The U.S. consumer confidence in the economy and its future outlook has witnessed a significant surge in January. The Conference Board revealed that the index of the U.S. consumer confidence for January stood at 114.8, exceeding the upwardly revised 108 for December. This is a momentous jump, marking the highest level in 25 months since December 2021.

The sub-index for the present-situation index experienced a substantial increase to 161.3 in January from 147.2 in the previous month. Similarly, the sub-index for consumer expectations improved to 83.8 in January from 81.9 in December.

According to Dana Peterson, chief economist at The Conference Board, the surge in consumer confidence reflects factors such as slower inflation, anticipation of lower interest rates ahead, and generally favorable employment conditions. Notably, confidence improved across all age groups, with the largest boost seen in consumers 55 and over. Moreover, confidence improved for all income groups except the very top.

In parallel, the University of Michigan reported that the preliminary index of the U.S. consumer sentiment for January landed at 78.8, well above the consensus estimate of 69.7. The substantial surge in consumer confidence is an optimistic sign for the domestic economy, indicating improved sentiment and future outlook.

Top Stock Picks

Amid the resurgence in consumer confidence, a selection of consumer-centric stocks with notable potential for 2024 has garnered attention. Notably, these stocks have seen positive earnings estimate revisions in the last 60 days, and each carries a Zacks Rank #1 (Strong Buy).

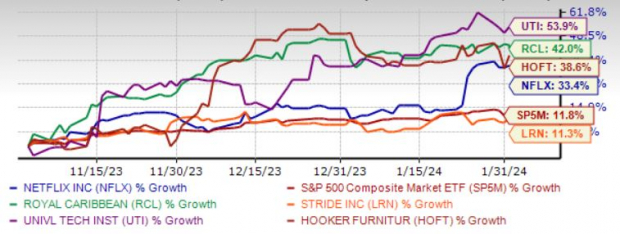

The chart below demonstrates the price performance of these five potential stock picks in the past three months.

Image Source: Zacks Investment Research

Netflix Inc. (NFLX)

NFLX added 13.12 million paid subscribers globally in the fourth quarter of 2023, with a rise of 1% in average revenue per subscription. The company attributed the robust top-line growth to its paid subscription-sharing offering, recent price changes, and the strength of its business in general.

NFLX is expected to continue dominating the streaming space, courtesy of its diversified content portfolio, which is attributable to heavy investments in the production and distribution of localized and foreign-language content.

Royal Caribbean Cruises Ltd. (RCL)

RCL has been benefiting from solid demand for cruising and acceleration in booking volumes. Additionally, the emphasis on strong pricing bodes well for the company, with booked load factors and rates surpassing those of all previous years. As a sign of continued momentum, RCL expects customer deposits to return to typical seasonality in the upcoming periods.

Stride Inc. (LRN)

LRN is a premier provider of K-12 education for students, schools, and districts, as well as career learning services through the middle and high school curriculum. For adult learners, LRN delivers professional skills training in healthcare and technology, as well as staffing and talent development. The company’s technology-based products and services enable clients to attract, enroll, educate, track progress, and support students.

Universal Technical Institute Inc. (UTI)

UTI provides transportation, skilled trades, and healthcare education programs in the United States. The company operates in two segments and offers certificate, diploma, or degree programs under various brands. Additionally, UTI serves students, partners, and communities by providing education and support services in various fields.

Hooker Furnishings Corp. (HOFT)

HOFT is a leading manufacturer and importer of residential furniture, primarily targeted at the upper-medium price range. The company offers diversified products across various style categories within this price range, attaining robust revenue and earnings growth rates.

Exploring Untapped Stocks for Potential Growth

When it comes to navigating the tempestuous seas of the stock market, discovering underappreciated investment vehicles with considerable potential for growth is akin to finding hidden treasure. Recent market analysis has unveiled a litany of promising stocks that represent compelling buying opportunities for shrewd investors.

High-Potential Stocks

In the wake of recent market tumult, several under-the-radar stocks have emerged as noteworthy prospects for discerning investors seeking to bolster their portfolios.

Netflix, Inc. (NFLX)

Amidst widespread market volatility, Netflix, Inc. (NFLX) has attracted attention as a stock with significant upside potential. The innovative streaming giant has exhibited resilience in the face of competitive headwinds and is poised for robust growth in the foreseeable future.

Royal Caribbean Cruises Ltd. (RCL)

Royal Caribbean Cruises Ltd. (RCL) has emerged as a diamond in the rough, demonstrating praiseworthy resilience and displaying potential for substantial gains in a sector that has been beset by adversity.

Universal Technical Institute Inc (UTI)

Universal Technical Institute Inc (UTI) has made significant strides in solidifying its position as a stock worthy of investor consideration. The company’s ongoing efforts to adapt to an evolving landscape and enhance its offerings position it as an attractive investment prospect.

Hooker Furnishings Corp. (HOFT)

Hooker Furnishings Corp. (HOFT) has distinguished itself as a stock with commendable potential. With a focus on innovation and a robust market position, the company is primed to deliver value to astute investors.

Stride, Inc. (LRN)

As the educational landscape undergoes transformative changes, Stride, Inc. (LRN) has emerged as an intriguing stock with substantial growth potential. The company’s ability to adapt and thrive in the digital learning realm positions it favorably for investors aiming to capitalize on this burgeoning sector.

Conclusion

Market volatility often unveils hidden gems that possess exceptional growth potential for investors. These stocks, replete with underappreciated value, represent opportunities to build and diversify investment portfolios. Additionally, such investment opportunities underscore the importance of conducting thorough research and analysis to identify stocks that have been overlooked amidst broader market turbulence.

Ultimately, for investors seeking to bolster their portfolios, these stocks represent compelling avenues for generating long-term wealth and solidifying financial well-being.