Sustainability Amidst Market Disappointment

Amidst reports of disappointment in the earnings of key players in ‘The Magnificent 7’ group, a closer analysis reveals a contrasting narrative of sustainable growth performances defining the market trajectory. Companies such as Amazon and Alphabet saw a substantial increase in both revenues and earnings, showcasing their robust financial standing.

Investments for Future Dominance

Despite the market’s apprehension, the underlying reason for the lukewarm response lies in the massive investments these companies are making in the artificial intelligence sector. The market sentiment reflects a lack of clarity on how these investments will translate into profitable ventures. However, the strategic foresight exhibited by these companies in investing in AI infrastructure is a testament to their commitment to future leadership in an AI-driven world.

Market Projections and Expectations

Current consensus expectations for ‘The Magnificent 7’ members indicate a robust +33.5% earnings growth, emphasizing the optimistic outlook for the group’s future. Moreover, the Tech sector as a whole anticipates a +20.3% increase in Q2 earnings, underlining a positive trend for the industry.

Historical Context and Future Outlook

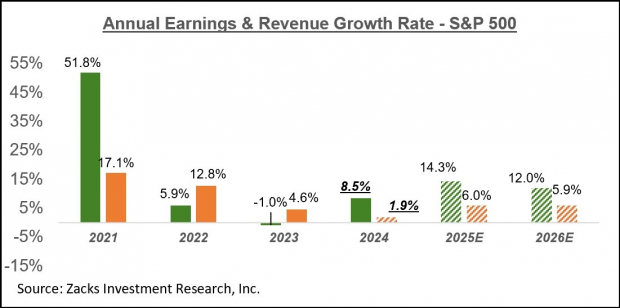

Examining the earnings season as a whole, S&P 500 earnings are poised to elevate by +10.5%, indicating a promising trajectory for the market. The upcoming quarters project a healthy growth rate, instilling confidence in investors about the sector’s resilience and adaptability.

Notable Earnings Reports Ahead

With a plethora of companies, including industry giants like Disney and Uber, set to report their earnings, the market anticipates further insights into the financial landscape. The historical context of revenue and earnings beats provides a nuanced perspective on the current market dynamics, offering valuable insights for investors.

Glimmer of Hope: Revenue Growth Outlook Brightens as Finance is Excluded

Encouraging Revenue Growth Trend

Amidst the tumult of aggregate data, a glimmer of hope emerges as the expected revenue growth pace improves to +4.2% when Finance is excluded. The index level aggregate earnings growth for the year, on an ex-Finance basis, holds steady at +8.1%.

Insightful Analysis

Looking beyond the numbers, the data reveals a more nuanced picture. This analytical approach sheds light on the potential trajectory of revenue growth sustainability.

Historical Context

Reflecting on historical financial trends underscores the significance of the current pace of revenue growth. Understanding the past provides a roadmap for potential future outcomes.

Market Experts’ Top Picks

Market experts have honed in on singular opportunities, identifying the “single best pick to double.” These insights, gleaned from extensive research, showcase a keen eye for potential market success.

Image Source: Zacks Investment Research