Pinduoduo or Zacks Rank #1 (Strong Buy) stock PDD Holdings (PDD) is a Chinese e-commerce platform founded in 2015. Despite being younger than its rivals like Alibaba Group (BABA) or VIP Shop Holdings (VIPS), PDD has quickly risen to prominence in the Chinese e-commerce landscape.

PDD’s Strategic Success with Temu

Temu, PDD’s e-commerce platform, has been a game-changer. This online marketplace, launched in September 2022, has gained traction for its vast array of affordable products. The decision to run an expensive Super Bowl ad in 2023 propelled the Temu app to rapid success in both China and the United States.

Temu: Disrupting the Status Quo

Amazon has long dominated the U.S. e-commerce market, but Temu has carved a unique path by targeting a niche market segment. Rather than prioritizing immediate shipping at a higher cost, Temu connects buyers directly with sellers for direct shipments from China. Despite longer shipping times, consumers grappling with inflation in the U.S. are willing to wait for the cost-effective offerings.

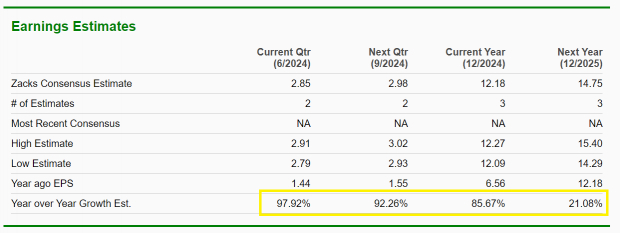

PDD Holdings: Exceptional Earnings Growth

PDD is witnessing exponential earnings growth outpacing most e-commerce companies. Analysts foresee this rapid growth trajectory continuing, with an expected EPS growth rate of approximately 97% next quarter and 85% for the full year 2024.

Image Source: Zacks Investment Research

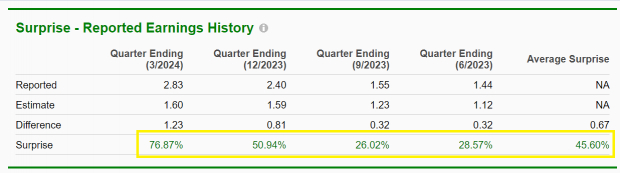

PDD’s Bullish EPS Track Record

Despite high expectations, PDD has consistently surpassed Wall Street’s EPS forecasts. Over the past four quarters, PDD has exceeded EPS expectations by an average of 45%.

Image Source: Zacks Investment Research

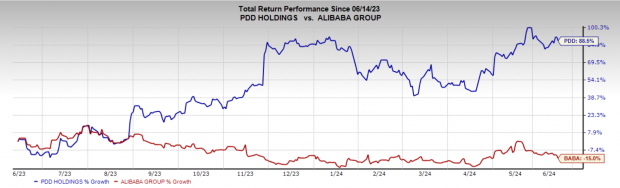

Relative Strength vs. Peers

Relative price action is a potent indicator in the investor’s toolkit. PDD is up by 88.5%, outperforming industry peers like BABA (-15%).

Image Source: Zacks Investment Research

Final Thoughts

PDD’s innovative Temu platform is not only aiding consumers in combating inflation but also propelling the company towards robust earnings growth.

Highest Returns for Any Asset Class

Bitcoin has been a standout performer, boasting more significant returns than any other decentralized form of money. Historical data illustrates extraordinary surges during presidential election years: +272.4% in 2012, +161.1% in 2016, and +302.8% in 2020. Zacks foresees another substantial surge on the horizon.