Bitcoin, the pioneer of the cryptocurrency world, forged a path that led to the creation of a new asset class.

In a truly remarkable journey, Bitcoin’s value soared by over 1,200 percent between March 2020 and November 10, 2021, peaking at an impressive US$69,044.

However, the cryptocurrency’s infamous volatility came to the forefront in the subsequent year, plunging to US$15,787 by November 2022 amidst economic instability and a barrage of negative press.

Opening 2024 just under US$45,000, Bitcoin has since witnessed remarkable growth in the first half of the year, culminating in a new all-time high of US$73,115 on March 11, 2024.

So, where did Bitcoin’s pricing saga commence, and what forces have been steering its tumultuous journey in recent times? Let’s delve into the riveting tale.

The Humble Genesis of Bitcoin

Back in 2009, Bitcoin took its nascent steps with a modest debut price of US$0.0009, laying the groundwork for its astounding price escalation over the subsequent years.

Emerging as a response to the 2008 financial crisis, Bitcoin was conceptualized in a seminal nine-page white paper titled “Bitcoin: A Peer-to-Peer Electronic Cash System” on October 31, 2008, authored by the enigmatic figure(s) known as Satoshi Nakamoto.

This innovative digital currency, secured by cryptography and resistant to censorship, harnessed blockchain technology to establish an immutable ledger, thereby addressing the issue of double-spending. Its appeal lied in its potential to democratize financial power, offering a decentralized alternative to conventional banking systems.

Against the backdrop of the 2008 financial meltdown, which inflicted widespread economic turmoil globally, Bitcoin’s genesis block was entrenched on January 3, 2009. This pivotal moment bore a poignant message referencing a scathing critique of government failings during the financial crisis.

A landmark transaction occurred on January 12, 2009, as Nakamoto executed the first-ever Bitcoin transfer to Hal Finney, a prominent computer scientist and early advocate of the cryptocurrency. This seminal event marked a significant milestone in Bitcoin’s evolutionary trajectory.

Bitcoin’s value remained negligible until a trailblazing moment on October 12, 2009, when a Finnish developer made history by exchanging 5,050 Bitcoins for US$5.02 via PayPal, thereby establishing Bitcoin’s initial monetary worth.

May 22, 2010, marked another milestone as Bitcoin conducted its inaugural commercial transaction, where 10,000 Bitcoins were exchanged for two Papa John’s pizzas, setting Bitcoin’s price at around US$0.0025.

Bitcoin finally breached the US$1 mark in 2011, soaring to heights of US$29.60 within that year, albeit taking a subsequent dip and a relatively subdued performance in 2012.

Significant growth beckoned in 2013, crowned by Bitcoin smashing milestones of US$100 and US$1,000 in the same year, peaking at an all-time high of US$1,242 in December 2013.

The Transformative Rise of Bitcoin

Serenko Natalia / Shutterstock

January 1, 2016, marked the commencement of Bitcoin’s upward trajectory, commencing the year at US$433 and concluding at US$989, showcasing a 128 percent surge over the span of twelve months.

Various factors catalyzed Bitcoin’s blossoming acceptance in mainstream circles – a sputtering stock market opening in 2016 prompted investors to seek refuge in Bitcoin as a “safe-haven” asset amid economic and geopolitical tumult.

The political seismic shifts of 2016, symbolized by the Brexit referendum in the UK and Donald Trump’s election to the White House, corresponded with spikes in Bitcoin’s value. The digital currency’s ascent persisted while industries increasingly explored the potential of blockchain technology,

Conjointly, there was a deepening interest in the technological and financial sectors in blockchain systems. Notable investments in firms developing blockchain solutions, like Dig Asset Holdings, saw top players like IBM and Goldman Sachs allocate substantial funds towards advancing this nascent technology.

In May, Bitcoin’s value soared by 21 percent, culminating in a price of US$539 by month-end, signaling a renewed bullish sentiment in the cryptocurrency market.

The Rollercoaster Ride of Bitcoin: A Financial Odyssey

The Turbulent Journey of Bitcoin

Bitcoin, the titan of cryptocurrencies, has been on a wild ride through the peaks and valleys of financial markets. In June, it soared to US$764, only to plummet to US$517 by August 1. Microsoft and Bank of America Merrill Lynch joined hands for a finance venture in September without causing significant price shifts, but Bitcoin maintained its upward climb. The cryptocurrency rallied from US$629 to US$736 in October following Ripple’s collaboration with 12 banks for cross-border payments.

Bitcoin’s Ascent to Prominence

Bitcoin’s popularity surged in 2017, as it surged from US$1,035.24 in January to an astounding US$18,940.57 by December. The Chicago Mercantile Exchange started trading Bitcoin futures contracts in December 2017, which marked a significant shift in perceiving Bitcoin as a legitimate investment. The hype around Bitcoin led to a media frenzy with celebrity endorsements and soaring trends in initial coin offerings continuing into 2018.

Bitcoin’s Resilience in 2020

The year 2020 tested Bitcoin’s mettle amid financial turmoil, starting at US$6,950.56 and witnessing a sharp drop to US$4,841.67 in March due to the pandemic-induced market crash. A subsequent buying spree helped Bitcoin recover its losses by May. The crypto juggernaut closed 2020 at US$29,402.64, marking a remarkable 323% annual increase despite the March setback.

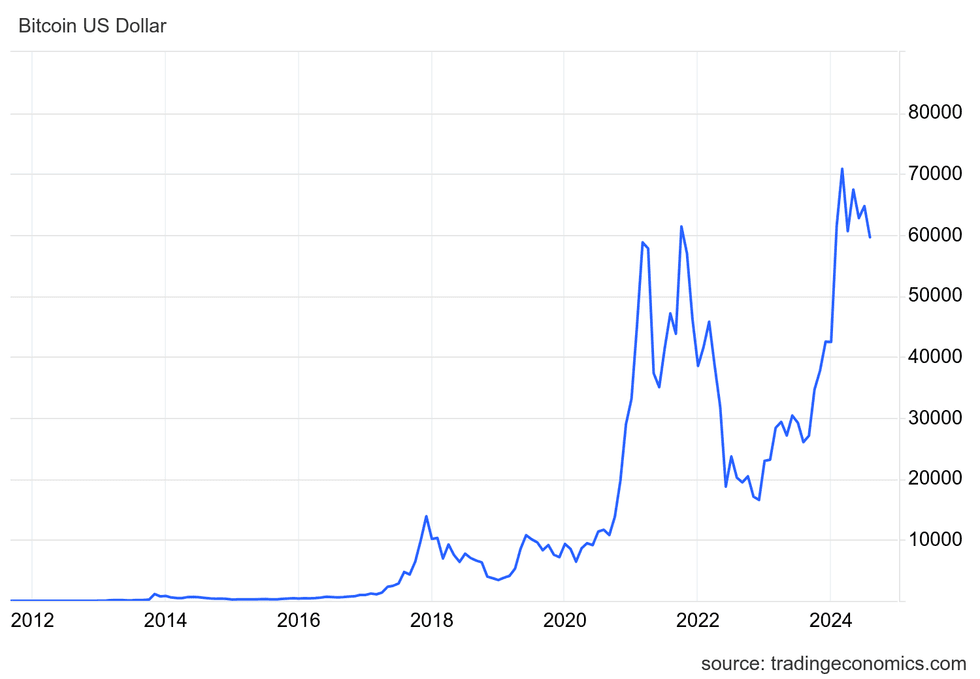

Bitcoin price chart via TradingEconomics.com.

Bitcoin’s valuation fluctuation from 2011 to August 8, 2024.

Bitcoin’s Meteoric Rise in the Early 2020s

The year 2021 witnessed Bitcoin hitting an all-time high of US$68,649.05 in November, which was a 98.82% increase from January. The surge was attributed to robust investor appetite for risks. Increased money printing due to the pandemic also favored Bitcoin as investors sought portfolio diversification. This success led to heightened interest in digital assets, including the emergence of non-fungible tokens (NFTs) in 2021.

The Crypto Industry’s Shake-Up

In 2022, Bitcoin faced market uncertainty, and its value dropped below US$20,000 in the second quarter, signaling turbulent times. The industry took a major hit when Terra Luna experienced a severe decline, eroding investor trust in cryptocurrencies. Following this, the Celsius network faced challenges, resulting in Bitcoin plummeting to US$19,047 in July.

The industry encountered a seismic jolt in November when revelations surfaced about Alameda Research and FTX’s financial entanglements, leading to a significant loss of investor confidence and a liquidity crisis.

The Rollercoaster Ride of Bitcoin’s Price in 2024

The Highs and Lows in Bitcoin’s Price Journey

Bitcoin, the notorious kingpin of cryptocurrency, set a new zenith on March 14, 2024, when it scaled to an unprecedented peak of US$73,737.94 per BTC. The journey to this newfound financial apex was tumultuous, marked by a slow ascent from the doldrums of 2022. The crypto’s resilience was on full display, with its valor reflected in remarkable price performances throughout the latter half of 2023 and the early months of 2024.

March 2023 witnessed a significant rally in Bitcoin’s price to US$28,211, fueled by growing concerns within the banking sector following the disconcerting collapse of multiple US banks. Despite regulatory storms gathering as the US Securities Exchange Commission (SEC) unleashed lawsuits upon Coinbase Global (NASDAQ:COIN), Binance, and its luminary founder Changpeng Zhao in Q2 2023, Bitcoin weathered the tempest, clinging firmly above the US$25,000 mark.

Notable support appeared on the horizon when BlackRock (NYSE:BLK), the behemoth asset manager, filed for a Bitcoin exchange-traded fund with the SEC on June 15, shoring up Bitcoin’s price above US$30,000 by June 21. The momentum persisted, culminating in a surge to US$31,500 on July 3. Despite a brief dip below US$30,000 on July 16, the crypto market remained robust.

As the curtains drew on 2023, Bitcoin benefited immensely from enhanced institutional investments, buoyed by the anticipation of SEC greenlights for a smattering of spot Bitcoin exchange-traded funds by early 2024. By mid-November, Bitcoin strutted at US$37,885, a harbinger of the milestones yet to be breached. The year wrapped with Bitcoin commanding a price of US$42,228 per BTC.

The Influence of Institutional Investments and SEC Approvals

The SEC’s nod to 11 spot Bitcoin ETFs catalyzed a price surge to US$46,620 on January 10, 2024, heralding a staggering 42% surge in Bitcoin’s value through February, surpassing the US$61,113 mark on the last day of the month. March unveiled even greater heights as Bitcoin leaped nearly 8% in 24 hours to perch at US$67,758 on March 4, tantalizingly close to its previous pinnacle. The crypto then shattered records on March 11, breaching the US$72,000 threshold before reaching an unprecedented zenith of US$73,737.94 on March 14, eclipsing the market cap of silver.

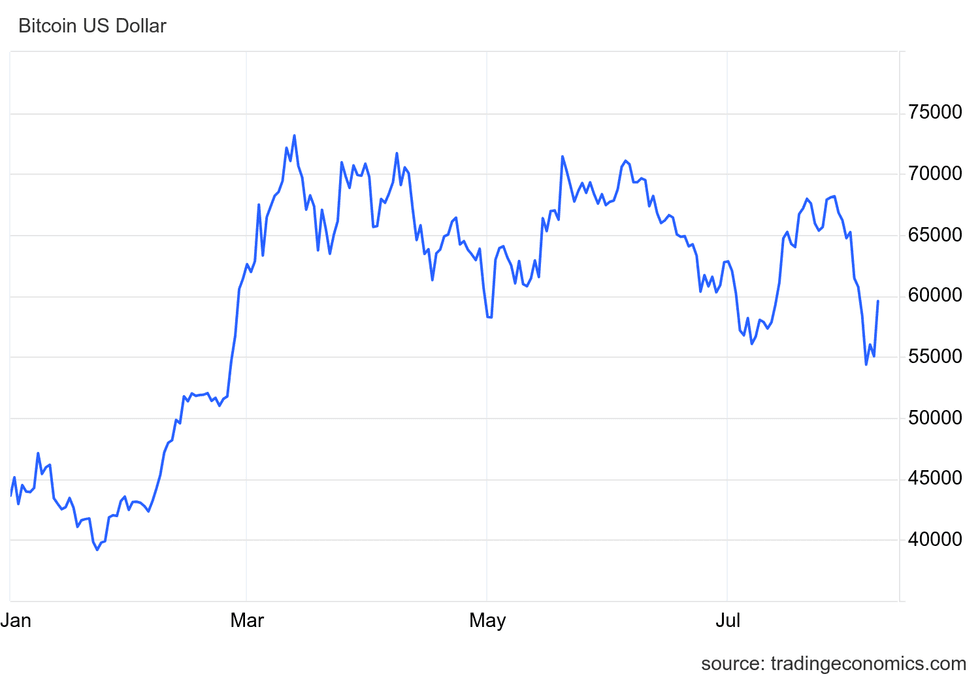

Bitcoin price chart via TradingEconomics.com.

Bitcoin price chart in US dollars from January 1, 2024, until August 8, 2024.

Critical Impact of 2024 Bitcoin Halving

The 2024 Bitcoin halving unfolded amidst a backdrop of heightened anticipation, a recurrent theme that infuses vitality into the crypto market before such events. The reduction in Bitcoin rewards for miners from 6.25 to 3.125 Bitcoin during the latest halving in April injected fresh vigor into the crypto’s price trajectory. Though the 2024 halving finds itself only the fourth such event in history, pinpointing precise price trends remains an enigmatic pursuit.

The halving, occurring around 8:10 p.m. EDT on a Friday, saw Bitcoin’s price settling steadily between the US$63,000 to US$65,000 range over the ensuing weekend. Post-halving on April 22, Bitcoin clung slightly above US$66,000. Fluctuations in trading volume painted a vivid picture, with a 45% surge from April 19 to April 20 met with a subsequent 68% downturn on April 21. The period spanning April 30 to May 3 saw Bitcoin recoiling to as low as US$56,903 following the Federal Reserve’s uneventful April policy meeting.

Reports highlighting the SEC’s trajectory towards approving spot Ether ETFs in May catalyzed another ascent in Bitcoin’s price trajectory. Bitcoin shimmered past the US$71,000 barrier for the second time at 8:00 p.m. EDT on May 20, days before the SEC’s nod on spot Ether ETFs on May 23.

Insights into Bitcoin’s Price Movements Amidst Global Events

Bitcoin, the volatile darling of the financial world, has recently weathered turbulent times due to a bizarre confluence of events. A rollercoaster ride ensued after a shocking incident involving a high-profile US political figure, triggering a cascade of speculations and market reactions that sent ripples through the cryptocurrency realm.

Bitcoin’s Price Volatility Post-Political Drama

Following the controversial events surrounding a US presidential candidate and his endorsement of the crypto industry, Bitcoin saw a remarkable surge in value. The market danced to the tunes of uncertainty, as the odds of a particular candidate winning seemed to sway prices in a seemingly unorthodox fashion. However, as fast as it rose, it didn’t falter when another key figure bowed out of the political race, hinting at the enduring resilience of the digital currency landscape.

Adding to Bitcoin’s tale of twists, recent weeks have seen a flurry of significant developments that have kept investors on high alert. From the underwhelming performance of spot Ether ETFs to the looming specter of a US government Bitcoin sell-off, each event has played its part in shaping the tumultuous journey of Bitcoin’s price trajectory. As the political climate simmers with speculative fervor, the market braces for waves of upheaval and opportunity.

The Economic Shake-Up and Bitcoin’s Response

Not immune to the broader strokes of global economics, Bitcoin faced a momentous test when an economic scare rippled through various markets, triggering a sell-off event that reverberated across both traditional and digital asset classes. The unforeseen events ignited a chain reaction, with weakened economic data and surprise interest rate adjustments in key markets fueling panic and uncertainty.

The ensuing turmoil saw Bitcoin shedding a significant portion of its value in a short span, testing the nerves of even the most seasoned investors. Yet, as the dust settled, a sense of cautious optimism emerged as the market recalibrated, taking stock of the long-term implications of the economic shockwaves. Bitcoin, it seems, stood its ground amidst the storm, showcasing its inherent resilience in the face of uncertainty.

Exploring the World of Cryptocurrency and Blockchain

Blockchain technology, the bedrock of cryptocurrencies like Bitcoin, continues to captivate investors and businesses alike with its promise of digitized, decentralized transactions. As the digital ledger of choice for an array of industries, blockchain’s allure lies in its immutable and transparent nature, offering a glimpse into a future where trust and security are paramount.

Navigating the World of Bitcoin Investments

For those intrigued by the world of Bitcoin investments, the road is paved with opportunities and challenges. From a finite supply model that defies traditional economic norms to the delicate dance of mining and halving cycles, the journey into the realm of Bitcoin is not for the faint of heart. Yet, for those willing to brave the storm, the rewards can be as exhilarating as the risks.

The Fascinating World of Bitcoin Investments Unveiled

Bitcoin’s Volatility: A Double-Edged Sword

Bitcoin has soared to remarkable heights in 2024, yet its hallmark trait remains its roller-coaster-like volatility. Those willing to dance on the razor’s edge of risk might find the cryptocurrency realm a tantalizing arena, historically brimming with fortunes to be made. Despite Bitcoin’s resurgence from the depths it plunged in 2022, the realm of virtual coins remains a high-stakes adventure where fortunes can evaporate as swiftly as they materialize. For more insights on traversing the surge of Bitcoin, delve into our discourse on the aptly timed query – Is Now a Good Time to Buy Bitcoin?

The Cryptocurrency Titans: Unsheathe the Secrets

A shroud of mystery envelops Satoshi Nakamoto, purportedly Bitcoin’s enigmatic architect, and a presumed possessor of the largest Bitcoin hoard. Scrutiny of early Bitcoin troves has unearthed a treasure trove that indicates Nakamoto may lay claim to over a million of the nearly 19.5 million Bitcoins in circulation.

Deciphering Elon Musk’s Cryptocurrency Allegiances

Elon Musk, the luminary steering Tesla and Twitter, casts a lengthy shadow over both Bitcoin and the whimsical Dogecoin. Musk’s tweets and Tesla’s maneuvers have indelibly shaped the trajectories of these cryptocurrencies over time. While the exact extent of his holdings remains shrouded in mystery, Musk has publicly acknowledged his stakes in Bitcoin, Dogecoin, and Ether. Rumblings surfaced in September 2023 hinting at Musk’s covert backing of Dogecoin, as per Forbes. Notably, Tesla dipped its corporate toe into the realm of cryptocurrencies by securing $1.5 billion worth of Bitcoin in 2021. However, the automaker offloaded 75 percent of its Bitcoin holdings the ensuing year. As of February 2024, Tesla’s cache comprised approximately 9,720 Bitcoins, positioning it as one of the premier public entities holding the digital asset. Musk himself divulged in a January 2024 social media post that “I still own a bunch of Dogecoin, and SpaceX holds a trove of Bitcoins.”