Anticipation mounts as Chewy Inc. (NYSE: CHWY) readies itself for the release of its second-quarter fiscal 2024 earnings on Aug 28. Investors are diligently gauging the allure of this stock as it continues to garner attention due to its remarkable upward trajectory and strategic maneuvers. With the imminent arrival of earnings day, the crucial question that looms is whether Chewy stands as a prudent investment option at this juncture.

Resilient Growth Trajectory and Financial Indicators

Chewy’s commendable growth, strong market position, and dedicated customer base have solidified its appeal among investors. Analysts at Zacks foretell revenues of $2.86 billion for the upcoming quarter, reflecting a 2.8% upsurge from the corresponding period last year.

On the earnings front, the consensus estimate stands firm at 22 cents per share, pointing towards a substantial 46.7% year-over-year growth.

Chewy boasts a robust track record, having exceeded earnings expectations by an average of 57.7% over the past four quarters. In its latest reported quarter, the company surpassed the Zacks Consensus Estimate by a notable margin of 47.6%.

Insights from the Zacks Model on CHWY

The trusted Zacks model forecasts that Chewy is poised to outperform this time around. The amalgamation of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy), or 3 (Hold) enhances the likelihood of an earnings beat – a scenario that currently holds true for Chewy.

Chewy sports an Earnings ESP of +4.55% and carries a Zacks Rank #2. Unearth the top stocks to buy or sell before their earnings announcements with our Earnings ESP Filter.

Dynamics at Work

Chewy’s strategic concentration on product expansion and elevating customer satisfaction is likely to have fostered revenue growth. By continuously enriching its product array with novel and exclusive items, Chewy adapts to evolving consumer preferences and necessitates. Such an approach, coupled with well-thought promotional endeavors and targeted marketing campaigns, is expected to draw in new customers while encouraging augmented spending from existing ones.

The sustained success of the Autoship program is also anticipated to have played a pivotal role in boosting revenues. As this program flourishes, its convenience and value are poised to translate into heightened customer retention and recurrent purchases.

The introduction of the Chewy Plus membership program stands as a significant driving force. As this initiative gains traction, the added perks such as complimentary shipping and exclusive discounts are likely to fuel increased purchase frequencies and larger cart sizes.

Chewy’s foray into fresh markets, especially its endeavors in Canada and other international territories, provides added revenue growth avenues. This geographical diversification unveils new paths for customer acquisition. Furthermore, Chewy’s exploration into veterinary services through the Chewy Health division is primed to attract pet owners seeking holistic care for their beloved animals. This strategic move is slated to generate cross-selling opportunities, elevate customer lifetime value, and further bolster revenue growth.

CHWY Takes the Lead

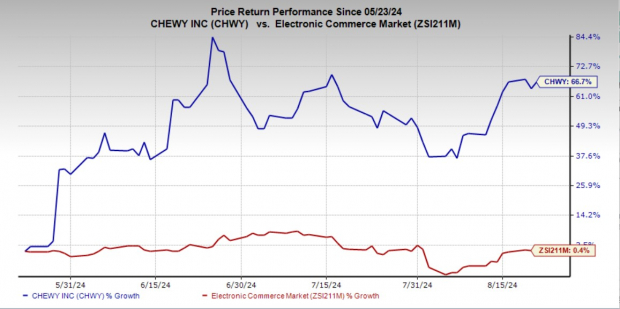

Chewy has witnessed a remarkable surge in its stock price over the past three months, with a whopping 66.7% rally, substantially outperforming the industry’s modest uptick of 0.4%.

Image Source: Zacks Investment Research

CHWY has also outshone its competitors, including BARK, Inc. (NYSE: BARK), Petco Health and Wellness Company, Inc. (NASDAQ: WOOF), and Central Garden & Pet Company (NASDAQ: CENT).

While BARK shares have surged by 43.3% during this timeframe, WOOF and CENT have experienced downturns of 10.7% and 13.7%, respectively.

Is CHWY a Compelling Proposition for Value Investors?

From a valuation perspective, Chewy shares present an appealing opportunity, trading at a discount relative to historical and industry standards. Boasting a forward 12-month price-to-sales ratio of 0.98, below the five-year median of 1.72 and the industry average of 1.73, the stock offers an enticing proposition for investors eyeing exposure to the sector.

Image Source: Zacks Investment Research

The Investment Narrative

Chewy stands out with its robust performance, evidenced by substantial stock price appreciation, strong financial metrics, and strategic implementations. Despite its recent upsurge, Chewy’s stock remains a promising prospect with attractive valuation metrics alongside encouraging growth prospects. The company’s commitment to innovation, including the expansion of its Autoship program and the introduction of services like Chewy Health, not only reinforces customer loyalty but also unlocks fresh revenue streams. Paired with its strategic expansion into global markets and a sharp focus on operational efficacy, Chewy is well-equipped to capitalize on the burgeoning pet care industry.

Final Thoughts

Delving into Chewy prior to its second-quarter earnings disclosure seems prudent. The company’s sturdy growth trajectory, supported by its strategic thrust on product diversification and enhanced customer satisfaction, positions it favorably for sustained success. The anticipated revenue growth, buoyed by initiatives such as the Autoship program and the Chewy Plus membership, underscores the company’s adeptness in attracting and retaining customers.

Furthermore, Chewy’s venture into global markets and the veterinary services sector bolster its prospects for long-term growth. Backed by a solid track record of surpassing earnings projections and promising signs for the upcoming quarter, Chewy emerges as an appealing investment opportunity.

© 2024 Benzinga.com. Benzinga refrains from offering investment counsel. All rights reserved.