CrowdStrike Holdings, Inc. CRWD is set to reveal its second-quarter fiscal 2025 results on Jun 4.

The company anticipates total revenues in the range of $958.3 million to $961.2 million for the second quarter. Analysts expect revenues around $958.7 million, indicating a 31% increase from the same period last year.

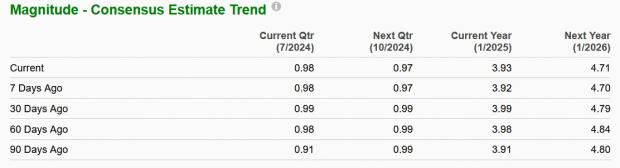

Projected non-GAAP earnings lie between 98 cents and 99 cents per share. The consensus estimate for earnings is 98 cents per share, showing a 32.4% year-over-year growth.

Image Source: Zacks Investment Research

CrowdStrike has consistently delivered strong financial results due to its subscription-based revenue model, exceeding earnings expectations in the past four quarters with an average surprise of 15.8%.

Factors Influencing Upcoming Results

The upcoming results are likely to showcase CrowdStrike’s ability to meet the robust demand for its products, driven by the strong global security market. The surge in employees accessing company networks has heightened the need for security solutions, potentially boosting the demand for CRWD products in the second quarter. A healthy deal pipeline supports this notion.

Significant growth in subscription revenues is expected to be a key contributor to the quarter’s revenue. Moreover, an increase in net new subscription customers may have bolstered the company’s performance.

The Zacks Consensus Estimate for Subscription revenues indicates a year-over-year growth of 31.9%, while revenues from Professional Services are likely to rise by 18.7%.

Furthermore, CrowdStrike’s collaboration with Amazon Web Services (“AWS”) is expected to have a positive impact, allowing the company to benefit from its products being available on the AWS platform, along with improved co-selling opportunities and service integrations.

Despite these positives, increased expenses on sales, marketing, and research and development might have impacted the company’s bottom line for the quarter.

Stock Performance and Valuation Overview

This year, CrowdStrike shares have seen a 4.8% increase, lagging behind the Zacks Internet – Software industry’s growth of 14.6%. In comparison, peers like Palo Alto Networks (PANW) and Fortinet (FTNT) have outperformed with YTD rises of 18.5% and 27.2% respectively.

YTD Price Return Performance

Image Source: Zacks Investment Research

Assessing CrowdStrike’s current valuation, the stock is trading at a premium with a forward 12-month P/S of 14.47X compared to the industry’s 2.57X, reflecting an extended valuation.

Image Source: Zacks Investment Research

Evaluating the Investment Landscape

Despite impressive growth post-IPO, CrowdStrike has recently experienced a slowdown in its growth trajectory. The once explosive revenue growth has moderated, partly due to the law of large numbers and increased competition in the cybersecurity domain.

The deceleration in growth rates is evident from historical data, with further decline expected for fiscal 2025 and beyond. This deceleration, coupled with softening IT spending and operational vulnerabilities highlighted by a global IT outage, poses challenges for the company.

Although CrowdStrike has taken swift actions to address operational issues, concerns remain regarding the company’s future growth prospects and market reputation. The high valuation multiples add another layer of risk for investors.

Final Considerations

Given the headwinds faced by CrowdStrike, investors are advised to reevaluate their positions. The company’s diminishing sales growth and operational vulnerabilities raise red flags, suggesting caution. The recent operational setback underscores the importance of trust and reliability in the cybersecurity sector. With these factors in mind, and considering its current valuation, CRWD stock appears to be a risky proposition at present.

To read this article on Zacks.com click here.