Throughout history, the space exploration landscape has largely been shaped by government funding, providing the necessary financial cushion for complex and capital-intensive projects. The Apollo program, a landmark in space exploration, was a testament to the impact of government investment in powering innovation and progress.

SpaceX, Elon Musk’s brainchild, epitomizes a modern approach to space endeavors with its unique blend of public-private partnerships. While SpaceX, a private entity, undoubtedly benefited from substantial government support surpassing $15 billion, Rocket Lab USA, Inc., a publicly traded company, is carving its path as a notable player in the space race.

Building on the legacy of its predecessors, Rocket Lab is strategically positioning itself as a robust contender against industry giants with its innovative practices and unwavering commitment to excellence.

Rocket Lab’s Strategic Launching Pad

In an era where technological prowess and efficiency are paramount, Rocket Lab’s minimalistic approach stands out as a beacon of innovation in the space launch arena. By embracing cutting-edge engineering solutions and streamlined practices, the company mitigates risks and enhances financial predictability.

Central to Rocket Lab’s success is its focus on practicality, evident in the utilization of 3D-printed components for its Rutherford engines. This forward-thinking approach not only expedites production but also underscores the company’s commitment to efficiency and sustainability.

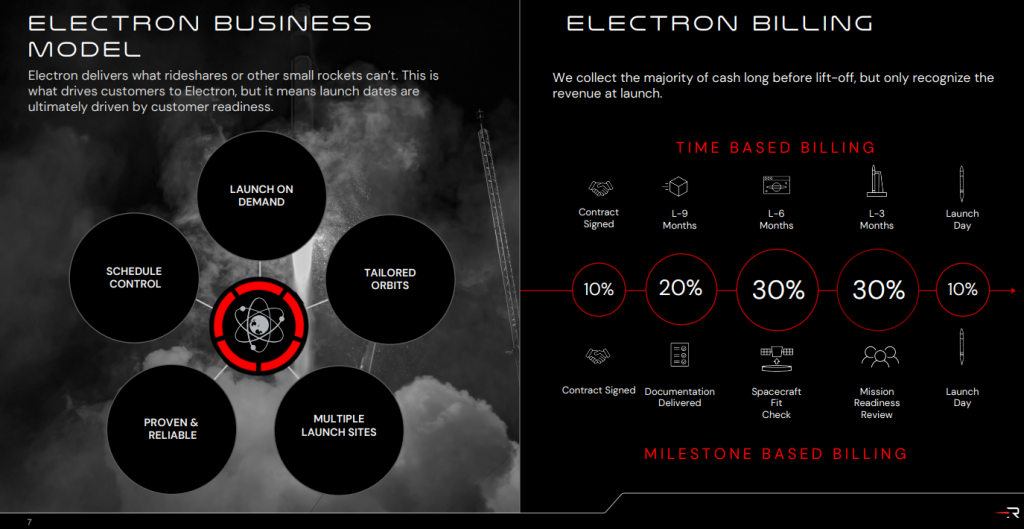

Despite offering a lower payload capacity than SpaceX’s Falcon 9, Rocket Lab’s Electron rockets are tailored for smaller satellite launches, enabling cost-effective and frequent missions. The company’s emphasis on flexibility and reliability has earned it a stellar reputation in the industry.

“Electron remains right-sized for the small sat market, and releasing additional performance is about providing our customers with even more flexibility on the same proven vehicle they have come to rely on.” – Peter Beck, Rocket Lab CEO

Having completed 51 successful Electron missions since its inception in May 2017, Rocket Lab boasts a commendable track record, with a mere four failures and over 190 satellites deployed.

Rocket Lab’s Aerospace Milestones

Steering through the vast expanse of space contracts, Rocket Lab has secured a myriad of collaborations, spanning both the government and commercial sectors. Noteworthy among these is the company’s landmark $515 million contract with the US Space Force for 18 Electron launches, underscoring its pivotal role in bolstering national security initiatives.

With a strategic focus on expanding its horizons, Rocket Lab has diversified its portfolio to encompass spacecraft design and advanced component acquisition, further solidifying its standing in the market. The company’s recent endeavors, such as the collaboration with French firm Kineis for a 5-rocket launch contract, reflect its unwavering commitment to innovation and growth.

An Insight into Rocket Lab’s Financial Trajectory

While revenue from Electron launches remains a key revenue stream for Rocket Lab, the company’s Space Systems division has emerged as a significant contributor to its financial success. Following strategic acquisitions such as Advanced Solutions, Inc. and Sinclair Interplanetary, Rocket Lab has expanded its capabilities in spacecraft design and hardware technology.

Noteworthy amongst its acquisitions is the integration of SolAero Holdings, which proved instrumental in enhancing the company’s solar technology offerings and driving revenue growth. Rocket Lab’s steadfast commitment to innovation and diversification is reflected in its impressive 71% year-over-year revenue increase, culminating in a robust backlog of orders valued at $1,067 million.

While the company continues to navigate its journey towards profitability, recent financial reports indicate a promising trajectory, propelled by its Electron business model and strategic acquisitions.

Anticipating the future with unwavering optimism, Rocket Lab is gearing up for its next phase with the introduction of Neutron mid-capacity rockets. With a payload capacity of up to 13,000 kg, the Neutron rockets are poised to challenge industry stalwarts and pave the way for new horizons in space exploration.

Having laid the groundwork for Neutron deployments following successful tests of the Archimedes engines, Rocket Lab is poised to capitalize on a projected $10 billion total addressable market by 2030, marking a significant milestone in its journey towards innovation and growth.

Rocket Lab’s Market Performance

Reflecting on RKLB’s market performance, the stock has witnessed steady growth, buoyed by positive market sentiments and strategic acquisitions. With a current price of $5.32, RKLB shares have shown resilience, demonstrating a potential for future growth.

Despite market fluctuations, Nasdaq’s forecasting data underscores an optimistic outlook for RKLB, with an average price target of $7.22, representing a 35% potential gain from current levels. As Rocket Lab continues to chart its course towards innovation and profitability, investors are presented with a compelling opportunity to partake in the company’s promising trajectory.

**