During periods of turbulence in the market, the question on everyone’s mind is whether this is merely a passing correction or the beginning of a more enduring downturn. Recent signals have left investors pondering the answer, with some fearing that the current bull market may be on its last legs.

MarketWatch’s report from last week shed light on a concerning statistic: less than 30% of stocks are currently trading above their 50-day moving average – a stark contrast to the 85% level in late March and 92% at the start of January. This shift signals a notable downturn in market dynamics, exacerbated by geopolitical tensions and inflation worries.

Various factors have contributed to the recent pullback in stock prices, such as geopolitical tensions in the Middle East and unexpected inflation data. However, this descent is not unforeseen; as previously mentioned in a March 2024 analysis, the surge in buybacks since 2009 has played a significant role in asset price increments.

Additionally, the recent halt in corporate buybacks coincided with a notably bullish investor sentiment. Historically, excessive bullish sentiment coupled with low volatility has often foreshadowed market peaks.

The interruption in buybacks and the surge in bullish sentiment have set the stage for a decline in asset prices. Understanding this dynamic is pivotal as investors navigate the market landscape for the remainder of the year.

Changing Dynamics Between Buyers and Sellers

In delving into market dynamics, it’s critical to recognize that prices are determined by the interplay of supply and demand. In the current scenario, where fewer sellers are willing to part with their holdings, buyers are compelled to bid up prices to facilitate transactions. However, this imbalance is unsustainable and is emblematic of the “greater fool” theory.

Shifts in market dynamics are inevitable. At a certain juncture, buyers will grow scarce as they resist paying inflated prices. As sellers catch wind of this shift, panic selling ensues, resulting in a precipitous drop in prices.

An essential concept to grasp is that buyers reside at lower price levels than sellers in the current market environment. This disparity is visually depicted in the volume-at-price chart, showcasing where the bulk of trading activity has occurred.

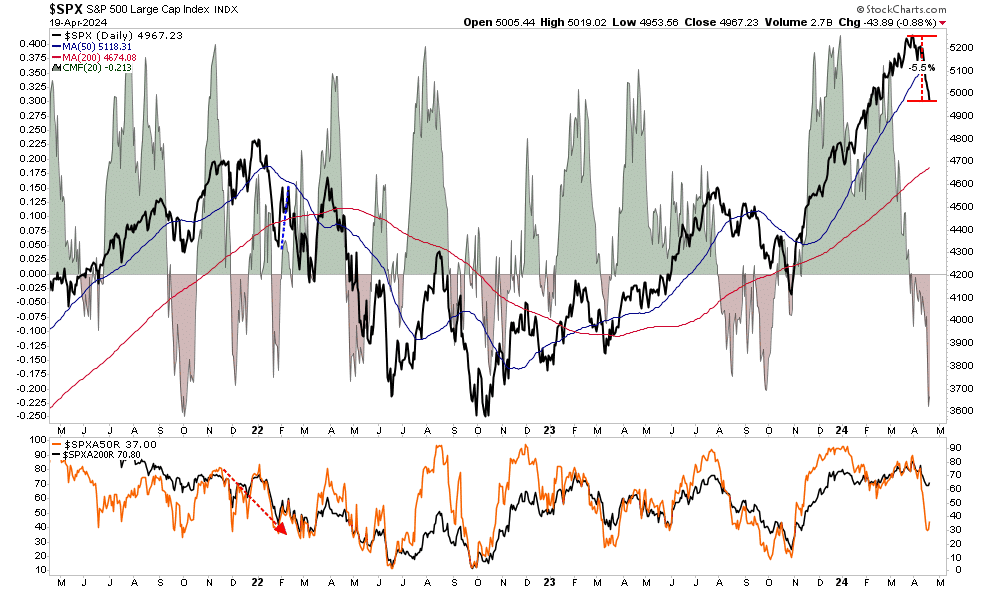

The ongoing correction is edging closer to oversold territory, hinting at a probable rebound towards the prior support level of the 50-day moving average. Drawing parallels to last year’s correction depicts a similar pattern, offering investors an opportunity to recalibrate their portfolios amid market fluctuations.

Shifts in Market Sentiment

Turning our attention to sentiment indicators, a rapid reversal in investors’ exuberant sentiment is underway. The composite net bullish sentiment index, juxtaposed with the volatility index, is witnessing a significant downturn, indicative of eroding bullish sentiment.

Professional investors, notorious for entering markets at their peaks, have drastically slashed their equity allocations within a brief two-week span. This sudden shift underscores the swift reversal in sentiment among market participants.

Market Sentiment Shift: A Closer Look at Current Conditions

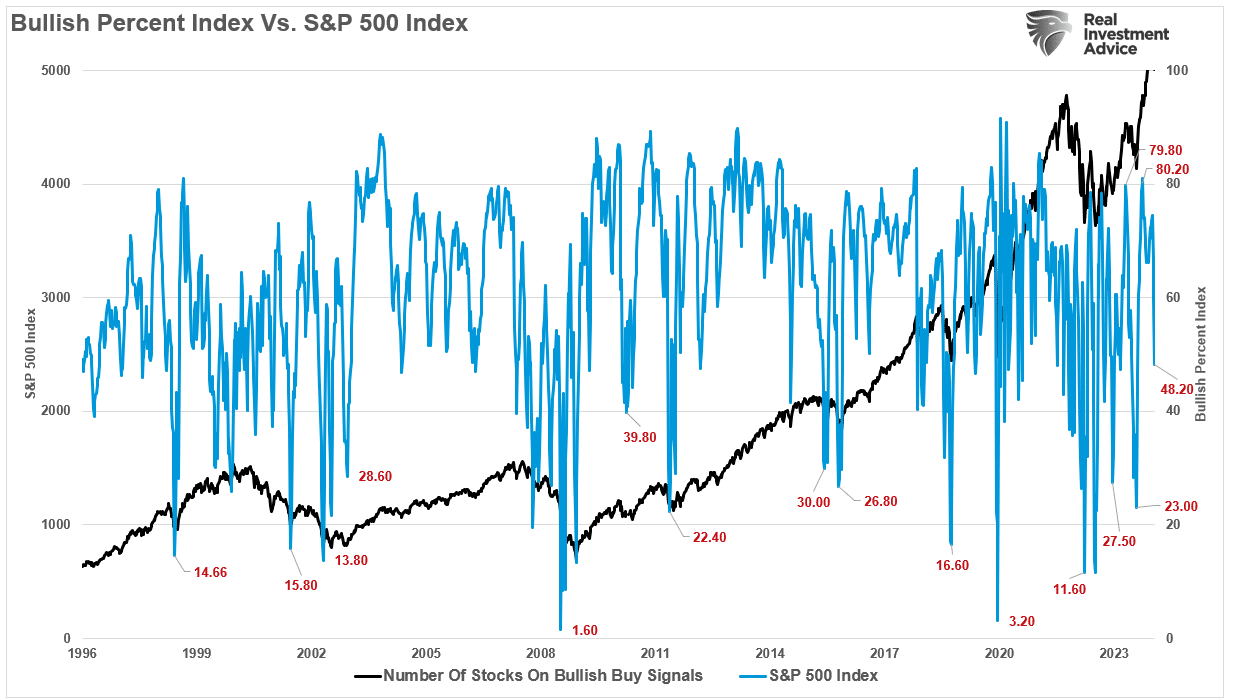

As market volatility remains a prevalent theme in recent days, notable shifts in sentiment and indicators have caught the attention of investors. The decline in stocks on bullish “buy signals” from 80.2 to 48.2 raises concerns about the strength of the bullish momentum.

Moreover, the decrease in stocks trading above the 50-DMA, dropping from over 80% to 37%, coupled with diminishing money flows, paints a picture of uncertainty in the market. Despite a modest 5.5% correction from recent highs, the clearing of previous overbought conditions signifies progress amid the turbulence.

Analysts anticipate a reflexive rally in the markets due to the extreme shift in sentiment and prevailing short-term oversold conditions. However, the presence of trapped bullish investors from the selloff suggests that any upswings might face significant selling pressure.

Despite the pervasive panic portrayed in media headlines, the current correction is likely part of the natural ebb and flow within a steadfast bullish market. The imminent resumption of corporate share buybacks in May is expected to offer crucial support to the markets as they navigate through the upcoming summer months.

Nevertheless, this correction, once concluded, may not mark the end of market volatility for the year. Historical market patterns hint at a potentially tumultuous journey ahead, particularly as anticipation grows around the forthcoming election cycle.

Let’s not paint a dire picture just yet. While uncertainty looms, the long-term outlook remains optimistic as resilience and adaptability have always been defining characteristics of the market. So, as we brace ourselves for potential turbulence ahead, let’s keep a watchful eye on how these market dynamics unfold.