With each passing day, the signs are mounting – American shoppers are feeling the pinch.

Take, for instance, McDonald’s Corporation (MCD), which felt the squeeze in its earnings report released on Monday, July 29, showing its first quarterly decline since 2020 with a 1% drop in same-store sales in the second quarter.

This decline, partly attributed to deflation and echoed in the disappointing sales figures from the likes of French fry supplier Lamb Weston Holdings, Inc. (LW), underscores consumer woes. To counteract this trend, fast-food giants like McDonald’s, Burger King, and KFC are doubling down on $5 meal promotions, while retail giants such as Target Corp. (TGT), Walmart, Inc. (WMT), and Best Buy Co. Inc. (BBY) are slashing prices on selected items.

Further adding to the signs of distress is the alcoholic beverage company Diego plc (DEO), which reported its first sales decline since 2020, underscoring a challenging environment for consumers.

These developments serve as a clear indication of consumer hardship, particularly among the lower income bracket, grappling with inflationary pressures and financial constraints.

As all eyes turned to the July U.S. retail sales report, released recently, the anticipation was palpable. Investors were keen to gauge consumer spending patterns and their implications for the wider economy.

Simultaneously, major retailers have begun unveiling their quarterly earnings, with Walmart leading the charge. As the largest retailer in America, surpassing even Amazon.com, Inc. (AMZN) in sales volume, Walmart’s performance serves as a litmus test for consumer sentiment and habits.

Insights from the July U.S. Retail Sales Report

The July U.S. retail sales report brought a glimmer of hope, with a 1% increase in sales, surpassing economists’ projections of a mere 0.3% uptick. Excluding auto sales, the rise was 0.4%, outperforming expectations for a 0.1% increase. This positive trend was further underscored by the revised figures for June, which initially reported a flat performance but were later adjusted to reflect a 0.2% decline.

A closer look reveals:

- 5.3% surge in spending at bars and restaurants.

- 2.6% increase in spending on clothing and accessories.

- 1.6% rise in sales at electronics and appliance stores.

- 0.3% growth in nonstore retail sales.

The data across 14 categories surveyed shows an overall upswing in sales. Consumers are still opening their wallets, but a shift towards bargain-hunting and opting for more affordable alternatives is evident.

This trend is mirrored in Walmart’s latest performance.

Decoding Walmart’s Earnings Display

Walmart’s second-quarter earnings, released on Thursday, August 15, showcased a commendable performance. The company surpassed expectations with earnings per share at $0.67, a 3.1% beat over the anticipated $0.65. Revenue climbed 4.8% year-over-year to $169.3 billion, exceeding estimates of $168.53 billion.

Noteworthy highlights include a 22% growth in e-commerce sales domestically and an 18% increase internationally. Additionally, Walmart’s advertising arm witnessed a robust 26% growth globally, with Walmart Connect contributing a 30% surge in the U.S.

Sam’s Club, the retail warehouse chain under Walmart’s umbrella, saw a 4.7% uptick in total net sales including fuel. This growth was propelled by strong performances in the food, health, and wellness segments.

Expressing his optimism, Walmart’s President and CEO Doug McMillon stated, “Each part of our business is growing – store and club sales are up, eCommerce is compounding as we layer on pickup and even faster growth in delivery as our speed improves. Our new businesses like marketplace, advertising, and membership, are also contributing, diversifying our profits and reinforcing the resilience of our business model.”

Contrary to speculations on consumer weakness, McMillon asserted, “We aren’t experiencing a weaker consumer overall.”

Walmart revised its guidance for the third quarter and fiscal year 2025 upwards, anticipating a 3.25% to 4.25% growth in net sales for the former and a 3.75% to 4.75% rise for the latter. Adjusted operating income is expected to grow by 6.5% to 8.0%.

Is Walmart an Astute Investment?

The recent retail sales report and Walmart’s robust earnings paint a picture of ongoing consumer spending, with a noticeable shift towards retailers like Walmart. This sentiment resonated well with investors, propelling Walmart’s stock 6.6% higher post-earnings announcement and contributing to an overall market upswing.

Considering Walmart’s current performance, should investors consider buying into the company?

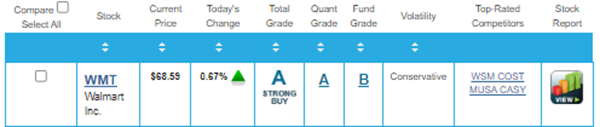

According to my Portfolio Grader assessment, the answer is a resounding yes. With an A-rating signaling a “Strong Buy,” supported by A and B ratings for its Quantitative and Fundamental Grades respectively, Walmart emerges as a solid investment, backed by institutional interest and sturdy fundamentals.

Resilient Walmart: A Beacon Amidst Economic Uncertainty

The Strength of Walmart in Economic Turbulence

Amidst a storm of economic unease, the American consumer may be treading rough waters, but Walmart stands as a steadfast lighthouse, guiding investors to calm seas. The stalwart retailer’s ability to weather the financial tempests is unparalleled, its sales and revenues standing firm against the winds of economic downturns.

Diversified Portfolio as a Shield

It’s a common adage in the financial world that a diversified portfolio is akin to a sturdy shield in the battlefield of investments. Just as some stocks sway while others dance, a carefully curated collection of assets can mitigate risks. In this regard, the recommendations from Growth Investor embody this principle flawlessly.

Steadfast Confidence Amidst Uncertain Times

As the tides of economic fortune ebb and flow, the unwavering confidence in the prosperity of Growth Investor stocks prevails. The certainty that these investments will not merely endure but thrive sets a beacon of hope amidst the fog of financial uncertainty.