A Mixed Bag for Ford

As legacy automaker Ford (NYSE:F) makes forays into electric vehicles, its journey has been rife with challenges and uncertainties. The recent developments elicited a mixed response from investors, resulting in a slight decline in Ford’s shares during Monday’s closing minutes.

ChargeScape’s Ignition

Amidst the tumult, Ford collaborated with a consortium of firms to launch the ChargeScape vehicle-to-grid charging platform. While this venture signifies progress in home-based electric vehicle charging solutions, it merely scratches the surface of the broader electric vehicle charging conundrum.

However, fortune failed to favor Ford entirely as a setback ensued. A blow to Ford’s green aspirations occurred when the electric Ford Bronco, steered by actor Ben Affleck alongside his son Samuel, experienced a breakdown on the freeway. The ill-fated vehicle necessitated towing on a flatbed truck, leaving Ben and Sam stranded at a nearby gas station, engrossed in their phones.

Weathering the Hurricane

Despite these trials, Ford displayed its charitable side by assisting victims of Hurricane Helene. The devastation wrought by the hurricane, especially in North Carolina, has rendered the region akin to a war zone in the eyes of some observers.

Witnessing the plight, Ford joined forces with Team Rubicon, a veterans’ humanitarian group, venturing into disaster zones to aid in the recovery efforts. By dispatching both financial aid and volunteers, Ford aims to aid the distressed population of North Carolina as they strive to recover from the aftermath. Notably, Ford’s own dealerships bore the brunt of the catastrophe, implying a grim outlook for new car sales in the area for the foreseeable future.

Assessment of Ford Stock

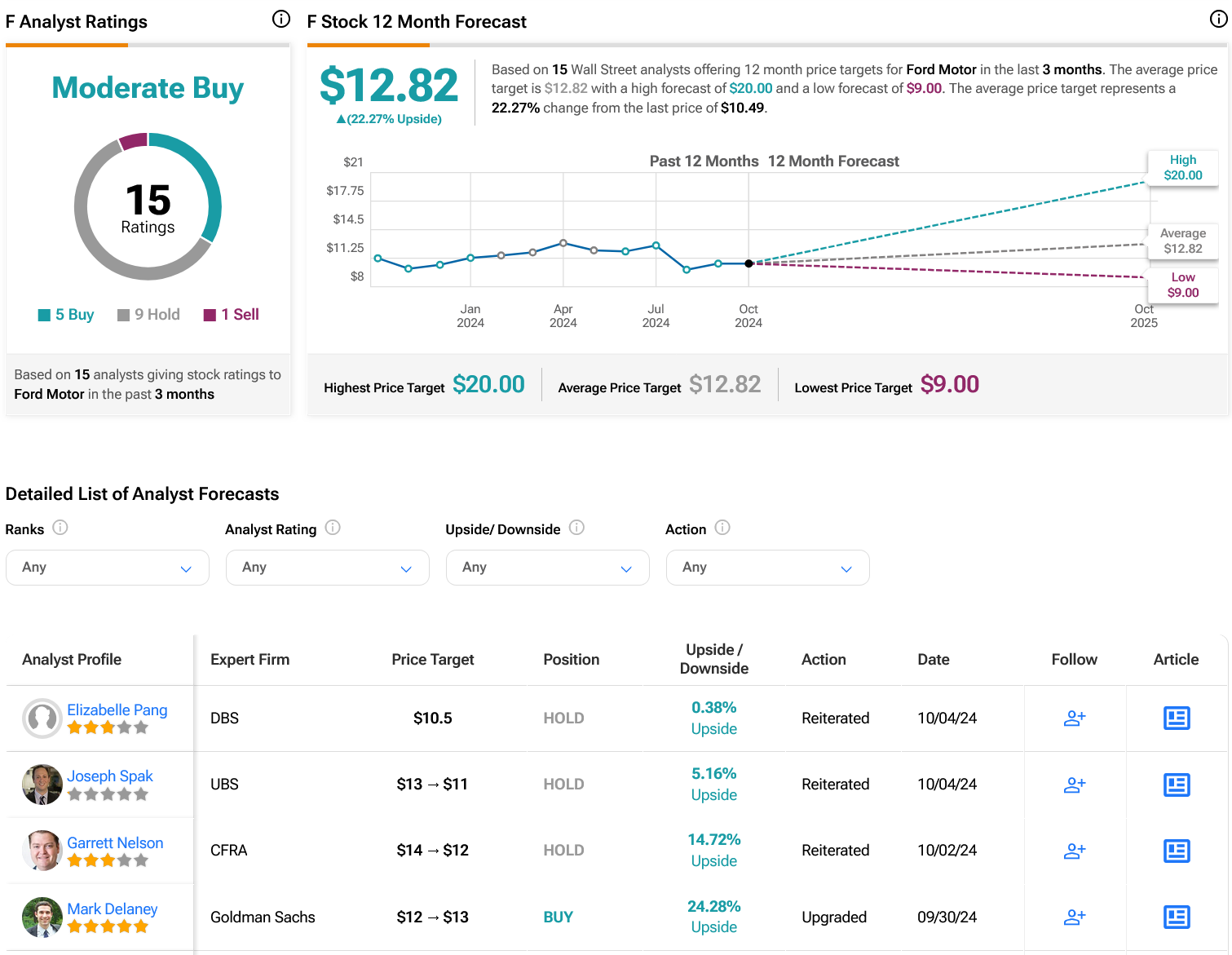

Shifting focus to Wall Street’s perspective, analysts have assigned a Moderate Buy consensus rating to F stock, underpinned by a mix of five Buy, nine Hold, and one Sell ratings over the past three months. Despite enduring a 7.1% depreciation in its share price over the past year, Ford’s average price target of $12.82 per share suggests a promising 22.27% upside potential.

For more insights on F stock analyst ratings, click here