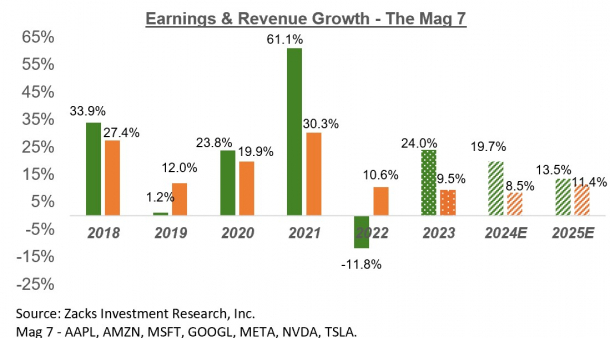

There’s been a lot of chatter recently about the Magnificent 7 stocks and how they’ve been solely responsible for this incredible market rally. After all, these seven companies – which include Apple AAPL, Amazon AMZN, Meta Platforms META, Alphabet GOOGL, Microsoft MSFT, Nvidia NVDA, and Tesla TSLA – account for nearly 30% of the S&P 500’s total market capitalization.

The choir has been preaching that these seven stocks are propping up an overall weak market. As a group, these stocks have mainly surprised to the upside during this fourth-quarter earnings season. Outside of Tesla, the five other reporting Mag 7 members delivered impressive growth figures. Chip giant Nvidia is slated to deliver its Q4 results later this month.

Total fourth-quarter earnings for this group are expected to be up 48.7% on 14.5% higher revenues versus the year-ago period. These are phenomenal growth rates for companies of this size; it’s no wonder why the individual stocks continue to outperform the market. Looking ahead to the full year of 2024, earnings for this group are expected to climb 19.7% on 8.5% higher revenues.

Image Source: Zacks Investment Research

But is it really just these seven stocks propping up the market? The answer to this question lies in identifying current market conditions. Let’s peel back the curtain and see what we discover.

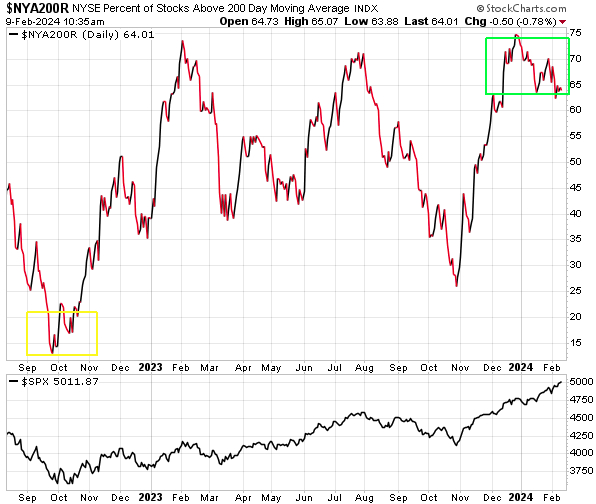

Critical Market Breadth

We can see below that market breadth, as measured by the percentage of stocks trading above their 200-day moving average on the NYSE, has dramatically improved relative to the bear market lows. The figure moved from the low teens to a multi-year high of approximately 75% as market breadth showed signs of life.

Image Source: StockCharts

This is what we want to see from a longer-term perspective; more stocks joining the rally translates to broader participation and increases the odds of a sustainable bull market. The major U.S. indexes are reaching new heights this year as a new bull market has emerged.

On the flip side, once market breadth reaches an extreme, odds of a reversal begin to increase. We’re beginning to see this now as breadth has somewhat declined relative to the beginning of the year. The chances of a short-term pullback coming relatively soon appear likely, particularly given the impressive run-up over the past several months. But again, longer-term the increased breadth bodes well.

Of course, tech stocks have largely led the advances this year, powered by a bullish artificial intelligence theme. It’s normally technology that leads in the early stages of a bull market, as these stocks also get hit hardest during times of volatility. But as bull markets broaden out, other pockets of the market become enticing once again.

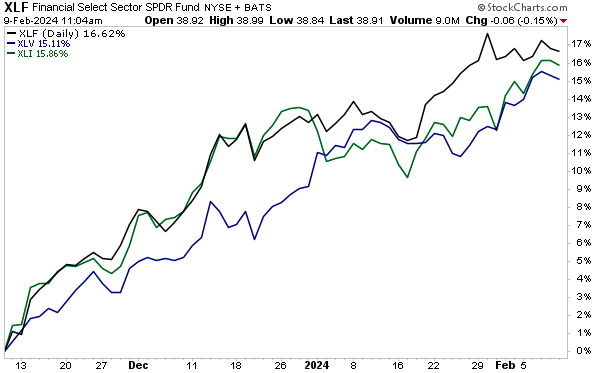

Broader Industry Participation

Outside of tech, several sectors are trading at or near 52-week highs. As noted below, financials, industrials, and health care have come back to the forefront:

Image Source: StockCharts

These areas of the market began to show strength late last year, with each rallying a minimum of 15% over the past few months. So when you hear that it’s only big tech participating in this rally, take it with a grain of salt.

Yes, tech is responsible for much of the gains in the major indices. And yes, the Mag 7 group account for a relatively large percentage of S&P 500 earnings. But there are plenty of individual stocks within the health care, industrial, and financial sectors making new 52-week highs.

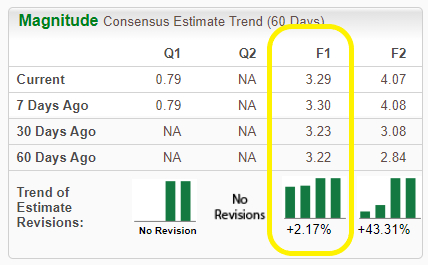

A couple that come to mind include pharmaceutical giant Novo Nordisk NVO, whose broad diabetes and obesity drug portfolio have boosted the stock to new all-time highs. Earnings estimates for the current year have increased 2.17% in the past 60 days. Full-year earnings for NVO of $3.29/share would translate to a 21.9% improvement relative to last year:

Image Source: Zacks Investment Research

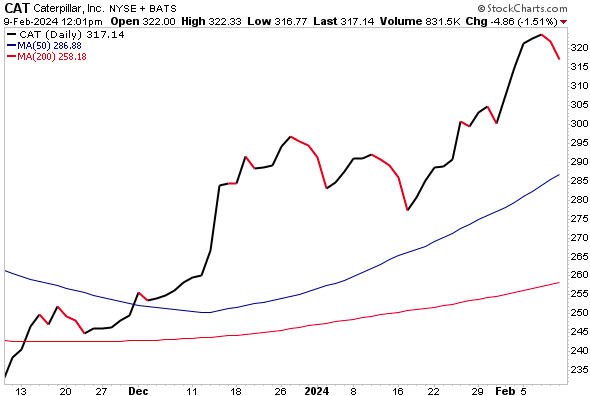

Within the industrial sector, construction and mining equipment manufacturer Caterpillar CAT stock has also soared to all-time highs. Considered a gauge of the global economy, Caterpillar has witnessed its shares surge more than 36% over the past 3 months:

Image Source: StockCharts

Final Assessment: Diversified Opportunities

The market is telling us to expect positive outcomes moving forward, with companies from a variety of sectors participating in this uptrend. While tech stocks led the advances in the early stages of this new bull market, other areas have shown renewed strength as they join the rally.

With many technology stocks extended past proper entry points, it’s a good time to look elsewhere and diversify portfolio holdings. Make sure you’re taking advantage of all that Zacks has to offer as we head further into the New Year.