While Deere & Company managed to surpass both top and bottom line expectations for its fiscal second quarter, the market’s response was less than warm. The stalwart in the realm of manufactured agricultural equipment witnessed a significant 5% drop in its stock value during Thursday’s trading, following a reduction in its fiscal 2024 net income forecast.

A conundrum befalls investors: Is it now the opportune moment to seize the dip in Deere’s stock, given its illustrious historical performance notwithstanding the recent setback?

Evaluating Deere’s Q2 Performance

In the second quarter, Deere reported a net income of $2.37 billion, equivalent to $8.53 per share, outstripping the Zacks Consensus of $7.86 per share by a solid 8%. On the revenue front, Q2 sales of $13.61 billion exceeded estimates by 2%, standing at $13.25 billion.

Year over year, the company witnessed an 11% decline in earnings compared to the same quarter last year, pegged at $9.65 per share. This dip was attributed to escalating operating costs, while sales plummeted by 15% due to reduced volumes. Nevertheless, this marked the seventh consecutive quarter of surpassing earnings forecasts and the eighth straight quarter of eclipsing sales estimates.

Image Source: Zacks Investment Research

Insights into Guidance & Future Prospects

However, this commendable performance was offset by a downward revision in the company’s fiscal 2024 net income outlook. Deere now anticipates a figure of $7 billion, down from the initial guidance range of $7.5-$7.75 billion provided in February.

The deceleration is primarily attributed to a projected 15% downturn in the large agriculture sector within the U.S. and Canada, with an additional estimated slump of 20% in the small agriculture market and turf sales.

According to Zacks estimates, Deere’s FY24 EPS is expected to witness a 21% decline, reaching $27.39 compared to the previous year’s $34.63 per share. Likewise, total sales are forecasted to decline by 15% to $47.19 billion.

Reflecting on Deere’s Historical Trajectory & Market Position

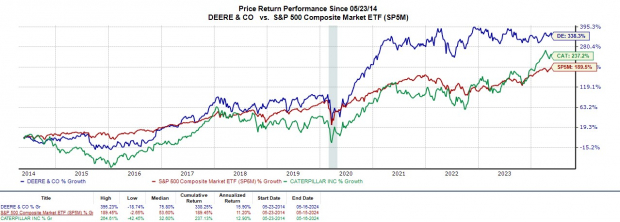

Even though Deere’s stock has witnessed a 1% decline year to date, it still boasts a 7% increase over the past year, albeit trailing behind the S&P 500’s 28% surge and notably lagging behind industry heavyweight Caterpillar’s +65% growth.

Over the last five years, Deere’s growth of 192% slightly outpaced Caterpillar’s 186% increase and significantly eclipsed the S&P 500’s 89% rise. Impressively, in the last decade, Deere’s stock has soared by a staggering 338%, outperforming both Caterpillar’s 237% and the benchmark’s 189%.

Image Source: Zacks Investment Research

Currently priced at $394, Deere’s stock trades at 15.1X forward earnings, marginally below its five-year median of 16.1X and significantly under the high of 33.1X. This valuation also presents a considerable discount relative to the S&P 500’s 22.2X and is in proximity to Caterpillar’s 16.5X.

Image Source: Zacks Investment Research

In Conclusion

Deere’s stock currently holds a Zacks Rank #3 (Hold). While the slowdown in agricultural operations could herald better buying opportunities, the company’s reasonable valuation and historical performance portend potential rewards for long-term investors even in the face of the recent setback.