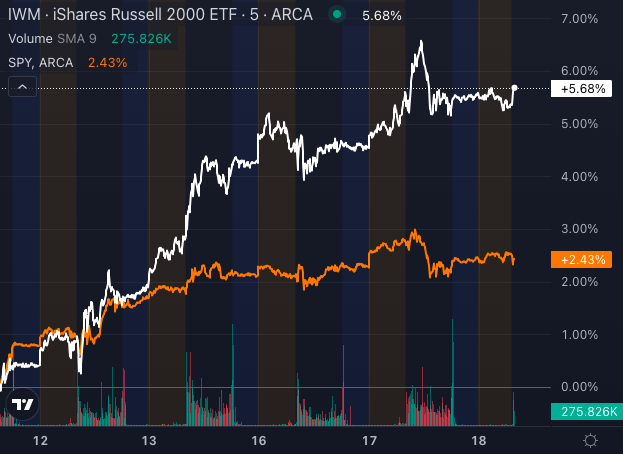

Small-cap stocks are ablaze with anticipation ahead of the Federal Reserve’s expected interest rate cut, relishing their time in the sun. Over the past week, the Russell 2000 Index roared ahead by more than 5%, eclipsing the performance of its larger counterparts in the S&P 500 Index, which mustered only a 2.5% gain.

Evidently, small-cap stocks represented by the Russell 2000 Index-tracking iShares Russell 2000 ETF (IWM) have outshone the S&P 500 index-tracked SPDR S&P 500 ETF SPY. Leading the surge in small-cap performance are stocks like IGM Biosciences Inc, Intuitive Machines Inc, and Applied Therapeutics Inc, showing impressive gains of 59.33%, 38.62%, and 44.90%, respectively, over the last five days.

Don’t let this unparalleled opportunity pass you by:

Small Caps on Edge for Borrowing Cost Reduction

Investors are convinced that the Fed is poised to relax its reigns, and small-cap stocks—especially those tethered to debt and floating rates—are reaping the rewards.

Why the frenzy? Small-cap firms often bank on variable-rate debt, so when interest rates dip, their borrowing expenses follow suit. This, in theory, liberates capital, providing a breather for companies with less sturdy financial foundations. Naturally, rate cuts have investors salivating at the thought of hefty returns from these diminutive equities.

But before you hop on the small-cap bandwagon, there’s a catch.

Earnings and Economic Winds of Change

While the allure of cheaper lending is enticing, market chatter also hints at lackluster earnings and an ambiguous U.S. economic panorama. Thus, the fuss around small caps might dwindle if the economy reneges on its promise.

For those seeking a piece of the action, exchange-traded funds like the IWM or the Vanguard Small-Cap ETF VB offer broad exposure to small-cap stocks. These funds mirror small-cap indexes’ performance, presenting a solid way to capitalize on potential gains without sifting through individual shares.

Still, one wonders how sustainable this rally could be.

Buoyant Trend in Small Cap ETF

The IWM, standing as a proxy for small-cap stocks, displays a vigorous bullish trend, with its share price at $219.23 positioned above the five, 20, 50, and 200-day simple moving averages (SMAs).

Notably, the eight-day SMA at $213.80, the 20-day SMA at $215.07, and the 50-day SMA at $214.41 all signal bullish prospects, reflecting the ETF’s sturdy upward momentum.

Despite the robust bullish trend, IWM is currently facing marginal selling pressure, hinting at potential short-term volatility. Remaining comfortably above its 200-day SMA of $203.57 further bolsters a positive technical outlook, signaling sustained strength in the small-cap sector.

If the Fed opts for a grand half-point cut, small caps might steal the spotlight. Even a modest 25-basis-point cut could keep the spree alive, for now.

Investors may want to monitor the SPDR S&P 600 Small Cap ETF SLY for broader exposure to small-cap firms poised to benefit from reduced rates.