A Megacap Duel of 2024

Amidst the tumultuous seas of the financial world, the megacap ships have been sailing particularly high in the year 2024. Nvidia, with a hefty 147% year-to-date climb, stands proudly in the ranks. The likes of Meta Platforms and Alphabet have also seen substantial gains. Together, these tech behemoths now command a colossal combined market cap of $15.6 trillion — a figure that rivals the magnitude of the Eurozone economy itself, a Goliath in the global economic theater.

Image source: Getty Images.

The Rise of Nvidia

Data lords and market watchers can attest to the unprecedented ascent of Nvidia, a titan in the realm of semiconductors. Like a monetary phoenix, Nvidia has soared, amassing a breathtaking $2.7 trillion in market value over a mere couple of years. It briefly donned the crown of the most valuable company globally, a tale that even the most riveting of Wall Street dramas could scarcely match.

Microsoft’s Enduring Might

Yet, in the shadows of Nvidia’s meteoric rise lies Microsoft, a perennial titan that continues to cast a long shadow in the tech arena. Firmly reclaiming its seat as the world’s most valuable company, Microsoft plays a formidable game of thrones, adapting to the ever-evolving tech landscape with finesse, especially in the realm of the AI revolution.

A Finely Balanced Scale: 2024 Verdict

A financial duel of epic proportions unfolds between Nvidia and Microsoft, where both warriors stand adorned in laurels of revenue, profits, and free cash flow. These tech gladiators, helmed by the charismatic Satya Nadella and Jensen Huang, reign supreme in the modern amphitheater of innovation.

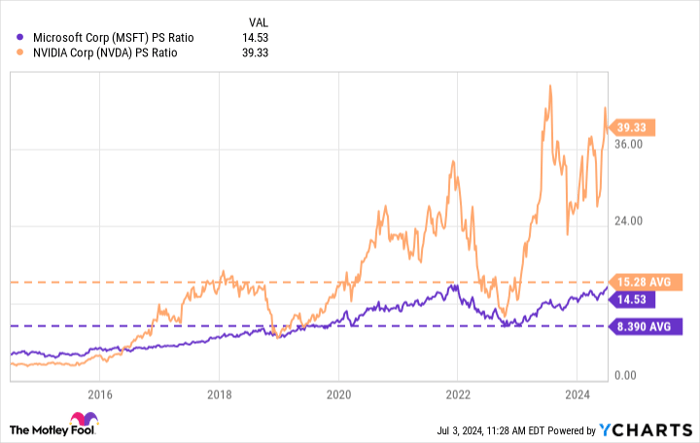

Peering beneath the financial veneer, Nvidia’s valuation scales the lofty heights of record territory, with a price-to-sales (P/S) ratio that now eclipses its decade-long standards. In contrast, Microsoft’s P/S ratio, while historically lofty at 14x, appears decidedly humble in comparison to Nvidia’s towering metrics.

MSFT PS Ratio data by YCharts

As the pendulum of market fortune swings, investors scrutinize Nvidia’s vigorous growth projections, placing their bets on a future where Nvidia’s valuation finds equilibrium. While Microsoft stands with swords drawn, fortified by its diverse business bastions that may shield it from the tempests of market uncertainty.

And so, amidst this financial fray, a seasoned investor may find solace in Microsoft’s more tempered valuation compared to Nvidia’s heady heights. Nevertheless, the sage advice of the markets echoes: let the champions run their course, for the vicissitudes of investment oft hold surprises of their own.

Unlocking the Investment Enigma

In the hallowed corridors of investment wisdom, the sages whisper of truths shrouded in enigma, challenging the unwary to gaze into the abyss of returns and risks…

Before one delves into the labyrinthine depths of Microsoft’s stock gamut, prudence beckons a moment of reflection…

Insights on Top Performing Stocks

Discover top stocks that investors are eyeing, and surprisingly, Microsoft didn’t make the cut. The selected 10 stocks have the potential to yield significant returns in the foreseeable future.

Imagine back to April 15, 2005, when Nvidia was mentioned in this list… If you had invested $1,000 according to the suggestion, your investment would have grown to $771,034*

Stock Advisor offers investors a lucid plan for triumph, with advice on constructing a portfolio, regular analyst updates, and two fresh stock recommendations monthly. The service has exceeded the S&P 500 returns more than fourfold since 2002*.

*Stock Advisor returns as of July 2, 2024