- Nvidia briefly held the world’s most valuable company title but lost ground to tech giants like Microsoft and Apple.

- The chipmaker faces antitrust investigations in Europe and potential fines for its dominant market share.

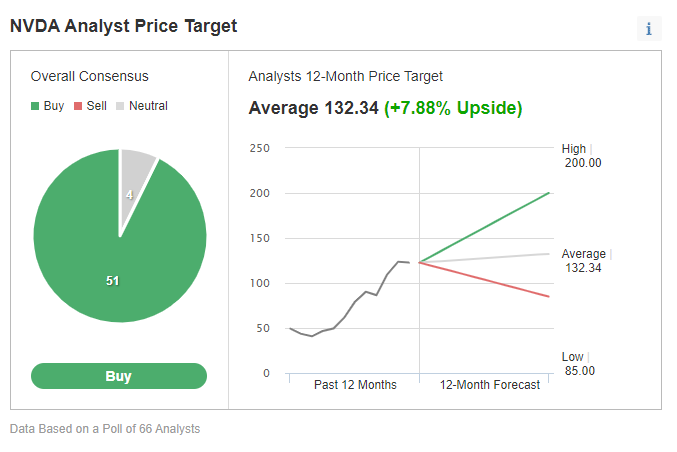

- Despite challenges, analysts remain bullish, citing Nvidia’s strong financials and future potential.

Nvidia’s meteoric rise in 2024 wasn’t without its bumps. After a brief dip in April, the chipmaker surged to become the world’s most valuable company by market cap on June 18th.

However, its reign was short-lived. Since then, Nvidia has stumbled, falling behind tech giants Microsoft and Apple in terms of market capitalization.

Source: Investing.com

CEO Jensen Huang’s company now faces the challenge of regaining its lost ground. Can Nvidia recapture the market cap crown once again?

Nvidia Confronts Antitrust Heat in Europe

France has thrown a wrench into Nvidia’s plans with antitrust investigations, mirroring the challenges faced by tech giants like Apple, Microsoft, and Meta.

The European authorities are concerned about Nvidia’s dominant position in the graphics processing card (GPU) market, where they hold an 84% market share against competitors like Intel and AMD. Nvidia’s GPUs are the go-to option for running generative AI systems, a technology with massive future potential.

This situation presents a double-edged sword. While Nvidia offers the best product for customers, it raises red flags for regulators. A violation of European antitrust rules could result in a hefty fine – up to 10% of annual global turnover.

Numbers Reinforce Nvidia’s Meteoric Rise

Nvidia’s exceptional numbers highlight its status as a leader in today’s crucial industry. The company recorded $60.9 billion in revenues in 2023 and posted profits of $44.3 billion, marking a substantial growth.

Nvidia’s rise contrasts with the tech boom that saw Cisco dominate in 2000. Unlike that hype-driven surge, Nvidia’s ascent is rooted in tangible results and industry innovation.

Analysts Optimistic about Nvidia

Analysts are bullish on Nvidia’s future. Morgan Stanley recently raised its target price for the stock, reflecting a 17.4% increase. Many market experts see Nvidia’s shares as a strong buy, backed by sustained growth and robust financial health.

Source Investing.com: data as of July 3, 2024

Analysts set Nvidia’s target price at $132.34 per share, up 7.88% from July 2 price.

Nvidia: Fairly Valued, But Can It Maintain the Meteoric Rise?

InvestingPro’s Fair Value analysis suggests Nvidia’s current price might already reflect its intrinsic value, predicting a potential decline.

In simpler terms, Nvidia isn’t necessarily overvalued based on Fair Value analysis, signaling consolidation periods before the next leg up, supported by a strong Piotroski score.

The Biggest Challenge: Living Up to Its Success

Perhaps the biggest uncertainty surrounding Nvidia is its explosive growth. Nvidia has been responsible for a significant percentage of the market’s returns this year, setting high expectations for itself through phenomenal performance.

***

Exclusive Discounts on Subscriptions

InvestingPro’s ProPicks tool offers AI-powered stock selection at your fingertips!

Subscribe to InvestingPro today and elevate your investing game!