Earnings Showdown: BlackRock vs. Goldman Sachs

As the fourth quarter earnings season kicks off, investors are closely eyeing two financial giants, namely BlackRock (BLK) and Goldman Sachs (GS). BlackRock is already reveling in the spotlight after surpassing its Q4 earnings forecasts, leaving investors pondering if Goldman Sachs can follow suit when it reveals its quarterly results next Tuesday, January 16. Let’s delve into whether now is an auspicious time to dive into the stocks of these financial powerhouses.

BlackRock’s Q4 Triumph

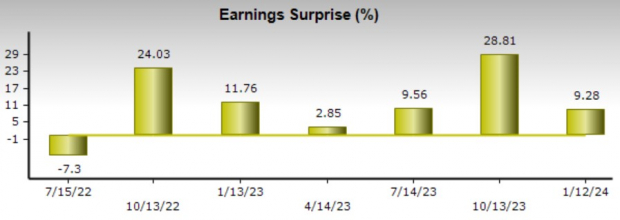

BlackRock’s announcement of fourth quarter earnings at $9.66 per share, trumping the Zacks Consensus of $8.47 a share by 9% and marking an 8% year-over-year increase, set the stage for celebration. Moreover, their Q4 sales of $4.63 billion slightly edged past estimates of $4.62 billion, rising by 7% from the preceding year. Notably, BlackRock has now outperformed earnings expectations for six consecutive quarters.

Image Source: Zacks Investment Research

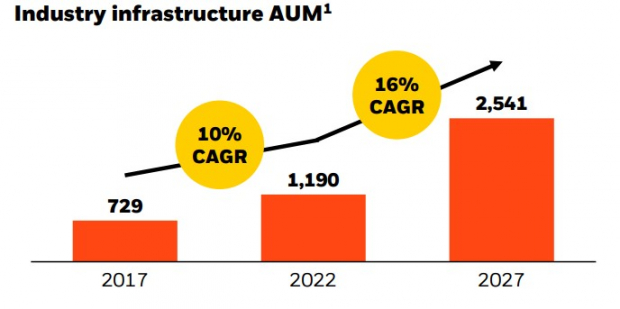

The favorable Q4 results were accompanied by news of BlackRock’s acquisition of Global Infrastructure Partners for approximately $12 billion. This strategic move is set to establish a leading infrastructure platform valued at over $150 billion, perfectly poised to meet escalating investor demand, given that Global Infrastructure Partners is a prominent player among independent infrastructure fund managers. CEO Larry Fink hailed the deal as “transformational,” recognizing the anticipated rapid growth of infrastructure as a private market segment.

Image Source: BlackRock Q4 Investor Presentation

Goldman Sachs’ Q4 Prospects

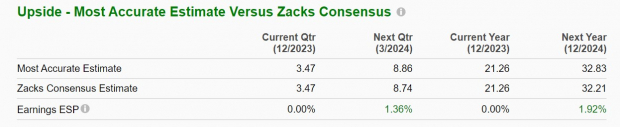

Investors are keeping a close watch on Goldman Sachs’ Asset & Wealth Management segment, hopeful that it will continue to fuel the company’s expansion amid a rebound in capital markets. Zacks estimates project a 4% increase in Goldman Sachs’ Q4 earnings to $3.47 per share, with sales anticipated to rise by 1% to $10.71 billion.

Image Source: Zacks Investment Research

The Zacks ESP (Expected Surprise Prediction) suggests that Goldman Sachs is likely to meet earnings expectations, with the Most Accurate Estimate aligning with the Zacks Consensus at $3.47 per share. Despite exceeding Q3 earnings expectations by 3% in October, Goldman Sachs has also missed estimates twice in its last four quarterly reports.

Image Source: Zacks Investment Research

The Verdict

At present, BlackRock’s stock proudly boasts a Zacks Rank #2 (Buy), while Goldman Sachs holds a Zacks Rank #3 (Hold). Both financial behemoths are expected to sustain their robust top and bottom line figures, further solidifying BlackRock’s position after yet another triumphant display by outperforming earnings expectations for the sixth consecutive quarter.