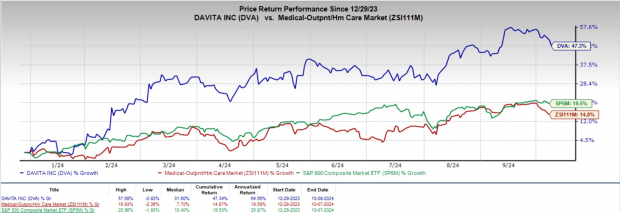

DaVita, Inc. DVA has experienced a remarkable ascent this year, with its shares soaring by 47.3%, outpacing industry growth which stands at 14.8%. In comparison, the S&P 500 composite has shown a solid rise of 19.5% in the same period.

DaVita, a Zacks Rank #2 (Buy) company, has been riding high on a wave of optimism driven by a robust second-quarter 2024 performance and strategic acquisitions of dialysis centers.

Known for being a premier provider of dialysis services in the US for patients with end-stage renal disease, DaVita operates numerous kidney dialysis centers and offers a range of medical services related to dialysis.

Image Source: Zacks Investment Research

The Propellers of DaVita’s Ascension

The surge in DaVita’s stock price can be credited to the potency of its dialysis and related lab services. The positive momentum driven by a stellar second-quarter 2024 performance and promising business prospects is forecasted to fuel the company’s growth further.

DaVita’s expansion is propelled by its approach of patient-centric care, leveraging its kidney care services platform to provide a diverse array of treatment models. The company is capitalizing on the increasing prevalence of value-based partnerships in kidney health, fostering enhanced care coordination and early interventions.

A pivotal part of DaVita’s growth strategy involves acquiring dialysis centers and related enterprises, as exemplified by the recent extension of a collaboration agreement with Nuwellis. The company is also making significant strides globally, expanding its reach to countries such as Brazil, Colombia, Chile, and Ecuador.

The company’s substantial market share growth has been bolstered by agreements to enhance its footprint in various countries. In the second quarter of 2024, DaVita reported results surpassing expectations, signaling a positive trend in revenue streams and patient services.

Dialysis treatments in the US have seen a sequential uptick, alongside the unveiling of new centers domestically and overseas acquisitions, underlining a robust growth trajectory for DaVita. Moreover, an upward revision of earnings projections for fiscal 2024, now estimated at an adjusted EPS within the range of $9.25 to $10.05, up from the prior outlook, is poised to attract increased investor interest.

Fluctuations and Forecasts

However, DaVita faces the risk of diminished profitability if patients transition from commercial insurance to government programs, which typically offer lower reimbursement rates. This potential shift, influenced by rising unemployment rates, could dent the company’s revenues and profit margins.

Glimpsing at Projections

The Zacks Consensus Estimate anticipates an 18% and 14.4% year-over-year enhancement in DaVita’s bottom line for 2024 and 2025, respectively, with projected earnings of $9.99 and $11.42 per share.

Revenue projections for 2024 and 2025 suggest a 5.4% and 4% climb, reaching $12.8 billion and $13.3 billion, respectively, on a year-over-year basis.

Exploring Other Gems

Among the standout stocks in the broader medical arena are Rockwell Medical RMTI, Quest Diagnostics DGX, and RadNet RDNT. Rockwell Medical boasts a Zacks Rank #1 (Strong Buy), whereas Quest Diagnostics and RadNet currently hold a Zacks Rank #2 each.

Rockwell Medical has consistently outperformed earnings estimates over the last four quarters, with an average beat of 87.9%. Its shares have surged by 79.7% year to date, overshadowing industry growth.

Quest Diagnostics showcases an estimated long-term growth rate of 6.8% and has surpassed earnings estimates in the trailing four quarters by an average of 3.3%. Similarly, RadNet has exceeded earnings expectations over the same period, with an average surprise of 98.2%. Quest Diagnostics and RadNet have both seen significant stock appreciation in 2024, outperforming industry growth.