GE Vernova Inc. GEV stock has soared following its April introduction. Investors and Wall Street have shown immense interest in GEV due to its direct connection to the energy transition landscape. Notably, companies like Microsoft have heavily invested in nuclear energy to sustain their AI acceleration strategies.

Considering the upcoming Q3 earnings release by GE Vernova on October 23, now might be the perfect time for investors to consider securing a position in GEV stock for the long term.

Examining the Influence of Nuclear and Energy Transition Stocks in the Economy and AI Sector

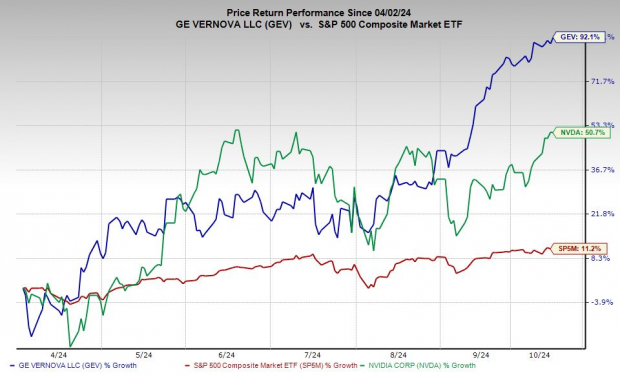

Among the top performers in the S&P 500 stocks in 2024 are three nuclear energy companies and companies focused on broader electrification, including Vistra, Constellation Energy, and GE Vernova. All three enterprises are currently part of the Zacks Alternative Energy Innovators service.

The connection between the AI revolution and energy consumption triggered a shift in investor attention towards nuclear and energy transition stocks. The recent partnership announcement between Constellation Energy and Microsoft solidified the premise that nuclear energy will be the driving force behind the impending AI era.

Following Constellation Energy’s agreement with Microsoft, as well as similar moves by Amazon and other tech behemoths, nuclear energy and uranium stocks have experienced significant growth as tech giants seek sustainable energy sources.

Image Source: Zacks Investment Research

Anticipations suggest that data centers could contribute up to 10.9% of U.S. electricity demand by 2030, a substantial increase from the current 4.5%. This forecasts an imminent and extensive revamp of the U.S. power grid to support the evolving energy landscape, electrification wave, and the AI transformation.

In this wave of change, nuclear energy companies are positioned as the unequivocal stars of the global energy transition initiative.

Reasons Behind the Favorable Outlook for GEV Stock as a Nuclear Energy and AI Investment

GE Vernova entered the market in April post General Electric’s division into GE Aerospace (GE), GE HealthCare (GEHC), and GE Vernova. CEO Scott Strazik describes GEV as singularly dedicated to expediting the energy transition, offering a comprehensive investment avenue embracing electrification, nuclear energy, and beyond.

With three business segments – Power, Wind, and Electrification – GE Vernova contributes to approximately 25% of the globe’s electricity supply through cutting-edge gas and wind turbines, advanced electrification technology, and more.

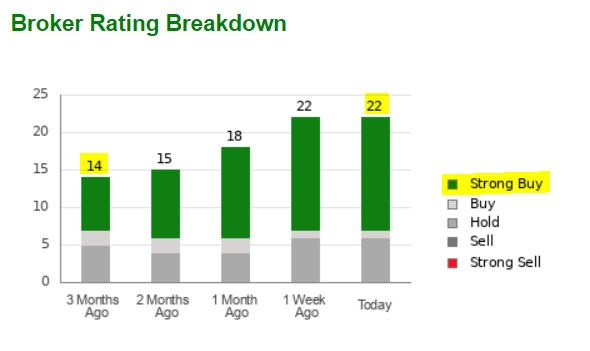

Image Source: Zacks Investment Research

Noteworthy in GEV’s portfolio is the steam power segment that offers nuclear turbine solutions and services catering to all reactor types. GEV’s Hitachi Nuclear Energy division stands out as a key provider of cutting-edge nuclear reactors, fuel, and associated services. GEV’s CEO recently mentioned to the Wall Street Journal that an inflow of “gigawatts upon gigawatts of nuclear capacity” is expected annually.

The U.S. Department of Energy’s recent selection of GE Vernova to play a pivotal role in advancing the next-gen nuclear and uranium industry underscores GEV’s significance in the nuclear energy sphere.

An important aspect to note is that the current nuclear reactors primarily function on uranium fuel enriched up to 5%. The rise of High-Assay Low-Enriched Uranium (HALEU), enriched between 5% and 20%, is essential for future small modular reactors (SMRs) to thrive.

Additional Upbeat Factors Supporting Investment in GEV Stock

GEV witnessed a 35% year-over-year growth in its Electrification backlog, reaching $4.8 billion in Q2. Similarly, its Power unit experienced a 30% surge to $5.0 billion, augmenting GE Vernova’s optimistic projections. The market responded positively to reports of GEV’s plans to downsize its challenged offshore wind operations amidst industry-wide inflation and supply chain complexities.

In the Upward Spiral: GE Vernova Strides Forward

The Earnings Acceleration

GE Vernova, the S&P 500’s fifth-best performing stock in 2024, has soared by 90% since its debut, outpacing the likes of Nvidia and Vistra. The company is set to experience a 5% increase in 2024, followed by a 6% rise the next year.

Analyst Enthusiasm

GE Vernova’s financial outlook for FY25 and FY26 has dramatically improved, leading to increased coverage by Wall Street analysts. With 22 brokerage recommendations at Zacks, up from 14 three months prior, a remarkable 70% of these recommendations classify as “Strong Buys.” This surge in positivity underscores the growing confidence in GE Vernova’s future performance.

Stock Performance and Considerations

Despite achieving fresh record highs, some investors believe GE Vernova’s stock may be overvalued. However, experts suggest that any potential pullback, either pre- or post-earnings release, to the company’s 21-day or 50-day moving average could present a robust buying opportunity. It is crucial to note that long-term investors are advised against trying to precisely time the market.

Upcoming Milestones

Investors and analysts eagerly anticipate GE Vernova’s Q3 earnings results scheduled to be unveiled on October 23. This snapshot of the company’s financial health will provide valuable insights into its trajectory for the near future.