Amid a sea of uncertainty, some companies emerge as beacons of shareholder value, recently bolstering their dividend payouts. A gesture not merely of financial prowess, but a statement of confidence in their own capabilities and unwavering dedication to reward shareholders.

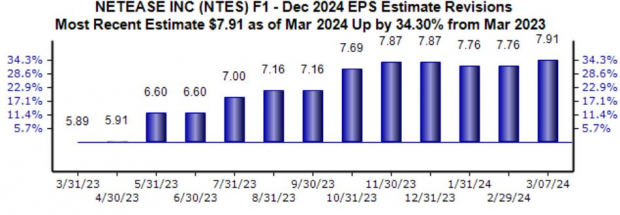

NetEase: Making Waves

NetEase, a shining star in the realm of Internet technology in China, has made a splash in the dividend pool with a whopping 120% increase in its quarterly payout. Such a move echoes a robust five-year annualized dividend growth rate of 24%, painting a picture of sustained growth and investor appeal. Market analysts are singing praises for the company’s current trajectory, with a Zacks Consensus EPS estimate of $7.91, up 35% over the last year and projecting a noteworthy 12% year-on-year growth. Moreover, the stock flaunts a ‘A’ rating for Growth in the Style Score arena.

Image Source: Zacks Investment Research

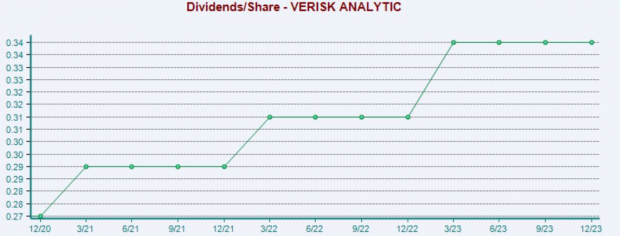

Verisk Analytics: Analyzing Success

Verisk Analytics, a stalwart in the data analytics domain catering to various industries, has raised eyebrows with a 14.7% elevation in its dividend, bringing the quarterly payout to $0.39 per share. Steadfastly rewarding its shareholders over the years, the company’s commitment to value creation shines through.

Image Source: Zacks Investment Research

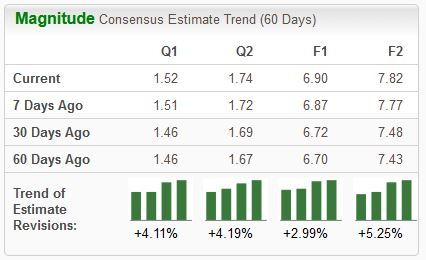

Waste Management: Cleaning Up

Waste Management, a titan in comprehensive waste services across North America, has boosted its quarterly dividend by 7%, reaching a payout of $0.75 per share. Analysts view the company’s earnings outlook in a positive light, upgrading their expectations across the board.

Image Source: Zacks Investment Research

The Resilience of Dividends

Dividends serve as a life raft in the tumultuous seas of market volatility, offering investors a steady stream of income and a chance to optimize returns through reinvestment. The recent upsurge in dividend boosts from companies like NetEase, Verisk Analytics, and Waste Management signifies a commitment to shareholders’ well-being and a belief in future growth prospects.