When it comes to stock investing, the opinions of Wall Street professionals can carry significant weight. But just how much weight should investors place on the brokerage recommendations for Alibaba (BABA)? Let’s dig beneath the surface of these bullish reports and find out if they truly hold water.

Brokerage Recommendation for Alibaba

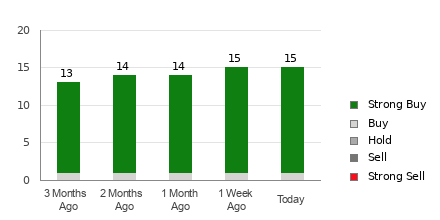

Alibaba currently boasts an average brokerage recommendation (ABR) of 1.27, indicating a consensus between “Strong Buy” and “Buy.” This ABR is derived from 15 brokerage firms, with a dominating 86.7% representation of “Strong Buy” ratings.

Validity of Brokerage Recommendations

While the ABR paints a rosy picture for Alibaba, it’s essential to question whether these recommendations are truly reliable. Studies have revealed that following brokerage recommendations doesn’t necessarily lead to the best investment outcomes. Analysts, influenced by their firm’s interests, tend to exhibit a strong positive bias in their ratings—often skewing their assessments in favor of the stocks they cover.

In sharp contrast, our proprietary stock rating tool, the Zacks Rank, offers an externally audited track record and uses earnings estimate revisions to classify stocks into five groups, ranging from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell). This approach provides a more dependable indicator of a stock’s near-term price performance and can serve as a valuable adjunct to broker recommendations.

Distinguishing Zacks Rank from ABR

While ABR is based solely on brokerage recommendations, the Zacks Rank is driven by earnings estimate revisions. Unlike ABR, which may not always offer a real-time reflection of the stock’s potential, the Zacks Rank is updated promptly as analysts revise their earnings estimates. This real-time correlation with changing business trends makes it a more timely predictor of future stock prices.

Is BABA a Sound Investment?

Examining Alibaba’s earnings estimate revisions, the Zacks Consensus Estimate for the current year has held steady over the past month at $9.12. This consistency, alongside other factors related to earnings estimates, has resulted in a Zacks Rank #3 (Hold) for Alibaba.

Given this assessment, it might be prudent to exercise caution despite the Buy-equivalent ABR rating for Alibaba.

Zacks Names #1 Semiconductor Stock

It’s only 1/9,000th the size of NVIDIA which skyrocketed more than +800% since we recommended it. NVIDIA is still strong, but our new top chip stock has much more room to boom.

With strong earnings growth and an expanding customer base, it’s positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>

Alibaba Group Holding Limited (BABA) : Free Stock Analysis Report