In a move showcasing unwavering bullishness towards Nvidia Corp, the renowned hedge fund Coatue Management LLC, helmed by the esteemed Philippe Laffont, has made a bold statement by significantly expanding its position in the chip giant.

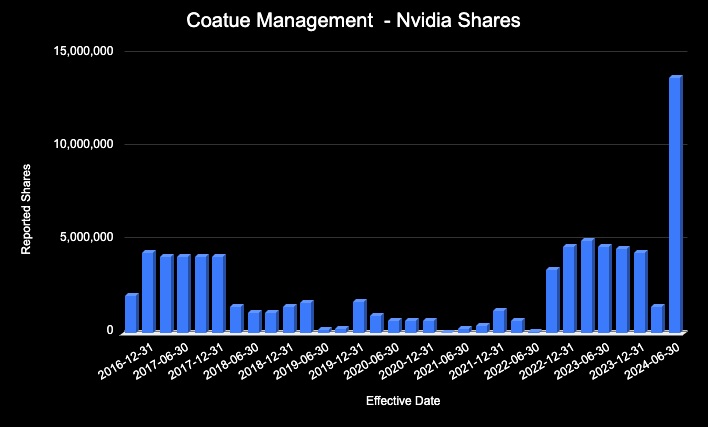

As per the most recent 13F filings, Coatue hiked its stake in Nvidia by a staggering 893% during the second quarter of 2024. This remarkable surge, from 1.39 million shares at the close of Q1 to an astounding 13.75 million shares by the conclusion of Q2, underscores the fund’s aggressive confidence in Nvidia’s future outlook.

Chart created by author using data from SEC 13F filings

Coatue’s Notable Investment: Key Drivers

Coatue’s substantial stock acquisition follows Nvidia’s consistent dominance in the semiconductor sector, especially in areas like artificial intelligence and high-performance computing. The fund’s decision to almost decuple its stake, now valued around $1.7 billion, serves as a resolute testament to the belief in Nvidia’s unyielding growth trajectory.

From Skepticism to Supremacy

Intriguingly, Coatue had previously downsized its Nvidia holdings in earlier periods, only to execute a remarkable about-face this time. The drastic shift from holding 1.39 million shares to 13.75 million shares signifies one of the most significant strategic turnarounds for the fund recently. The pressing question now lingers on whether this monumental gamble will strike gold as Nvidia rides the crest of AI and gaming demand.

Read Also: Nvidia’s Rebound Rally Adds Billions To Market Value, Analysts Eye AI Growth: Report

A Historic Leap For Coatue

This isn’t merely an incremental increase; it’s a historic leap for Coatue. The 893% surge in ownership accentuates the hedge fund’s bold confidence in Nvidia’s market supremacy. With Nvidia positioned as one of the prime beneficiaries of the AI upsurge, Coatue’s move evidently hinges on the anticipation of sustained, enduring growth in the sector.

Nvidia: The Finest Jewel In Coatue’s Holdings?

With this maneuver, Nvidia now stands as a substantial segment of Coatue’s portfolio, constituting 6.61% of the fund’s total holdings. This marks a substantial escalation from a mere 4.91% in the prior quarter, outlining how the chip manufacturer has evolved into a pivotal component of Coatue’s investment strategy.

The Path Forward

While Coatue’s wager on Nvidia undeniably exudes boldness, it’s also a well-calculated move. Nvidia’s dominant position in pivotal growth sectors like AI, data centers, and gaming suggests that the stock could experience even greater upswings in the foreseeable future.

For Coatue, this nearly tenfold surge in stake might just be the opening act of a grander play on the tech giant’s fortune.

Read Next:

Photo: Shutterstock