Strong Performance in Q1

Amazon showcased remarkable results in its first-quarter financial report, beating expectations with a revenue increase of 13% to $143.3 billion. Notably, its operating margin expanded by 700 basis points, fueled by efficiency gains from the regionalization of its fulfillment network. The company’s GAAP net income tripled, reaching $0.98 per diluted share.

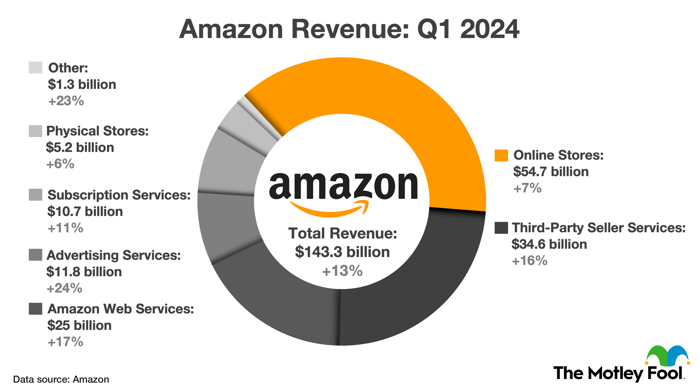

The chart illustrates Amazon’s first-quarter revenue growth across its seven primary business segments.

Three Vital Growth Engines

Amazon’s success hinges on its robust presence in e-commerce, digital advertising, and cloud computing. Straits Research forecasts an 8% annual growth in online retail sales through 2030. Additionally, Grand View Research predicts that digital advertising and cloud computing sales will grow at compound annual rates of 15% and 14%, respectively.

In the e-commerce landscape, Amazon leads as the largest online marketplace in North America and Western Europe by sales volume. Despite its dominance, the company continues to capture market share, projected to command over 40% of online retail sales in the U.S. Analysts even suggest that Amazon could surpass Alibaba as the world’s top e-commerce company by 2027.

Employing the momentum from retail, Amazon has flourished in the digital advertising realm. The company is anticipated to claim three-quarters of U.S. retail ad spending this year, overshadowing its closest competitor Walmart by a significant margin. Globally, Amazon stands as the third-largest player in digital advertising, with a projected market share increase of 180 basis points over the next two years, especially as it capitalizes on new prospects within Prime Video.

Further solidifying its position, Amazon Web Services (AWS) reigns as the foremost provider of cloud infrastructure and platform services. Analysts like Jim Kelleher from Argus believe that AWS holds a strategic advantage in the evolving AI market, particularly as the primary infrastructure-as-a-service provider in the burgeoning AI-as-a-service sector. Despite a slight market share dip in the past year, AWS remains ahead with innovative partnerships and investments in generative AI solutions across their technology stack.

At the infrastructure level, AWS is developing custom AI chips for efficient training and inference at a lower cost compared to Nvidia GPUs. In the model-tuning space, Amazon recently launched Amazon Bedrock, a generative AI development service that incorporates cutting-edge technologies like Claude 3 Opus from Anthropic, a groundbreaking large language model surpassing GPT-4. Notably, at the application level, AWS unveiled Amazon Q, an advanced conversational copilot capable of data summarization, answering queries, and automating tasks including coding.

Unlocking Amazon’s Potential in the AI Boom

The age of artificial intelligence is upon us, and Amazon is positioning itself as a frontrunner in this technological revolution. With a keen focus on innovation, the e-commerce giant is leveraging AI in its product development, from custom chips to groundbreaking software like Amazon Q. The company’s “Q” is not just any AI-powered assistant; it’s a game-changer in software development and data processing, setting new standards for performance and functionality.

Riding the Wave of AI Advancements

Amazon’s strategic investments in AI technology, such as Amazon Q, have the potential to catapult its cloud services sales to new heights. As the company continues to refine its AI offerings, there is speculation that Amazon could regain lost market share and emerge as a dominant force in the industry. AWS stands to gain significantly from the unfolding AI boom, solidifying its position as a key player in cloud computing.

Amazon’s Robust Growth Prospects

Looking ahead, Amazon’s growth trajectory appears promising, with projections indicating the potential for low-double-digit sales growth through the end of the decade. Analysts foresee Amazon maintaining a steady sales growth rate, with estimates suggesting an annual growth rate of 11.1% through 2026 and 10.9% over the next five years. These figures leave room for optimism, especially if AWS emerges as the premier cloud provider for AI workloads.

Considering Amazon’s current valuation, trading at 3.3 times sales, investors may find the stock attractively priced. While this valuation represents a premium compared to the three-year average of 2.9 times sales, it still appears reasonable. Anticipating a potential market outperformance in the next three to five years, patient investors could benefit from taking a position in Amazon stock today.

Strategic Investment Considerations

Before making investment decisions, investors should weigh various factors related to Amazon’s growth potential and market positioning. While the company’s AI initiatives hold significant promise, it’s essential to conduct thorough research and assess the risks associated with investing in the stock.

Reflecting on success stories such as Nvidia’s meteoric rise after being highlighted by Motley Fool Stock Advisor, investors are reminded of the transformative power of sound investment choices. The Stock Advisor service offers a blueprint for success, providing insights on portfolio construction, regular analyst updates, and monthly stock picks. Over the years, Stock Advisor has significantly outperformed the S&P 500 index, underscoring the value of informed investment strategies.

As the AI landscape evolves and Amazon’s role in shaping this future becomes clearer, investors stand to benefit from aligning their investment portfolios with the company’s growth trajectory. By staying informed and leveraging valuable resources like Stock Advisor, investors can navigate the dynamic market landscape and potentially capitalize on emerging opportunities.