Analyzing Alphabet and Netflix

Alphabet’s YouTube topping TV viewership charts in May, a surprise victory in today’s competitive streaming landscape. While traditional TV declines, Netflix, the streaming behemoth, might seem like the natural favorite.

Netflix, a pioneer in streaming, invested heavily in original content and shifted towards ad-supported models to survive. Revenue hit $9.4 billion, driven by memberships and pricing.

Contrastingly, Alphabet’s vast revenue sources span advertising, cloud services, and more. Despite YouTube’s $8 billion win, Google’s $46 billion ad revenue dwarfs it.

Alphabet has strategically diversified its income streams, yet advertising still dominates its $81 billion revenue, growing by 15%.

Comparing Key Metrics

Alphabet’s financial might is evident in its $17 billion free cash flow, impressive compared to Netflix’s $2.1 billion. Stock-wise, Netflix shines in the short run with 65% growth, while Alphabet has a 55% increase.

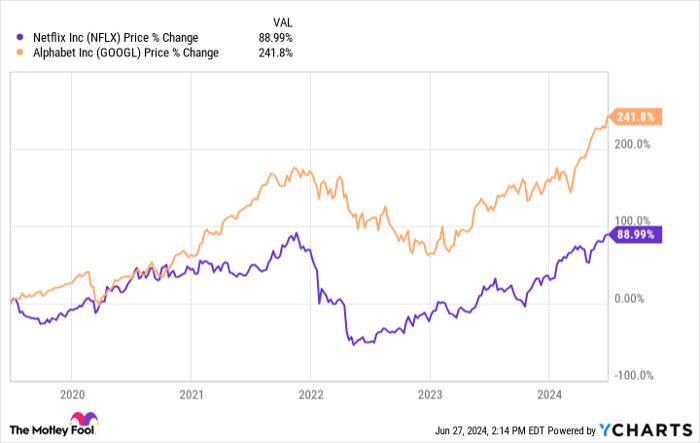

However, Alphabet’s long-term outperformance against Netflix over the past five years showcases its consistent strength. Despite Netflix’s recent growth, Alphabet’s lower valuation and diversified portfolio stand out.

Netflix’s recent upswing comes at a price – a 48 P/E ratio compared to Alphabet’s 28. Despite Netflix’s current edge, Alphabet’s lower valuation is a long-term advantage.

Deciding Between Alphabet and Netflix

Alphabet’s diverse revenue streams and strong advertising base position it well in the evolving streaming landscape. With YouTube’s lower-cost content, Alphabet’s streaming business setup may trump Netflix.

Moreover, Alphabet’s robust free cash flow and lower valuation indicate a wiser investment choice compared to Netflix in the long run.

Investing Considerations

Before diving into Alphabet, consider insights from the Motley Fool’s Stock Advisor team. They suggest 10 top stocks for investing, excluding Alphabet. These picks have a higher potential return than Alphabet.

Remember, past favorites like Nvidia have shown significant growth. Seeking advice from reliable sources like Stock Advisor can lead to substantial gains in your investment journey.

*Stock Advisor returns as of June 24, 2024