A turbulent Q3 in the crypto market was marked by price volatility and shifts in investor sentiment.

Popular cryptocurrency Bitcoin, often seen as a bellwether for the industry, experienced sharp price corrections at the start of each month, with July and August witnessing declines exceeding 12 percent.

Meanwhile, Ethereum’s performance in Q3 showed signs of declining user engagement and network activity, marked by a drop in daily active addresses compared to previous periods. Competing blockchains, particularly Solana, experienced growth in user activity during the same period, potentially signaling a shift in user preferences away from Ethereum.

Read on for an overview of market-moving events that shaped the crypto landscape in Q3.

July: A Rollercoaster Ride for the Crypto Sector

July presented a dynamic period for the crypto market, marked by shifting trends and price movements. Crypto emerged as a major political catalyst after current president Joe Biden withdrew as the Democratic nominee, and Bitcoin’s price trended upward. However, as price swings through the month demonstrated, it remained sensitive to external factors, underscoring the continued influence of news and events on Bitcoin’s supply and demand dynamics.

A Picture of July: Bitcoin, Ether, and Solana

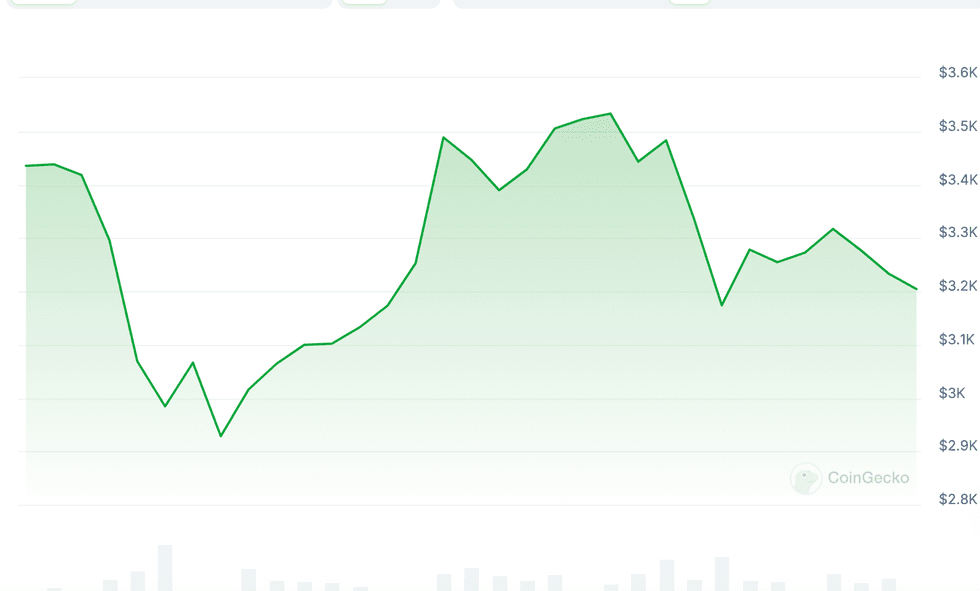

Chart via CoinGecko.

In contrast, Ether saw a steep 8 percent drop in its valuation immediately following the launch of the highly anticipated Ethereum exchange-traded funds (ETFs) on July 23. The ETFs themselves, however, fared well, demonstrating an impressive daily growth rate through the end of the month.

Chart via CoinGecko.

Meanwhile, Solana emerged as a strong performer, driven by the growing popularity of liquid staking protocols. Solana outperformed Bitcoin and Ether as crypto surged between July 11 and July 21. Focus immediately shifted to a potential Solana ETF, although analysts consider this unlikely in the near term. Solana’s decentralized exchanges ultimately processed more on-chain volume than Ethereum in July, amidst some volatility in the market.

August: A Month of Trials for Crypto Markets

August began with turmoil as macroeconomic headwinds triggered a wave of selloffs that affected the entire economy after the Bank of Japan unexpectedly raised interest rates on July 31.

In the US, employment data ignited fears of a recession and sparked a widespread stock rout. By August 5, the crypto industry had lost US$510 billion, and Bitcoin was below US$50,000, its lowest valuation since February. While the broader stock market quickly rebounded, Bitcoin and Ether’s prices remained subdued, with a “death cross” pattern forming in Bitcoin’s price action, a historical signal of further potential decline.

Chart via CoinGecko.

The downturn was exacerbated by a surge in short-selling activity. Institutional investors initially provided some buying support after the rout, scooping up digital assets at lower prices, but this proved to be a short-lived reprieve. As the month progressed, momentum shifted decisively toward sellers, with many likely capitalizing on the opportunity to short Bitcoin and other cryptocurrencies, further amplifying downward pressure.

Crypto Market Trends and Insights for Investors

September Trends: Bitcoin and Ether Surpass Expectations

In September, traditionally a bearish month for the crypto sector, the landscape defied historical norms. The U.S. Federal Reserve’s announcement of an interest rate cut on September 18 provided the impetus for Bitcoin and Ether to break through resistance levels. Concurrently, stablecoin valuations, particularly XRP, saw a surge post the launch of Grayscale’s XRP Token Trust on September 12.

Analysts speculated that Bitcoin’s post-halving “reaccumulation range” might culminate by the month’s end, potentially signaling a shift toward a bullish trend in Q4. Despite projections of consolidation, Bitcoin closed the month up 7.39% at just over US$64,540.

Q4 Market Factors to Watch

As we step into Q4, market dynamics are poised to deeply influence the future of cryptocurrencies. WonderFi’s report underlines Bitcoin’s evolving volatility and hints at increasing periods of stability, indicating a possible maturation of the asset class. Global liquidity and political affairs emerge as pivotal factors to monitor this quarter.

Experts predict Solana and Ethereum to shine in Q4, echoing earlier sentiments expressed in September. The upcoming election looms large as a potential game-changer, with various outcomes likely to sway the industry’s trajectory.

Regulatory Implications and Speculation

Regulatory whispers have stirred concerns and expectations within the crypto community. Speculation around potential leadership changes at key regulatory bodies, notably the U.S. Securities and Exchange Commission (SEC), has ruffled feathers. The industry is at a crossroads, with calls for regulation and clarity intensifying amid an atmosphere of uncertainty.

The future of crypto policies hinges on the upcoming U.S. presidential election, with differing outcomes expected to have profound impacts on the regulatory landscape. As stakeholders await clarity on impending decisions, the tides of change swirl around the industry.

Key Takeaways for Investors

As the crypto market continues to evolve and mature, the final quarter of 2024 presents a pivotal juncture for investors. Institutional acceptance, regulatory shifts, and the burgeoning interest in alternative coins signal a period of significant growth and innovation within the crypto ecosystem.

Stay updated by following us here for real-time insights!

Securities Disclosure: The author has no direct investment interest in any discussed companies.