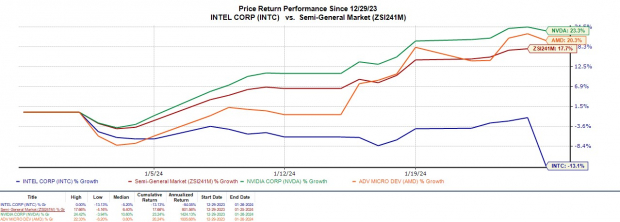

Intel’s (INTC) stock took a deep dive of -12% in today’s trading session following the company’s favorable Q4 results post-market hours. However, the chip giant’s underwhelming guidance for the first quarter disappointed investors.

Notwithstanding, the broader backdrop of chip stocks has been optimistic due to the easing inflation. The Zacks Semiconductor-General Industry has surged +18% year to date and an astounding +121% over the last year, led by the strong performance of industry players like Nvidia and AMD.

Although Intel’s stock has slipped -13% since the start of the year, it has gained an impressive +55% over the last year, which may prompt investors to ponder whether the recent setback presents a buying opportunity.

Image Source: Zacks Investment Research

Q4 Review

Intel’s CEO Pat Gelsinger hailed the fourth quarter as a period of remarkable progress in the company’s transformation journey, with Q4 EPS of $0.54 a share topping the Zacks Consensus estimate of $0.44 a share by a substantial 23%. Furthermore, Q4 earnings saw a whopping 440% surge from the prior year quarter’s $0.10 a share, marking Intel’s fourth consecutive quarter of beating earnings estimates.

On the revenue front, Q4 sales of $15.4 billion exceeded expectations by 2% and climbed 10% year over year. Intel credited this remarkable performance to its consistent execution and accelerated innovation, which led to strong customer traction for its products.

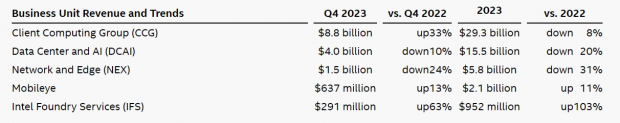

Image Source: Zacks Investment Research

Despite a spirited recovery in 2022, Intel’s full-year fiscal 2023 revenue of $54.2 billion dipped -14% year over year, with annual earnings of $1.05 per share falling -43% from $1.84 a share.

Looking to combat competition in the AI-powered chips arena, Intel is steadfastly growing its external foundry business and at-scale global manufacturing, aligning with its mission to make AI ubiquitous.

Intel anticipates this strategy to drive long-term value for its shareholders, having previously announced an organizational shift to integrate the Accelerated Computing Systems and Graphics Group into its Client Computing Group and Data Center and AI Group. Notably, Data Center and AI revenue declined -10% during Q4 to $4 billion, while Client Computing revenue surged 33% to $8.8 billion.

Image Source: Intel Press Release

Mobileye Headwinds & Weaker Outlook

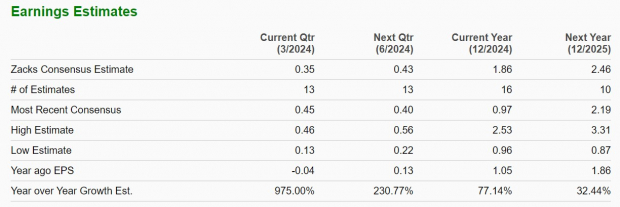

Intel’s Mobileye segment, dedicated to autonomous driving technologies, and other business exits are currently impeding overall revenue for the first quarter. Consequently, Intel’s first quarter revenue guidance of $12.2 billion-$13.2 billion fell below most analysts’ expectations as well as the current Zacks Consensus of $14.3 billion.

Intel expects Q1 earnings to hit $0.13 a share, substantially lower than the current Zacks Consensus of $0.35 a share, signaling the selloff seen today.

Image Source: Zacks Investment Research

Bottom Line

Purchasing Intel’s stock at this juncture may be premature, given that earnings estimates are likely to retract amid the company’s weaker-than-expected guidance. Currently, Intel’s stock holds a Zacks Rank #3 (Hold) and is poised to continue rewarding long-term investors. Nevertheless, close scrutiny of the company’s transformation and outlook is imperative in the foreseeable future.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2023. Previous recommendations have soared +143.0%, +175.9%, +498.3%, and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Intel Corporation (INTC) : Free Stock Analysis Report

Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report