Key Index Performance

Most major indices, aside from the Russell 2000 ($IWM), are hovering near all-time highs as we begin the year 2024. The S&P and Nasdaq are particularly noteworthy, with potential for double tops on their monthly charts.

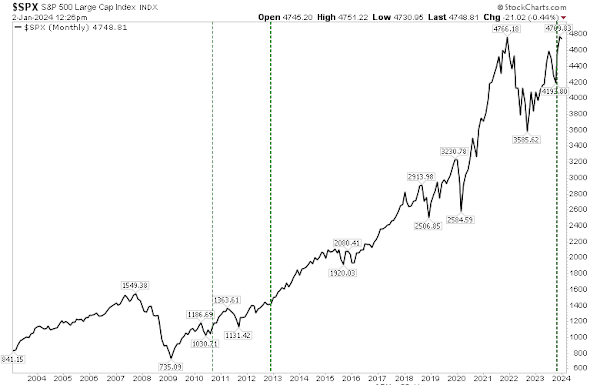

S&P 500-Monthly Chart

If the 2021 high is surpassed in the coming weeks, the risk of a double top diminishes. Despite this, substantial profit-taking from the October rally has yet to occur. Observers emphasize the importance of monitoring the 50-day moving average for potential buying opportunities as 2024 progresses.

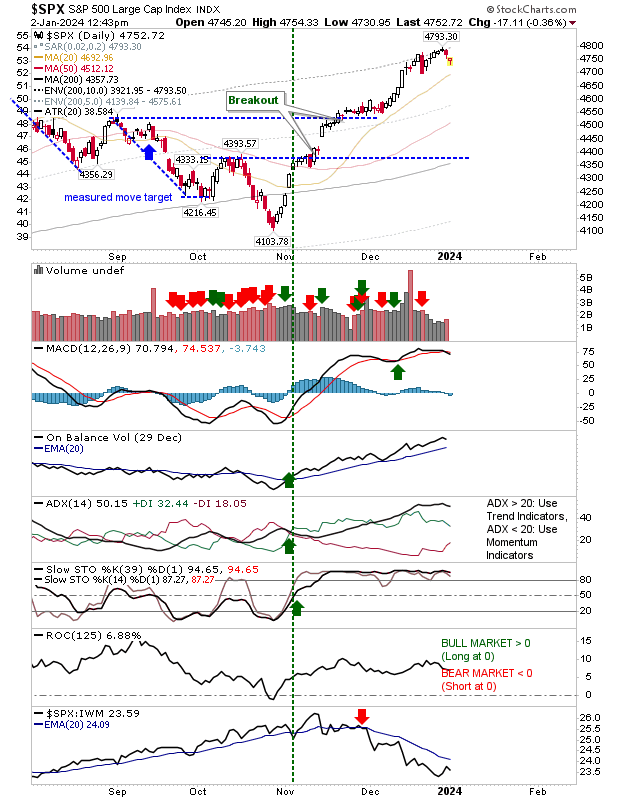

S&P 500-Daily Chart

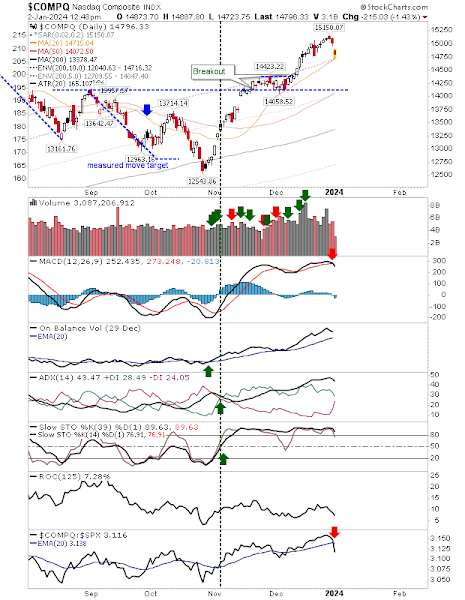

While the Nasdaq has not extended itself to the same extent as the S&P, there remains pent-up demand, which could be triggered by attempts to control the index’s activity. The MACD indicates a ‘sell,’ but other technical indicators remain healthy, and selling volume is notably lower in comparison to recent buying.

Nasdaq Composite-Daily Chart

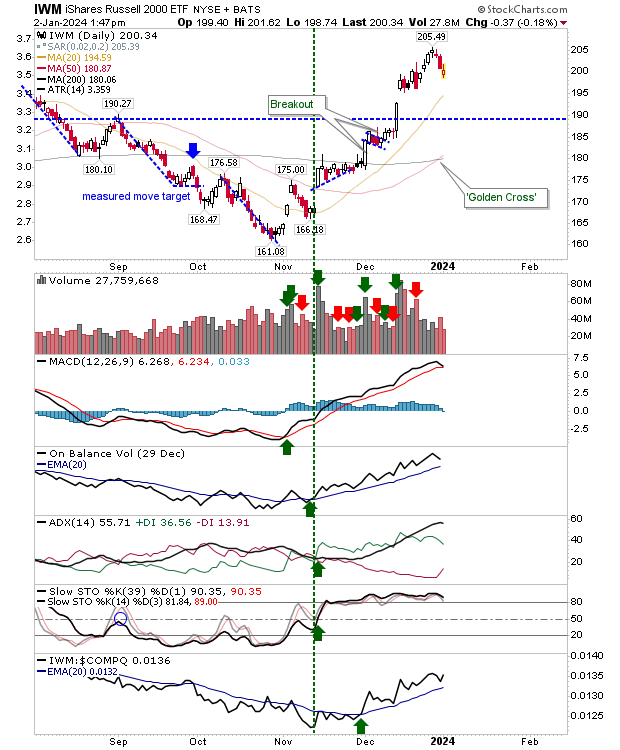

The Russell 2000 ($IWM) has yet to reach 2021 highs, but end-of-year developments, such as a ‘golden cross’ between the 50-day and 200-day moving averages, signify a trend reversal in favor of bullish sentiment. Technicals signal strength, and selling volume has been minimal compared to buying activity seen in recent times.

IWM-Daily Chart

Looking ahead, the goal is to sustain the October trend, but not before allowing ‘weak hands’ to take their profits. The Russell 2000 ($IWM) presents an appealing prospect for attracting buyers as a “value” index compared to the S&P and Nasdaq. The following week will provide a clearer picture as traders return in full force.