Crypto exchange Kraken has made a bold move by filing a motion to dismiss the legal battle it faces with the U.S. Securities and Exchange Commission.

Examining the Situation

In its motion, Kraken raised a crucial point – the SEC did not directly accuse the platform of perpetrating fraud or causing harm to its users.

Significance of the Case

This lawsuit is just one piece in a larger puzzle that the industry is watching closely. Legal actions against major players like Coinbase, and Binance.US, with a newbie contender stepping into the ring hoping for a favorable outcome in a specific jurisdiction, are all under the spotlight.

Deconstructing the Arguments

Kraken’s move to dismiss the case echoes familiar refrains that the SEC has not convincingly demonstrated that the assets in question qualify as securities. The challenge lies in the SEC’s widened scope of what constitutes an “investment contract,” a point that Kraken vehemently contests.

While some aspects of the motion were standard fare, such as disputing the lack of direct harm to consumers as alleged by the SEC, other sections touched on unique aspects. For instance, the SEC’s claim that Kraken actively promoted the digital assets was mentioned but not elaborated upon. Similarly, while the regulator’s accusations of commingling were left unaddressed, Kraken, much like Coinbase and Binance.US, employed comparable lines of defense.

The legal landscape remains murky, with a dearth of definitive rulings on such matters. However, one thing is certain – the involvement of the U.S. Supreme Court seems increasingly probable as these legal sagas unfold.

The legal battlegrounds in the Coinbase and Binance.US cases are set in the Southern District of New York and the District of Washington, respectively. Kraken finds itself grappling in the Northern District of California, while a fresh contender, Legit.Exchange, has taken the plunge in the Northern District of Texas.

The prospect of disparate district judges arriving at a unanimous decision appears bleak. Furthermore, assuming subsequent appeals, multiple circuit courts are poised to intervene, prolonging the legal showdown.

Speculating on the timeline and potential trajectory of these legal tussles, it seems probable that, given the vested interests and resources at play, at least one of these cases will meander through the appeals process until all avenues are exhausted.

For our legally astute readers, the burning question remains – what might unfold in the foreseeable future? What timelines are we staring at, and how might the sequence of events play out until the Supreme Court steps in, should it come to that?

As we await the unfolding drama, it is essential to acknowledge the complex legal terrain these crypto giants are navigating, punctuated by legal strategies, judicial deliberations, and the inexorable march towards potential appellate scrutiny.

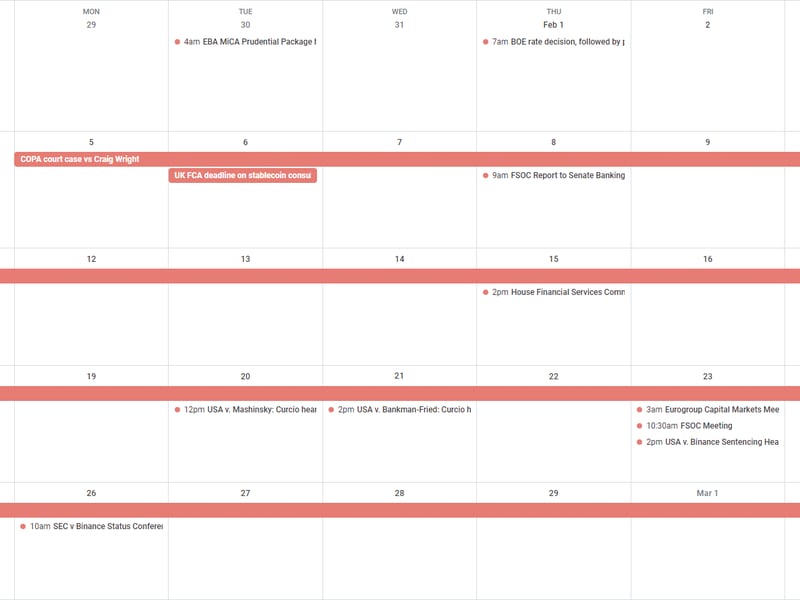

Upcoming Legal Events

- On Tuesday at 17:00 UTC (12:00 p.m. ET), the judge presiding over the U.S. case involving Alex Mashinsky held a hearing to address the dual representation concerns involving Sam Bankman-Fried.

- Wednesday at 19:00 UTC (2:00 p.m. ET) witnessed a similar hearing in the U.S. case concerning Sam Bankman-Fried, confirming his change in legal representation.

- Friday at 14:30 UTC (10:30 a.m ET), the Financial Stability Oversight Council convened for a closed-door session.

- At 19:00 UTC (11:00 a.m. PT) on Friday, the judge presiding over the Binance case approved the proposed plea deal, with sentencing for former Binance CEO Changpeng Zhao rescheduled for April.

- (Ars Technica) A Canadian court mandated Air Canada to adhere to a refund policy purportedly crafted by its AI chatbot, subsequently leading to the chatbot’s removal.

- (Reddit) In a curious state of affairs, passengers exploiting in-flight Wi-Fi now post images of peculiarities like holes in aircraft wings, exemplified by a recent incident on United Flight 354 that safely diverted to Denver.

- (Bloomberg) Allegations have emerged against Deltec Bank for extending a secretive credit line amounting to billions to Alameda Research, facilitating the expansion of tether (USDT).

If you have any thoughts on potential discussion topics for the upcoming week or wish to provide feedback, feel free to reach out via email at nik@coindesk.com or connect on Twitter via @nikhileshde.

Join the engaging discourse on Telegram. Until next week, take care and stay informed!