Despite the storm of negative press hovering over Tesla (NASDAQ: TSLA) in recent times, with challenges in the electric vehicle (EV) market and organizational restructuring, the question on investors’ minds remains: Is Tesla still a sound long-term investment?

Image source: Tesla.

Delving into Tesla’s Value Proposition

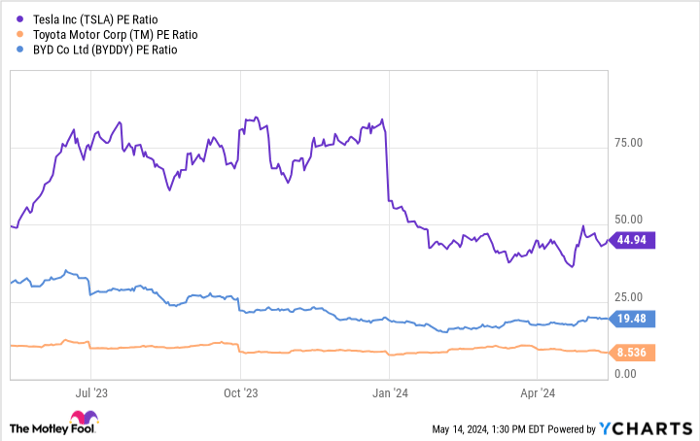

When scrutinizing Tesla’s stock against other automotive giants, it appears pricey and overvalued. With a current P/E ratio of 42, Tesla stands as a stark contrast to traditional automakers like Toyota and China’s BYD, with its valuation seemingly inflated.

TSLA PE Ratio data by YCharts.

However, when viewed through the lens of its future prospects, Tesla’s stock begins to reveal hidden potential, suggesting it might currently trade at a discount despite its seemingly steep price tag.

Many industry pundits hail Tesla as a prime investing opportunity to tap into the future of artificial intelligence (AI), despite the need for continued development to fully leverage this technology.

The Uncharted Journey Ahead: Why Tesla’s Underappreciated

CEO Elon Musk has grand ambitions for Tesla, envisioning it as the most valuable company globally. Central to this vision are advancements in its full self-driving software and the innovative humanoid robot, Optimus.

Projected as a pioneer in the impending robotaxi service, Tesla foresees a transformative future in ride-hailing with self-driving vehicles, heralded as a demand driver with infinite potential by Musk and industry analysts alike.

Despite the intangible nature of groundbreaking technology, ARK Invest’s Monte Carlo simulation estimates that robotaxis could drive as much as $440 billion in revenue, a quantum leap from Tesla’s 2023 total revenue.

Moreover, Optimus stands to disrupt a significant chunk of the global labor market by assuming tasks currently performed by humans, potentially overtaking vehicle manufacturing revenues, per Morgan Stanley’s analysis.

Although Optimus is already operational at Tesla’s manufacturing plants, Musk eyes expanding its role by year-end, paving the way for consumer and market deployment by 2025.

The Golden Hour for Investment

Whilst Tesla’s electric vehicle segment may face uncertainties, its true value lies in its AI ventures. As Tesla ramps up EV production and rides the global EV wave, the real dividends may stem from its pioneering AI projects.

For risk-tolerant, long-haul investors, Tesla’s trajectory amidst short-term challenges could present a compelling growth opportunity. In the words of legendary investor Warren Buffett, “Be greedy when others are fearful, and fearful when others are greedy.” In the current sea of apprehension surrounding Tesla, this sage advice rings true.

Looking beyond the noise, Tesla’s track record of innovation, strides in AI development, and the monumental impact these technologies promise to deliver indicate that Tesla stands as a robust long-term growth prospect for astute investors.

Identifying Hidden Gems in the Market Today

For potential investors, the broader market sentiment often overshadows hidden jewels like Tesla. As Motley Fool Stock Advisor touts its latest recommendations, Tesla’s inclusion in the mix underscores the untapped potential amidst overlooked stocks.

While caution is warranted, exploring Tesla’s potential against the backdrop of its AI initiatives opens doors to a realm of growth that few other companies can match.

*Stock Advisor returns as of May 13, 2024