Over the past decade, Netflix’s TV app has remained relatively static, with a few minor adjustments here and there. However, a seismic shift has recently taken place as Netflix unveiled its most significant overhaul of the TV app in years. Despite this ambitious move, investors seemed rather underwhelmed, causing shares of the streaming giant to dip slightly during Friday’s closing bell.

Netflix’s primary focus with these changes is to streamline the user experience, particularly when it comes to connecting viewers with content swiftly. While the phenomenon of aimlessly scrolling through endless options like staring into a refrigerator may never completely dissipate, Netflix aims to expedite the process of finding desired content. This strategic revamp is poised to increase user engagement and consequently boost ad consumption, aligning with Netflix’s robust revenue strategy.

To achieve this goal, Netflix is implementing enhancements such as enlarging title cards, restructuring landing pages, and introducing informative snippets like “spent eight weeks in the top 10.” The revamped app is currently undergoing a controlled release to a limited audience before a full-scale launch.

Augmenting Changes with Captivating Content

Ensuring a rich content library is pivotal for Netflix to captivate its audience, and the streaming service is pulling out all the stops in this regard. For instance, Netflix’s latest original movie, “Hit Man,” has garnered an impressive 98% on Rotten Tomatoes, solidifying its position as one of the platform’s top original films in recent memory. Additionally, the debut of “Under Paris,” an intriguing shark-themed movie, comes at a serendipitous time as Warner Bros Discovery gears up for this year’s highly anticipated “Shark Week” event. Furthermore, Netflix has scored a major win by securing the rights to its own “SpongeBob SquarePants” movie featuring the infamous character Plankton.

Evaluating the Netflix Stock Outlook

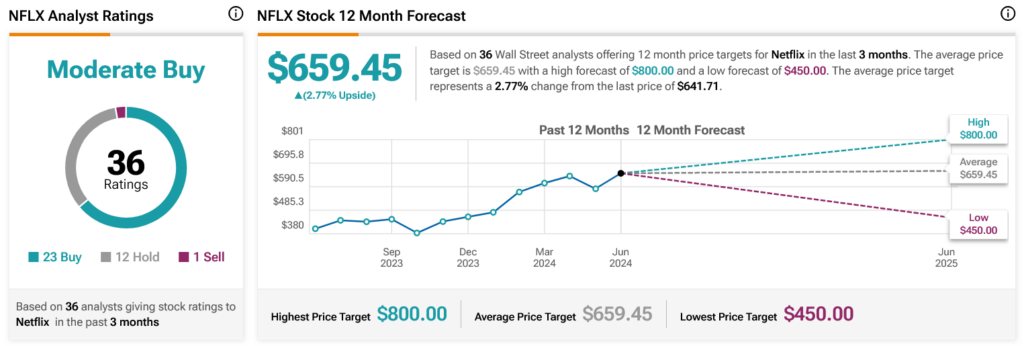

Analyzing the sentiments on Wall Street, analysts maintain a Moderate Buy consensus rating on NFLX stock, comprising 23 Buys, 12 Holds, and one Sell within the past three months. Following a noteworthy 56.11% surge in its share price over the past year, the average NFLX price target of $659.45 per share indicates a modest 2.77% upside potential for investors.

Kindly note, the information provided above does not constitute investment advice. Please consult with financial professionals to make informed decisions.