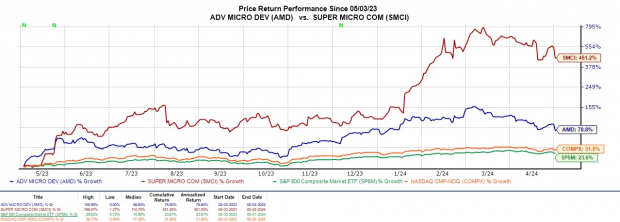

Despite surpassing quarterly earnings forecasts, both AMD (AMD) and Super Micro Computer’s (SMCI) stocks witnessed a significant drop in trading post-announcement. Such corrections, akin to a necessary brake check on a speeding sports car, may actually serve to stabilize the market. Notably, Super Micro shares have seen a meteoric rise, akin to a rocket blasting off into the stratosphere, climbing an astonishing +451% over the past year, while AMD has held strong with a respectable +79% increase.

Reactions to Earnings Performance

Was the market’s reaction an overblown knee-jerk response, or is it potentially an opportune moment for investors to seize the post-earnings hiccup in these AI titans? Super Micro’s stock, demonstrating resilience after the fall, surged by +3% on Thursday, with AMD also showing a modest increase at +1%.

Image Source: Zacks Investment Research

Analyzing Performance

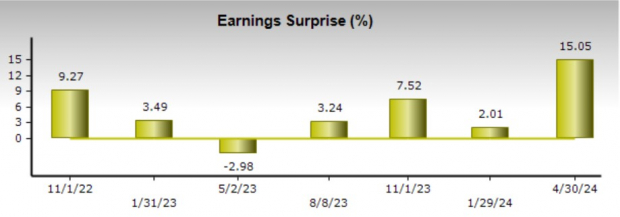

Nvidia’s (NVDA) stellar growth trajectory, fueled by soaring demand for AI chips, may have set a high bar for AMD’s Q1 report. Despite this, AMD posted earnings of $0.62 per share, edging out expectations of $0.60 a share—a flat performance from the comparative quarter. Quarterly sales of $5.47 billion also exceeded estimates by 1% and marked a 2% increase from $5.35 billion in Q1 2023.

Image Source: Zacks Investment Research

Contrastingly, Super Micro, a provider of optimized server solutions, faced lofty expectations following its stock’s dizzying ascent, mirroring that of Nvidia. Its substantial hype and growth as an original equipment manufacturer of AI-compatible servers have been notable. Despite beating expectations with earnings of $6.65 per share for the fiscal third quarter, a 15% outperformance, Q3 sales of $3.85 billion marginally missed estimates by -3%, signaling a 200% surge from $1.28 billion a year prior.

Image Source: Zacks Investment Research

Growth Trajectories Unveiled

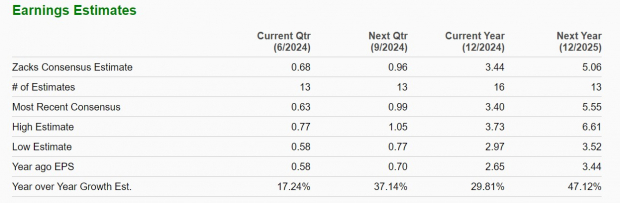

Zacks estimates project a 30% annual earnings upsurge for AMD in fiscal 2024, with expectations of a further 47% leap in FY25 to $5.06 per share. Sales are anticipated to climb by 11% this year and by a substantial 23% in FY25, reaching $30.97 billion.

Image Source: Zacks Investment Research

Conversely, Super Micro’s annual earnings are anticipated to skyrocket by 85% in FY24 to $21.88 per share from $11.81 a share in 2023. Projections for fiscal 2025 show a further 35% increase to $29.51. Sales for Super Micro are expected to surge by 103% in FY24 and are forecasted to soar an additional 35% in the following year, reaching $19.5 billion.

Image Source: Zacks Investment Research

Key Takeaway

While the market reaction post-earnings may not have been unwarranted, the growth prospects for both AMD and Super Micro remain enticing. AMD boasts a Zacks Rank #2 (Buy), signaling promise, whereas Super Micro holds a Zacks Rank #3 (Hold) post a tremendous run-up in its stock price.

7 Best Stocks for the Next 30 Days

Experts have singled out 7 top-tier stocks from a pool of 220 Zacks Rank #1 Strong Buys, deeming these selections as “Most Likely for Early Price Pops.” Since 1988, this curated list has outperformed the market by over double, with an impressive annual average gain of +24.2%. Make sure to keep a close eye on these meticulously chosen 7 options.