Nvidia (NASDAQ: NVDA) achieved a historical milestone by surpassing Microsoft to claim the title of the world’s most valuable company, boasting a market capitalization of $3.335 trillion. This remarkable feat was accomplished on a Tuesday, propelled by a staggering 8,280% surge in its stock price since the onset of 2023.

Embarking on an exponential trajectory, Nvidia owes its skyrocketing success to the burgeoning adoption of artificial intelligence (AI), with a focus on delivering leading-edge graphics processing units (GPUs) vital for fueling AI training and inference systems.

The recent completion of a highly successful 10-for-1 stock split further ignited investor enthusiasm, propelling Nvidia to newfound heights.

Yet, amidst this remarkable surge, suggesting that the prime moment for gains has lapsed would be an ill-advised conclusion. Instead, I forecast Nvidia’s market cap will soar to an astounding $5 trillion, propelling its share value above $203, with a potential upside of 50% compared to the closing price on Tuesday. Join me in exploring the path that may lead Nvidia to this extraordinary pinnacle in the foreseeable future.

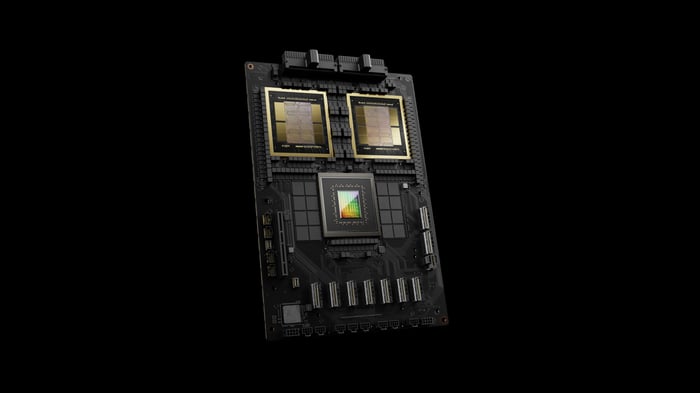

The Nvidia GB200 Grace Blackwell Superchip. Image source: Nvidia.

Continued Momentum: A Blueprint for Success

Generative AI emerged as a groundbreaking force in the previous year, promising to streamline and automate mundane tasks, inciting widespread enthusiasm across corporate landscapes as firms rush to embrace these cutting-edge algorithms.

Nvidia’s provision of processors endowed with substantial computational power has become indispensable for running AI systems. Grappling with a demand surge overshadowing supply capacities, Nvidia has diligently collaborated with partners to ramp up production, gradually mitigating supply shortages.

Furthermore, holding an estimated 95% stranglehold on the machine learning market, Nvidia’s virtual monopoly spells dominance, illuminating why the ascent of generative AI swiftly blossomed into a windfall for Nvidia, leveraging on its well-established prowess in the domain.

Equally pivotal is the imperative to modernize data centers to accommodate the exigencies of AI, forming the crux of the ongoing demand surge that is projected to persist. With Nvidia purportedly commanding a 92% share of the data center GPU market, the future trajectory is poised to favor Nvidia.

Projections indicate a continued robust expansion within the data center market, scaling from $302 billion in 2023 to $622 billion by 2030. As the preeminent provider of data center GPUs, Nvidia stands to benefit significantly from this evolving trend.

Initiating with the humble GPUs employed for rendering lifelike imagery in gaming realms, an arena where Nvidia reigns supreme, the company sustains a substantial lead in the vanguard industry it pioneered. Despite escalating competition, Nvidia retains a commanding position. In the initial quarter of 2024, it commanded an 88% share of the discrete desktop GPU market, as per Jon Peddie Research.

As inflation recedes, a surge in demand for state-of-the-art graphics cards will catalyze a new wave of upgrades for Nvidia gaming chips. Projections indicate gaming GPU sales catapulting from $2.7 billion in 2023 to $11.7 billion by 2028. As the market frontrunner, this trend firmly aligns with Nvidia’s interests.

Moreover, Nvidia harbors multiple untapped avenues for growth, encompassing self-driving cars, professional visualization, and quantum computing, segments currently representing a minuscule fraction of the company’s overall revenue.

Lastly, the imminent release of the Nvidia GB200 Grace Blackwell Superchip later this year heralds a new benchmark in AI processing. Major hyperscale cloud-infrastructure providers are already poised to invest substantially in these cutting-edge AI platforms, reaffirming Nvidia’s standing as the premier player in the AI domain.

Charting the Course to a $5 Trillion Valuation

Presently boasting a market capitalization of approximately $3.34 trillion, Nvidia necessitates stock price increments of roughly 50% to elevate its worth to $5 trillion. Given its staggering year-to-date growth of 174% in 2024, such an ascent appears merely a question of time.

Eminent Wall Street consensus forecasts indicate an anticipated revenue stream of $120.5 billion for the fiscal year 2025. Anchored by a forward-price-to-sales (P/S) ratio of about 28, Nvidia will need to generate an annual revenue of roughly $180 billion to substantiate a $5 trillion market cap, if the P/S ratio remains unchanged.

Intriguingly, Wall Street predictions already foresee revenue escalation of 98% for the fiscal year 2025 and an additional 33% in fiscal 2026. Should Nvidia hit these targets, it could conceivably reach the coveted $5 trillion market cap as early as 2026.

Defer not to my assertions alone. Analyst Hans Mosesmann from Rosenblatt Securities recently reiterated his BUY rating on Nvidia stock, setting a Street-high price target of $200. He cited escalating demands for AI software and the imminent launch of the Blackwell architecture later this year.

It remains imperative to acknowledge the absence of certainties. Any shortfall in meeting investors’ exalted aspirations, whether substantial or perceived, could potentially trigger a swift and merciless selling spree. Conversely, the perpetuation of Nvidia’s market supremacy might persist, affirming the calculated timeline.

The Meteoric Rise of Nvidia: A Stock to Watch

Analyzing Nvidia’s Growth Trajectory

Amidst the ever-evolving landscape of the stock market, Nvidia has emerged as a formidable force, showcasing a remarkable ascent with a staggering 27,570% gain over the past decade. Such exponential growth cannot be overlooked, signaling a steep trajectory that has captured the attention of investors far and wide. While the current forward earnings multiple may appear daunting at 51 times, a historical perspective sheds light on Nvidia’s outstanding performance in recent years.

Future Prospects and Market Position

Despite the exorbitant gains of the past decade, Nvidia’s dominance in the industry remains unshaken. Fueled by strong secular tailwinds, the company is poised for continued success in the years to come. The question that looms large is whether Nvidia can maintain its position and deliver market-beating returns in the foreseeable future. While the road ahead may not replicate the meteoric rise of the past, the company’s stronghold in the industry instills confidence in its potential.

Looking Beyond the Numbers

Delving into the intricacies of Nvidia’s current valuation, it is essential to peer beyond the numerical figures. The stock’s upward trajectory reflects not just financial performance but also market sentiment and industry dynamics that have propelled Nvidia to the forefront of technological innovation. As investors assess the viability of investing in Nvidia, a holistic view that encompasses both quantitative and qualitative aspects is imperative.

Strategic Investment Considerations

Amidst the flurry of market analyses and projections, the decision to invest in Nvidia beckons a thoughtful evaluation of strategic considerations. While traditional metrics may paint a picture of pricey valuation, the intangible assets and strategic positioning of Nvidia offer a unique investment proposition. As investors navigate the complex terrain of the stock market, the allure of a company like Nvidia lies not just in numbers but in a holistic assessment of its market presence and growth potential.

Conclusion

With Nvidia’s stock soaring to unprecedented heights and its market position solidifying with each passing day, the company stands as a prominent player in the tech industry. While past performance serves as a testament to its potential, the future trajectory of Nvidia hinges on a delicate balance of market dynamics and strategic decisions. As investors weigh the pros and cons of investing in Nvidia, the company’s journey from obscurity to prominence offers a compelling narrative of growth and resilience in the ever-evolving landscape of the stock market.