Apple (NASDAQ: AAPL) has been rewarding investors’ faith for years. The stock is up 435% over the past five years, including a 46% rise in 2023 as one of the “Magnificent Seven” stocks that contributed such a large share of the major market indexes’ gains last year.

But Apple stock has cooled off in early 2024. Just a few trading sessions into the new year, its shares have already slipped by more than 3%. Is this a “buy-the-dip opportunity” for a proven winner, or could this be the beginning of a long year for shareholders?

A big clue to the answer can be found in the company’s fundamentals.

Evaluating Apple’s Trajectory in 2023

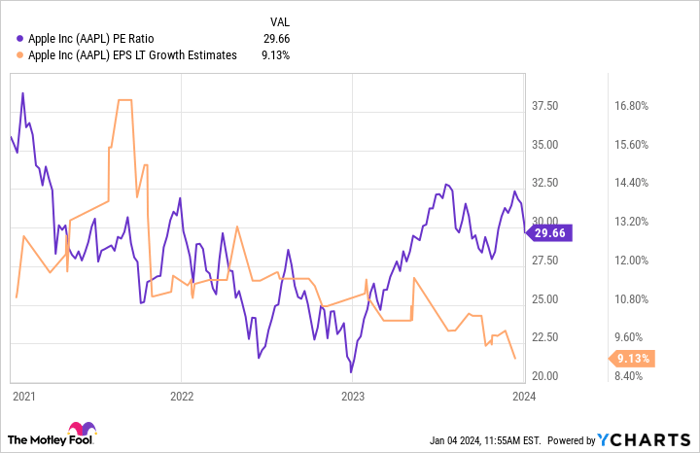

Often, what the market is willing to pay for a stock depends heavily on how much growth the underlying business can deliver. Apple’s price-to-earnings (P/E) ratio and analysts’ expectations about long-term earnings growth tend to follow each other. In other words, investors pay up for the stock when they expect good things in the future.

AAPL PE Ratio data by YCharts.

These lines began diverging from each other in early 2023. Remember, the stock rose tremendously last year, but analysts have become increasingly pessimistic about Apple’s future earnings growth.

These gulfs between valuation and market expectations generally don’t last, because they indicate that someone is wrong. Either analysts are too pessimistic about Apple’s future, or the market’s expectations are too high. Eventually, it will become clear which side has it right. The potential risk in buying Apple stock today is that you’ll turn out to be on the wrong side of this gap.

Seeking Insights into Apple

Though it’s a $3 trillion company, Apple’s business is fairly simple. The company sells a line of hardware products, headlined by the iPhone. It also sells various subscription services for cloud storage, video, news, games, music, and more. The company’s total revenue in its fiscal 2023 (which ended Sept. 30) was $383 billion. Roughly 78% of that came from products, the rest from services.

Today, there are over 2 billion active Apple devices worldwide. Considering that it sells premium devices that aren’t affordable for everyone, hitting 2 billion customers is pretty impressive. Nonetheless, it’s seemingly getting more challenging for the company to grow. Noteworthy product updates are fewer and farther between because the smartphone is maturing nearly two decades after the first iPhone launched.

Apple got a temporary boost as customers and telecoms upgraded from 4G networks; it launched its first 5G model in late 2020. But its revenues have roughly flattened over the past two years. Much of Apple’s user base has newer models now (most phone installment plans run from 12 to 24 months).

AAPL Revenue (TTM) data by YCharts.

There might not be another company that generates as much free cash flow as Apple — just under $100 billion over the past year. Apple has primarily aimed that cash-flow cannon at its own stock, feverishly repurchasing shares to boost its earnings per share. The number of shares outstanding has fallen by more than 17% over the past five years.

Management leaned on Apple’s balance sheet to do this, occasionally using debt to help fund repurchases. While Apple is rock-solid financially, it carries $111 billion in long-term debt on its balance sheet — a net debt of roughly $50 billion once you subtract its $61 billion in cash. Repurchases likely won’t stop, but they could slow. Adding more debt wouldn’t be good for Apple’s long-term health and isn’t a sustainable way to operate.

Predicting Apple’s Trajectory

Nobody knows for sure where a stock will trade tomorrow, next month, or even next year. However, a company’s fundamentals can indicate to investors what direction it may eventually go. Investing sometimes boils down to making the best educated guess you can with the best information you have. Even the greats aren’t always correct.

Apple is showing investors some clues right now.

The combination of stagnant revenue growth and the potential for a slowdown in share repurchases helps explain why analysts are a bit down on Apple. The stock is trading at a P/E ratio of almost 30, which is expensive if Apple only grows earnings by 9% annually. That would give it a PEG ratio of more than 3. I consider any ratio around 1.5 or less to be a good value for a long-term investor.

Consider standing on the sidelines with this stock until either one of two things happens: Apple’s earnings growth exceeds expectations, or its valuation reverts to something more appropriate for a company with a slower growth rate.

Should you invest $1,000 in Apple right now?

Before you buy stock in Apple, consider this:

Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Apple wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of December 18, 2023

Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple. The Motley Fool has a disclosure policy.