The battle of the clouds between Oracle Corp ORCL and Salesforce Inc CRM is reaching a fever pitch, with both companies riding the AI wave to extraordinary stock gains.

But who is emerging victorious in this high-stakes showdown? Let’s delve into the figures, recent developments, and crucial insights for savvy investors.

Oracle’s Bold Move: Dominating Malaysia’s Cloud Landscape

Oracle has been flexing its muscles in the cloud arena, witnessing a remarkable 20% surge in stock price over the past month, skyrocketing by 61% year-to-date, fueled by robust growth in its cloud infrastructure services. The latest power play involves a substantial $6.5 billion investment to establish a public cloud region in Malaysia—a move that outpaces Amazon.com Inc‘s $6.2 billion AWS initiative. Oracle’s aggressive push is set to capitalize on Malaysia’s surging demand for AI, data, and analytics, marking a potentially monumental tech investment in Southeast Asia.

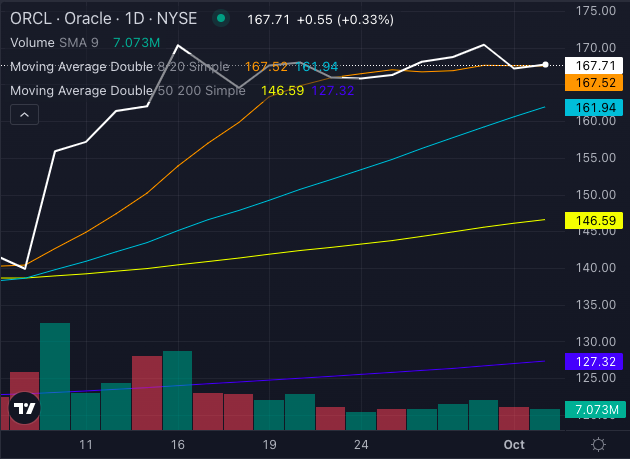

Chart created using Benzinga Pro

From a technical standpoint, Oracle’s stock exhibits strong bullish signals, currently trading at $167.71, above its eight-day, 20-day, and 50-day moving averages. Despite some selling pressure hinting at caution for short-term players, Oracle’s ambitious revenue target of $104 billion by fiscal year 2029 underscores its strategic long-term vision.

Salesforce: Empowering with GenAI

Meanwhile, Salesforce is not resting on its laurels. With a 12.67% surge in stock value over the past month, fueled by the introduction of its innovative AgentForce platform, which analysts tout as “on par” with Microsoft Corp‘s GenAI.

Piper Sandler’s recent upgrade of Salesforce to ‘Outperform’ with a price target of $400 has injected further momentum. AgentForce, tailor-made for sales, marketing, and service workflows, carries the potential to expand Salesforce’s Total Addressable Market (TAM) by a staggering $3.2 trillion.

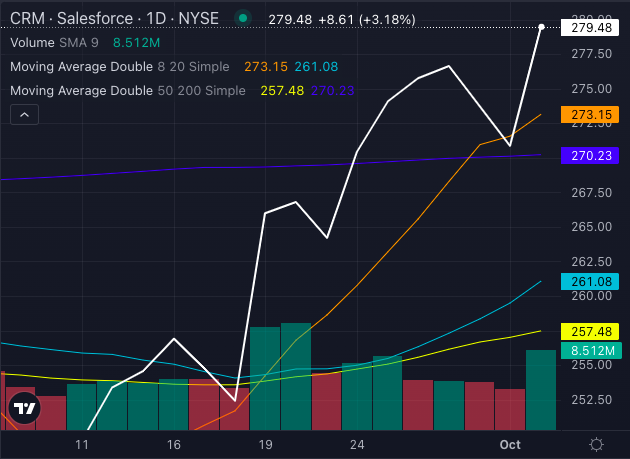

Chart created using Benzinga Pro

Noteworthy technical indicators see Salesforce’s stock trading at $279.48, comfortably above its eight-day, 20-day, and 50-day moving averages, signaling robust buying pressure.

The Verdict?

Both Oracle and Salesforce stand as AI-driven behemoths with significant growth avenues. Oracle’s expansive infrastructure maneuvers in Asia grant it a global footprint, while Salesforce’s GenAI endeavors position it as a potential leader in enterprise software. Investors seeking exposure to the cloud and AI realms should closely watch both players, yet Oracle’s international forays and optimistic long-term perspectives might provide an edge over Salesforce’s innovative short-term victories.

The burning question looms: Who will ascend the throne as the ultimate ruler of the cloud domain? Only time will unveil how the AI saga unfolds.

Read Next:

Photo: Shutterstock

Market News and Data brought to you by Benzinga APIs