Nvidia’s Unique Employee Strategy

Nvidia Corp has managed to curb its employee turnover rate through a distinctive compensation approach.

The renowned chip designer is infamous for its rigorous work culture, with employees clocking in up to seven days a week, often toiling till the wee hours of 2 a.m.

CEO Jensen Huang’s philosophy of “torturing them into greatness” stands in stark contrast to competitors’ reliance on frequent hirings and firings, as revealed by Bloomberg reports.

Intel’s Workforce Downsizing Efforts

Meanwhile, Intel Corp looks to streamline its operations by cutting thousands of jobs, translating to over 15% of its workforce, as part of a strategic turnaround plan. This move comes after Intel had already shed 5% of its workforce in 2023.

Also Read: Nvidia Tech Fuels Chinese AI Growth Overseas, Alibaba Ramps Up $7B Investment

Nvidia’s Employee Wealth Creation via Stocks

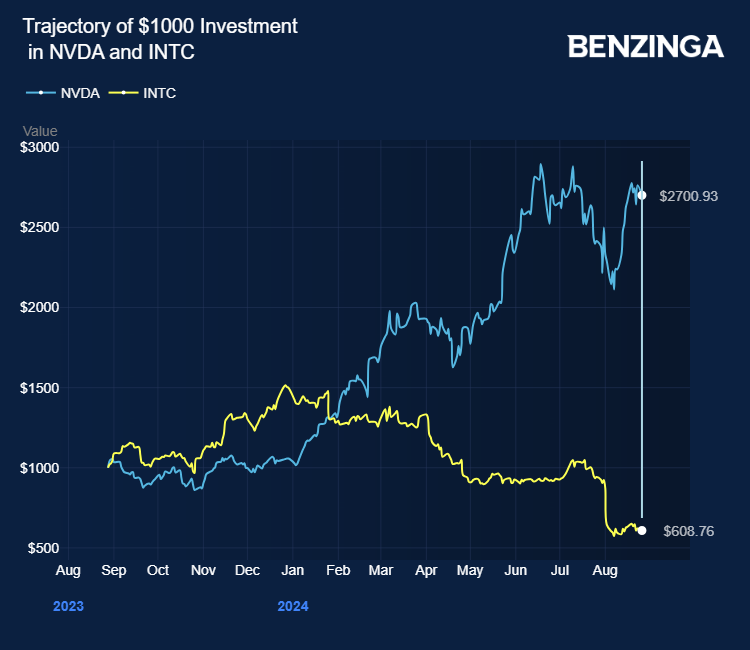

Nvidia’s stock incentives, usually vesting over a four-year period, have played a pivotal role in retaining talent. The New York Post reports that the company’s stock has surged an astonishing 3,776% since 2019, primarily fueled by Big Tech’s substantial investments in artificial intelligence, turning many Nvidia employees into millionaires.

Following Nvidia’s market capitalization eclipsing $1 trillion, the company witnessed a significant drop in its employee churn rate from 5.3% in 2023 to 2.7% – a remarkable feat compared to the industry average of 17.7%.

Leveraging its stronghold in artificial intelligence, Nvidia employees have indulged in luxury purchases including high-end real estate, luxury cars, and VIP access to events such as the Super Bowl and NBA Finals.

As per Bloomberg, Nvidia’s CFO Colette Kress, with an 11-year tenure, holds stocks valued at $758.7 million, while Advanced Micro Devices Inc’s CFO Jean Hu, who joined in 2023, has stocks worth $6.43 million.

Nvidia’s stock has surged by an impressive 170% over the last 12 months. Investors keen on exposure to this growth can consider options like Vanguard Information Tech ETF and iShares S&P 500 Growth ETF.

Price Actions: NVDA stock traded higher by 0.58% at $127.19 premarket at last check Tuesday.

Photo via Shutterstock