Bitcoin, the pioneer cryptocurrency, has captivated investors with its extraordinary growth trajectory. From its humble beginnings to its recent price surge, this digital asset has carved its unique path, continually on the cusp of shattering records in 2024.

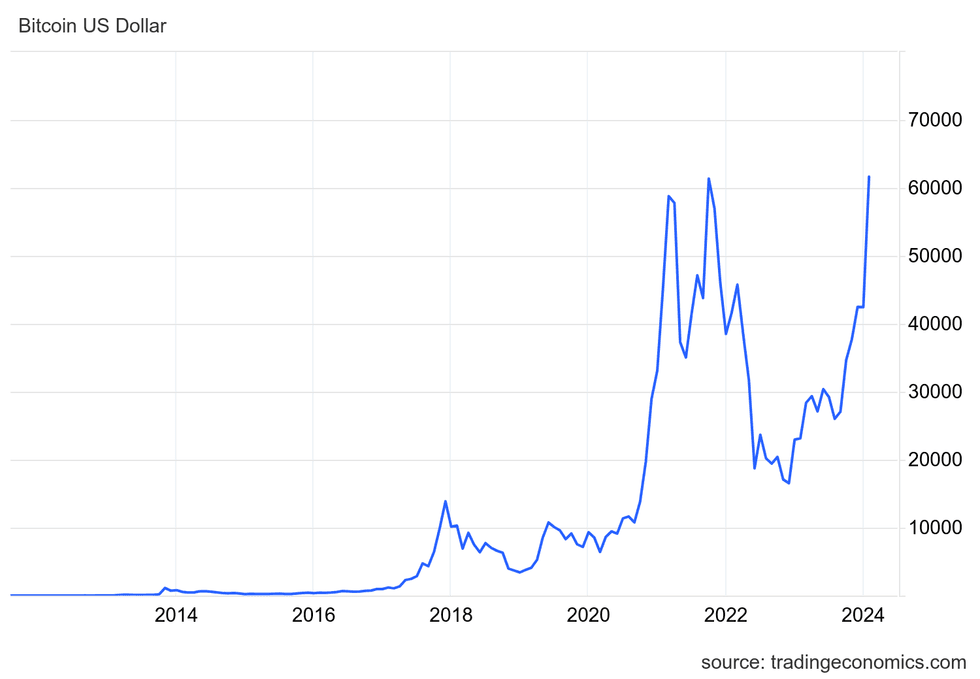

Bitcoin soared to an all-time high of US$68,649.05 on November 10, 2021, representing a remarkable 1,200 percent surge from March 2020 to November 2021. Despite facing hurdles in 2022, Bitcoin commenced 2024 at over US$44,000 and has recently shot up to trade at US$61,113 as of February 29, 2024.

The Genesis of Bitcoin

Bitcoin emerged in response to the 2008 financial crisis, introducing a novel concept to the monetary landscape. Initially unveiled in late 2008 through a white paper titled “Bitcoin: A Peer-to-Peer Electronic Cash System,” the pseudonymous entity Satoshi Nakamoto presented a groundbreaking vision for a decentralized digital currency built on blockchain technology.

The Finite Universe of Bitcoins

Distinct from traditional currencies, Bitcoin operates within a finite supply of 21 million coins, with approximately 19.1 million already in circulation. This scarcity, an inherent feature of Bitcoin’s algorithm, guards against inflation and underscores its value proposition. The process of mining new Bitcoins, limited by halvings occurring every four years, ensures sustained interest and value retention within the Bitcoin ecosystem.

Milestones and Market Dynamics

Bitcoin’s journey has been punctuated by notable milestones, including the unprecedented surge to US$68,649.05 in November 2021. Momentum in 2021 was fueled by factors such as heightened investor risk appetite and Tesla’s notable foray into the cryptocurrency space through a substantial investment and acceptance for product payments. Despite retracements, Bitcoin closed the year at US$47,897.16, marking a significant yearly increase.

The Impact of External Forces

The shockwaves of the COVID-19 pandemic in 2020 tested Bitcoin’s resilience and market positioning. Following a significant dip in March 2020, Bitcoin swiftly rebounded, aligning with gold as a preferred haven asset for younger demographics amidst economic uncertainty. The digital coin concluded 2020 with substantial gains, outperforming gold and solidifying its status as a reliable investment option.

Chart via TradingEconomics.com.

Bitcoin price in US dollars, inception to February 29, 2024.

Exploring the Turbulent Terrain of Cryptocurrency: An Inside Look at Bitcoin

Bitcoin’s Volatility and Market Dynamics

Bitcoin, the pioneering digital currency, has been on a wild ride navigating through the turbulent waters of market dynamics. Since 2021, its journey has been marked by extreme price swings and unprecedented highs and lows. The crypto coin’s trajectory has been heavily influenced by market uncertainty, particularly evident in 2022 when values plunged below US$20,000 for the first time in over a year, settling under US$17,500 by the end of that tumultuous year.

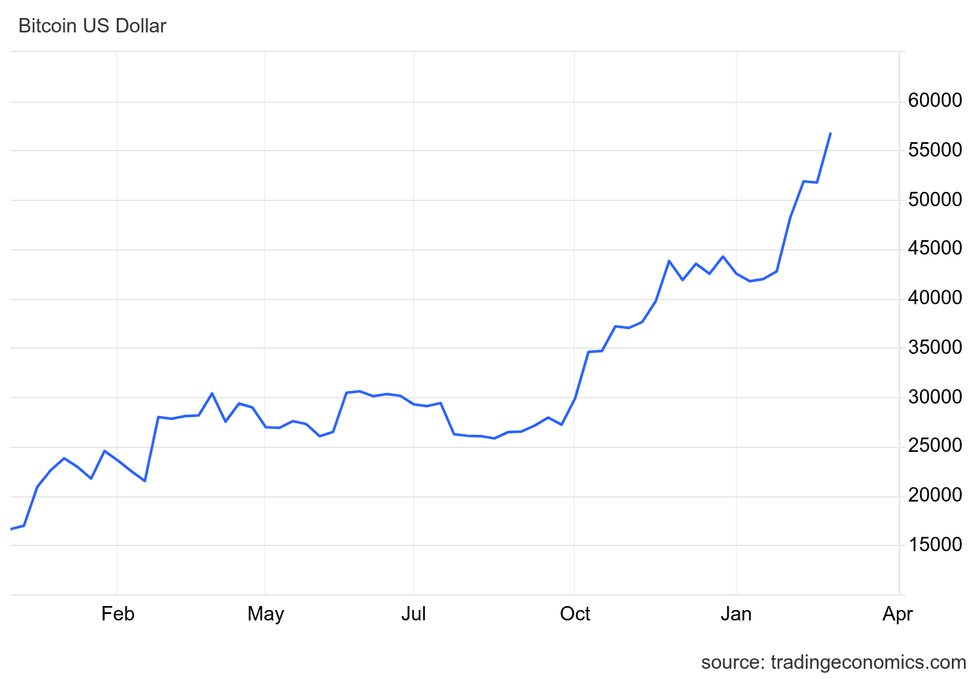

Despite these sharp declines, Bitcoin proved its resilience and potential for impressive performance. The price of Bitcoin witnessed a significant rally in 2023 and has continued its upward momentum into 2024.

In March 2023, Bitcoin surged to US$28,211 following concerns triggered by the failure of multiple US banks, showcasing its strength in adverse conditions. Throughout the second quarter of 2023, despite regulatory challenges such as lawsuits against major platforms like Coinbase and Binance, Bitcoin remained stable above US$25,000, buoyed by positive news like BlackRock’s filing for a Bitcoin exchange-traded fund.

The digital currency’s price soared past US$30,000 in June 2023 and reached a peak of US$31,500 in July, holding above US$30,000 for several weeks before experiencing a slight dip. By September, prices had settled around US$25,150, highlighting the coin’s resilience in the face of market fluctuations.

The Meteoric Rise of Bitcoin in 2024

Heading into the final months of 2023, Bitcoin’s price saw a substantial uptick, driven by increased institutional investments and optimism surrounding the potential approval of multiple spot Bitcoin exchange-traded funds by the SEC in early 2024. By mid-November, the cryptocurrency was trading at US$37,885, and by year-end, it had surged to US$42,228 per Bitcoin.

Following the SEC’s green light for 11 spot Bitcoin ETFs, Bitcoin’s value climbed to US$46,620 in January 2024. These investment instruments have sparked fresh demand for cryptocurrencies, propelling Bitcoin to a remarkable 42 percent increase in February, breaching the US$61,000 mark by month-end.

“Bitcoin’s impressive performance is being bolstered by steady inflows into new spot ETFs and a positive outlook driven by upcoming events like April’s halving and potential Fed interest rate cuts,” remarked Ben Laidler, a global markets strategist at eToro, to Reuters.

Unraveling the Enigma of Blockchain and Bitcoin Investment

A blockchain stands as a decentralized ledger that digitally records all cryptocurrency transactions. Continuously expanding with each transaction, blockchain technology has garnered significant interest as it finds application across diverse sectors like finance, cybersecurity, and supply chain management.

Investing in Bitcoin: Navigating the Terrain

To venture into the world of Bitcoin investment, individuals can explore various cryptocurrency exchange platforms and peer-to-peer trading apps to acquire and store Bitcoin securely. Notable platforms include Coinbase Global, CoinSmart Financial (OTC Pink: CONMF, NEO: SMRT), BlockFi, Binance, and Gemini.

Exploring the Impact of Bitcoin on the Banking Industry

The Rise of Cryptocurrencies

Younger generations, comprising 53% of crypto owners aged between 18 and 34, gravitate towards cryptocurrencies due to their appeal as assets outside conventional financial systems. Privacy and detachment from central banks allure investors, with crypto transactions known for their alacrity and cost-efficiency compared to traditional banking procedures. Notably, as cryptocurrencies gain mainstream acceptance, banks are beginning to invest in these digital assets and blockchain enterprises.

Bitcoin and the Banking Crisis

The specter of the banking crisis looms large on the financial landscape, compelling anxious investors to flock to Bitcoin for security amidst the turmoil. Recent institutional failures like that of Silicon Valley Bank and Signature Bank have instigated concerns, exacerbated by UBS’ move to acquire Credit Suisse. While the crisis might have momentarily tapered off, its underlying presence persists, hinting at forthcoming repercussions in the regional banking sector. Rooted in the aftermath of the 2008 financial meltdown, Bitcoin’s volatile valuation remains susceptible to regulatory interventions and market sentiments, underscoring the uncertainty surrounding its trajectory.

The Genesis of Bitcoin

The genesis of Bitcoin traces back to an epoch-making transaction in late 2009, where 5,050 Bitcoins exchanged hands for a paltry sum of US$5.02 via PayPal, setting each Bitcoin’s value at approximately US$0.001. This humble beginning marked the inception of a digital revolution that would eventually shake the realms of finance and technology.

Bitcoin as an Investment

Despite its recent resurgence in value during 2024, Bitcoin’s erratic price movements are emblematic of its volatile nature. Investors inclined towards risk-taking eye the cryptocurrency space as a lucrative avenue for potential gains, juxtaposed with the looming peril of significant losses. Prudent investors preferring steadfast ventures might seek alternative investment opportunities amid the unpredictable terrain of Bitcoin.

The Vision of Cathie Wood

A prominent advocate for Bitcoin, Cathie Wood of ARK Invest envisions an optimistic future for the cryptocurrency. Wood’s prognostications forecast a base-case target of US$600,000 by 2030, with a bullish scenario surpassing US$1 million, underscoring her unwavering confidence in Bitcoin’s long-term growth potential.

The Enigma of Satoshi Nakamoto

Satoshi Nakamoto, the enigmatic founder of Bitcoin, remains shrouded in mystery, purportedly holding a considerable stake in the digital currency. Analyses of early Bitcoin wallets suggest Nakamoto’s ownership of over 1 million Bitcoins out of the nearly 19.5 million in circulation, solidifying his status as a pivotal figure in the realm of cryptocurrencies.

Elon Musk’s Cryptocurrency Ventures

Renowned Tesla and Twitter magnate Elon Musk’s association with Bitcoin and Dogecoin is well-documented, with his tweets and Tesla’s actions exerting tangible influence on the cryptocurrencies’ trajectories. Musk’s disclosed holdings in Bitcoin, Dogecoin, and Ether, coupled with Tesla’s strategic investment in Bitcoin, highlight his active participation in the dynamic cryptocurrency landscape.

Warren Buffett’s Stance on Bitcoin

Eminent investor Warren Buffett’s aversion to Bitcoin and other cryptocurrencies is a matter of public record. Buffett’s skepticism towards digital assets manifests in his categorical dismissal of Bitcoin as a substantial investment, denoting it as a speculative token devoid of intrinsic value. His candid remarks underscore a stark contrast to the fervor surrounding cryptocurrencies.