Google Earnings are Due

Google parent and Zacks Rank #2 (Buy) stock Alphabet (GOOGL) will report third-quarter earnings Tuesday, October 29th after the market closes. Below are the things you need to know about the upcoming report:

Wall Street Expectations

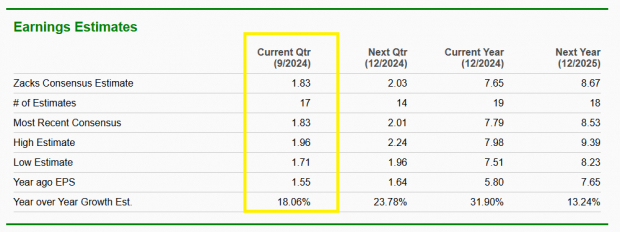

Zacks Investment Research accumulates data from hundreds of Wall Street firms devlop its consensus estimates. Wall Street analysts tracked by Zacks expect Google to earn $1.83 for the third quarter, which represents 18.06% year-over-year growth, on $72.85 billion in sales (13.73% YoY growth).

Image Source: Zacks Investment Research

Implied Options Move

The options market can hint at a stock’s potential price move the day after earnings. Currently, the options market implies a move of plus or minus ~6%.

Post-EPS Price Reaction History

Google has been down the session after earnings in 3 of the past 5 quarters. Returns were as follows:

· -5.04%

· +10.22%

· -7.50%

· -9.51%

· +5.78%

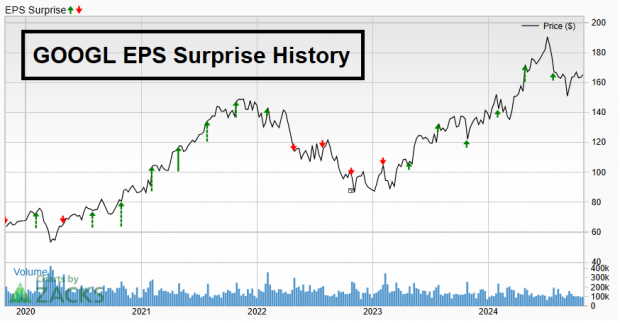

EPS Surprise History

Alphabet has surpassed Zacks Consensus Estimates in 14 of the past 20 quarters.

Image Source: Zacks Investment Research

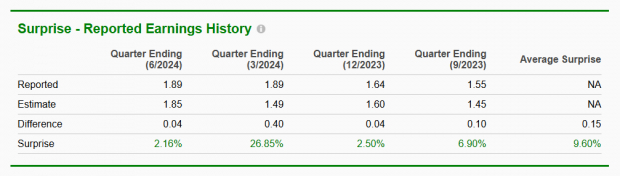

Over the past four quarters Google has surpassed Zacks Consensus Estimates by 9.60% on average.

Image Source: Zacks Investment Research

Historical Valuation & Valuation vs. Peers

Google’s valuation is cheap on a historical basis. The stock trades at a relatively cheap price-to-earnings multiple of 23.71x. GOOGL’s P/E has ranged from ~17x to ~37x in that timeframe.

Image Source: Zacks Investment Research

Meanwhile, Google is the cheapest name out of the “Magnificent 7” names which include Microsoft (MSFT), Amazon (AMZN), Apple (AAPL), Nvidia (NVDA), Tesla (TSLA), and Meta Platforms (META).

Technical Levels & Information

GOOGL key levels to watch:

· Shares are coiling above their 200-day moving average which is ~3.4% lower ($161.29).

· Google’s swing low is $147.22.

· Short-term resistance sits at $169.16.

· There’s an open daily price gap at $183.61, and all-time highs are at $191.75.

Note: The coiled nature of shares suggests that GOOGL may move more implied move of the options, as price contraction leads to price expansion.

Image Source: TradingView

3 Potential Catalysts

Below are 3 things to watch for during the earnings call:

1. Cloud: Google’s Cloud business is a key driver for the company. Despite the highly competitive cloud market Google generated cloud revenues of more than $10 billion in Q2 and accounted for ~12% of total revenues. Google Cloud revenue rose 28.8% year-over-year and management is making the company’s main expansion segment.

2. Artificial Intelligence: Google has intensified its generative AI efforts with its Gemini large language model. Wall Street expects Google’s AI business to grow at a scorching hot CAGR of ~50% until 2030.

3. Search Cannibalization Commentary: Ad revenue from Google’s search business still accounts for the largest portion of total revenues by a lot. However, Google bears believe that AI will cannibalize its search business and eat into profit margins, though no evidence of this phenomenon exists yet.

What to Not Expect

The Department of Justice’s (DOJ) monopolistic crackdown against Alphabet is unlikely to be a factor or discussed because the legal battle is ongoing.

Only $1 to See All Zacks’ Buys and Sells

We’re not kidding.

Several years ago, we shocked our members by offering them 30-day access to all our picks for the total sum of only $1. No obligation to spend another cent.

Thousands have taken advantage of this opportunity. Thousands did not – they thought there must be a catch. Yes, we do have a reason. We want you to get acquainted with our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators,and more, that closed 228 positions with double- and triple-digit gains in 2023 alone.

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Apple Inc. (AAPL) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report