The Elusive 100-Baggers: An Odyssey Through Time

The term “100-bagger” caught fire in Peter Lynch’s iconic “One Up on Wall Street” in 1989. Microsoft, Dell, Nvidia, and Apple – just a sprinkle of the titans Lynch spotlighted to illustrate the prospect of tenfold stock price growth.

But, how frequently do these explosive gains materialize, and can we identify the supernovas on the brink of illumination?

Adventuring into the realm of 100-baggers, behold the mesmerizing revelation proffered by the chart: to unearth a ten-bagger in contemporary times, one must embark on a rewind expedition back to the 1980s.

The profound spectacle lies in stocks from the 1980s blossoming a hundredfold in value over time, underscoring the endless growth potential of the bourse, with the S&P 500 averaging 11% annual returns post-1980.

Decoding the DNA of 100-Baggers

While a bulletproof formula remains a mirage, analyzing historical 100-baggers often unveils recurring traits. Here are some linchpin elements:

- Steady Growth: Firms boasting a history of unwavering earnings growth, especially on the bottom line, tend to wield strong potential.

- Modest Valuations: Seek out stocks with appealing valuations, such as a modest price-to-earnings (P/E) ratio.

- Compact Market Cap: Through history, companies with a sub-$500 million market capitalization held an elevated chance of reaching 100-bagger status, fueled by their potential for explosive growth.

Achieving a hundredfold surge usually entails continual growth, particularly in earnings, and embarking from a subdued valuation, like a humble price-to-earnings (P/E) ratio. Furthermore, numerous victors in this realm commenced as fledgling entities since larger corporations find Herculean toil in such monumental growth.

Crafting Your Radar: Sieving for 100-Bagger Potential

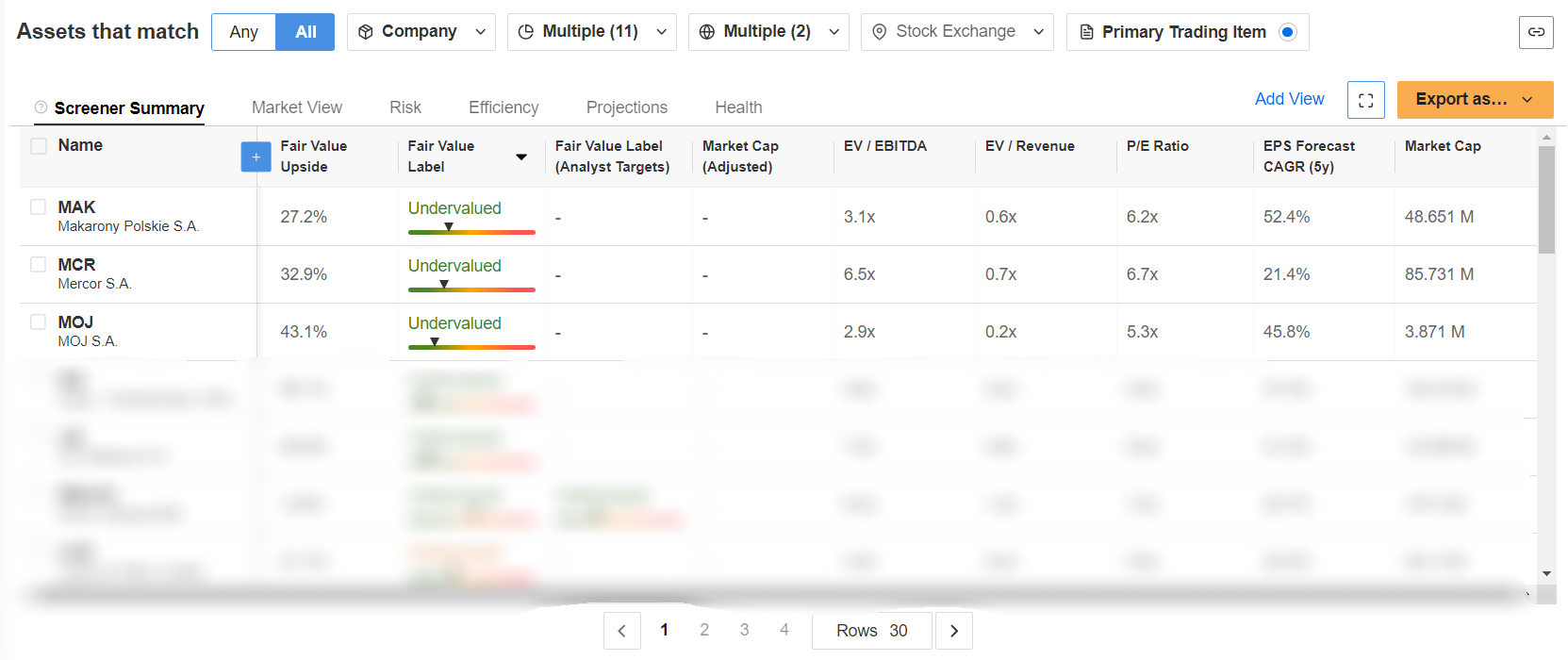

The beacon of hope? Leveraging tools like InvestingPro to erect filters and pinpoint stocks boasting attributes echoing those of historical 100-baggers. Here, we enacted three pivotal filters:

- Annual Earnings Growth Compound: Notching a minimum of 20% over the precedent five years.

- P/E Ratio: Nestled betwixt 5 and 10.

- Market Cap: Nestled below $500 million.

By applying these sieves across the U.S. and European stock cosmos, we funneled a gargantuan database of over 162,000 equities into a concise roster of 113 budding contenders. Might any of them sprout into the next 100-bagger phenomenon? Only the passage of time will enlighten us.

Is the potential for hundredfold growth cloaked within? Glimpse at the foremost triad on our radar (in no preferential sequence):

Disclaimer: This piece is drafted for informative intents exclusively; it doesn’t constitute a solicitation, tender, counsel, or urging to invest, hence it doesn’t strive to prod asset procurement in any form. Remember, any asset merits evaluation from myriad angles and is steeped in peril; hence, any investment resolution and its tethered peril linger with the investor.