As we commemorate the second anniversary of the ongoing bull market, we are presented with a compelling narrative of investment success. The saga of turning a humble $25,000 into a staggering $212,787 serves as a beacon of light in the realm of financial acumen.

The bedrock of accumulating wealth over time lies in the strategic investment in high-quality businesses. The alchemy of compounding unveils its magic, propelling the trajectory of our portfolio’s performance.

It’s a common misconception that hefty sums are essential to embark on this journey. In reality, modest beginnings can swiftly burgeon into substantial gains.

Crafting a Winning Portfolio Strategy

The ethos of a more focused, concentrated portfolio resonates strongly. Diluting our investments across a myriad of 40-50 stocks inevitably dilutes our chance of outperforming the market. The nucleus of our approach is centered on pinpointing the market’s shining stars, those companies that stand head and shoulders above the rest.

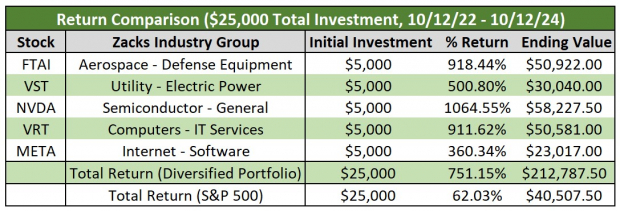

In this particular scenario, we spotlight 5 stocks, namely FTAI Aviation FTAI, Vistra Energy VST, Nvidia NVDA, Vertiv Holdings VRT, and the tech titan Meta Platforms under the umbrella of Facebook. While the tech sector dominates this selection, it is undoubtedly justified in light of the prevailing bullish artificial intelligence theme.

The remarkable returns showcased below stem from the inception of the bull market in mid-October 2022 to its second anniversary date. With a starting pot of $25,000 or an equal division of $5,000 across the selected stocks, the results speak volumes.

Image Source: Zacks Investment Research

Within this timeline, the modest $25,000 burgeoned into an astounding $212,787, eclipsing the growth of the S&P 500 during the same period. Notably, a $25,000 wager on the S&P 500 would have yielded a respectable 62% return, amounting to just over $40,500. It’s imperative to underscore that these results transpired sans the crutch of leverage or margin trading.

Building a robustly diversified portfolio need not be a labyrinthine endeavor teeming with an excess of positions. The perils of over-diversification do loom, and simplicity often emerges victorious in both the realm of investments and life at large. Success in this domain is contingent on nurturing a steadfast long-term perspective.

This powerful narrative serves as a poignant reminder that formidable returns need not hinge on speculative escapades but can be realized through prudent, calculated investments.

Unearthing Stocks with Untapped Profit Potential

Amidst the sea of stocks flashing technical buy signals, the endeavor to distill the choices culminates in a strategic application of the Zacks Rank system.

Earnings are the lifeblood of corporate viability, serving as a bedrock for stock market dynamics. Earnings estimates and expectations hold pivotal importance, with particular emphasis placed on changes in earnings estimates, known as earnings estimate revisions. Our research strongly attests to the profound impact of these revisions on stock prices.

Having identified and corroborated a stock’s trajectory, the Zacks Rank system emerges as a beacon, guiding us towards stocks basking in the glow of positive earnings estimate revisions. A judicious fusion of fundamental and technical analysis further delineates stocks poised for meteoric ascents.

Unlock a Wealth of Insights for a Meager $1

The tale unfolds…

A revelation unfurled several years ago when we dared to extend a 30-day invitation granting access to our treasure trove of insights for a mere dollar. No strings attached, no hidden transactions beckoned.

While countless seized this golden opportunity, others hesitated, questioning the apparent catch. Yes, a motive does in fact lurk beneath the surface. We yearn to acquaint you with our suite of portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators, and more – services that bequeathed 228 positions with double and triple-digit gains in 2023 alone.

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

FTAI Aviation Ltd. (FTAI) : Free Stock Analysis Report

Vistra Corp. (VST) : Free Stock Analysis Report

Vertiv Holdings Co. (VRT) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report