robust demand from existing customers, who “continue to demand more of Supermicro’s optimized AI computer platforms and rack-scale Total IT Solutions.”

Moreover, Supermicro highlights its expanding presence in the AI server market. As a result, the company now anticipates its fiscal 2024 revenue to range between $14.3 billion and $14.7 billion, marking a substantial leap from its earlier projected range of $10 billion to $11 billion. If Supermicro attains this target, it would more than double its revenue from fiscal 2023.

AI constitutes a pivotal role in this astronomical revenue upsurge, as the company generates over half of its total revenue from the sale of server solutions within this segment. Therefore, it should not come as a surprise to see Supermicro concluding fiscal 2024 with even more impressive revenue growth. The demand for AI servers is rapidly increasing, with Gartner’s researchers estimating a 30% annualized growth rate in this market through 2027.

Supermicro is aggressively investing in capacity expansion to capitalize on this opportunity. During its latest earnings conference call, the management stated that its new production “sites will support our annual revenue capacity above $25 billion.” Consequently, analysts are optimistic about Supermicro’s long-term prospects, projecting a 48% annualized earnings growth over the next five years.

As a result, Supermicro may continue to stand out as a top AI stock for several years and sustain its impressive share price rally.

The Case for AMD

Although AMD’s shares have doubled in the past year, this surge has been predominantly fueled by hype, as the chart below illustrates.

AMD Revenue (TTM) data by YCharts.

Furthermore, AMD’s Q4 results, released on Jan. 30, indicate that its AI business is not poised to reach the scale of that of Supermicro. AMD anticipates generating at least $3.5 billion in revenue from AI chip sales in 2024. Considering that Supermicro derives over half of its total revenue from AI hardware sales, its projected $14.5 billion in revenue for the year suggests that AI could drive over $7 billion in annual sales for the server manufacturer.

However, AMD has substantially raised its revenue guidance for 2024 related to AI. Initially forecasting $2 billion in revenue from AI chip sales this year, the company has significantly increased that guidance following a strong initial reception of its family of MI300 Instinct accelerators released in December.

“We have also made significant progress with our supply chain partners and have secured additional capacity to support upside demand,” stated CEO Lisa Su during the Q4 earnings call. Consequently, there is a strong possibility that AMD might generate more revenue from its AI business in the future and revise its guidance. Nevertheless, investors should recognize that AI accounts for a small percentage of AMD’s overall business, and the company faces challenges in crucial areas.

As a result, it comes as no surprise that analysts expect AMD’s revenue to grow by 14% in 2024 to $26 billion, a significantly slower pace than the growth anticipated for Supermicro. It is also important to note that AMD’s growth is predicted to accelerate in 2025, with its revenue expected to increase by 25% to $32.3 billion. Nonetheless, this growth rate is lower than the 30% revenue surge expected for Supermicro in the next fiscal year.

Consequently, AI is likely to exert a more substantial positive impact on Supermicro in comparison to AMD. However, this is not the sole reason why Supermicro seems to be a better AI investment at present.

Valuation: Shedding Light on the Preferred AI Stock

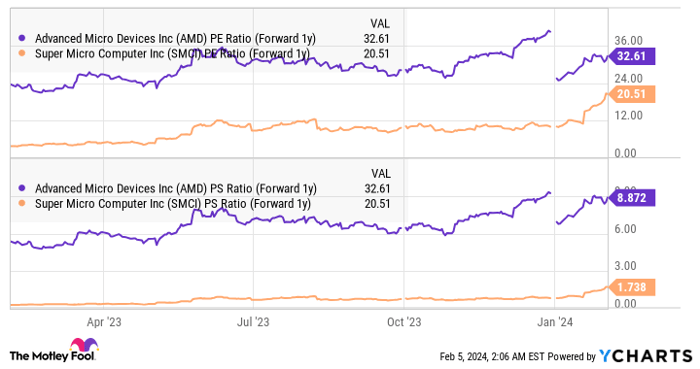

Supermicro is experiencing much faster growth than AMD and is currently trading at a modest 3.6 times sales, in contrast to AMD’s lofty price-to-sales multiple of 11. Additionally, Supermicro’s forward valuation multiples indicate that it is more attractively priced than AMD.

AMD PE Ratio (Forward 1y) data by YCharts.

The Rise of Super Micro Computer in the AI Stock Market

The artificial intelligence (AI) stock market presents a unique opportunity for investors to make substantial gains, with companies like Super Micro Computer and Advanced Micro Devices (AMD) at the forefront. However, a deeper analysis reveals a compelling case for Super Micro Computer as the superior investment. In comparison to AMD, not only is Super Micro Computer’s stock attractively priced, but it is also experiencing significant growth driven by the increasing demand for its server solutions. Let’s delve into the factors contributing to this shift in the AI stock market and why investing in Super Micro Computer may be a lucrative proposition.

The Superior Potential of Super Micro Computer

When it comes to evaluating the potential of Super Micro Computer as an investment, it is evident that the company’s trajectory in the AI stock market is distinctively promising. The company’s strategic positioning in delivering server solutions, coupled with the surging demand for AI-related technologies, provides a strong foundation for sustained growth. This positions Super Micro Computer as a compelling option for investors seeking exposure to the AI sector.

Comparative Analysis: Super Micro Computer vs. Advanced Micro Devices (AMD)

While AMD has long been lauded for its contributions to the semiconductor industry, the current landscape of the AI stock market presents an intriguing dichotomy. Amid Super Micro Computer’s ascendance, AMD faces the challenge of not only delivering on market expectations but also contending with the more compelling value proposition presented by Super Micro Computer. As a result, the scales seem to be tipping in favor of the latter, amidst the broader market sentiment favoring companies with a strong foothold in AI technology.

Historical Context and Market Dynamics

The historical context of the AI stock market provides valuable insights into the evolution of key players and their respective trajectories. This historical backdrop serves as an important reference point, allowing investors to discern the underlying market dynamics that are influencing the current surge of interest in Super Micro Computer and its position as a formidable contender in the AI sector. Understanding these dynamics is crucial for informed investment decisions in the ever-evolving AI stock market.

Investment Considerations and Opportunities

Considering the compelling case for Super Micro Computer, it is imperative for investors to evaluate the opportunities presented by the company’s ascent in the AI stock market. The convergence of its competitive pricing, robust growth, and increasing demand for its server solutions underscores the potential for substantial returns. As such, exploring the investment landscape and identifying opportunities that align with the evolving dynamics of the AI stock market becomes paramount.

Closing Thoughts on Super Micro Computer in the AI Stock Market

In conclusion, the rise of Super Micro Computer as a prominent player in the AI stock market warrants careful consideration from prospective investors. With its advantageous positioning, growth potential, and the evolving market dynamics favoring AI technology, Super Micro Computer emerges as a compelling investment avenue. As investors navigate the ever-changing landscape of the stock market, the strategic evaluation of companies like Super Micro Computer and their role in the AI sector is essential for informed decision-making.